10 frequent scams that hit Ontario in 2023

Published December 3, 2023 at 3:42 pm

Scams will forever be the gift that keeps on “stealing.”

From collecting personal information through phishing tactics or creating deceptive scenarios to trick individuals into sending funds for a fabricated emergency, here are 10 scams that made their rounds in Ontario in 2023.

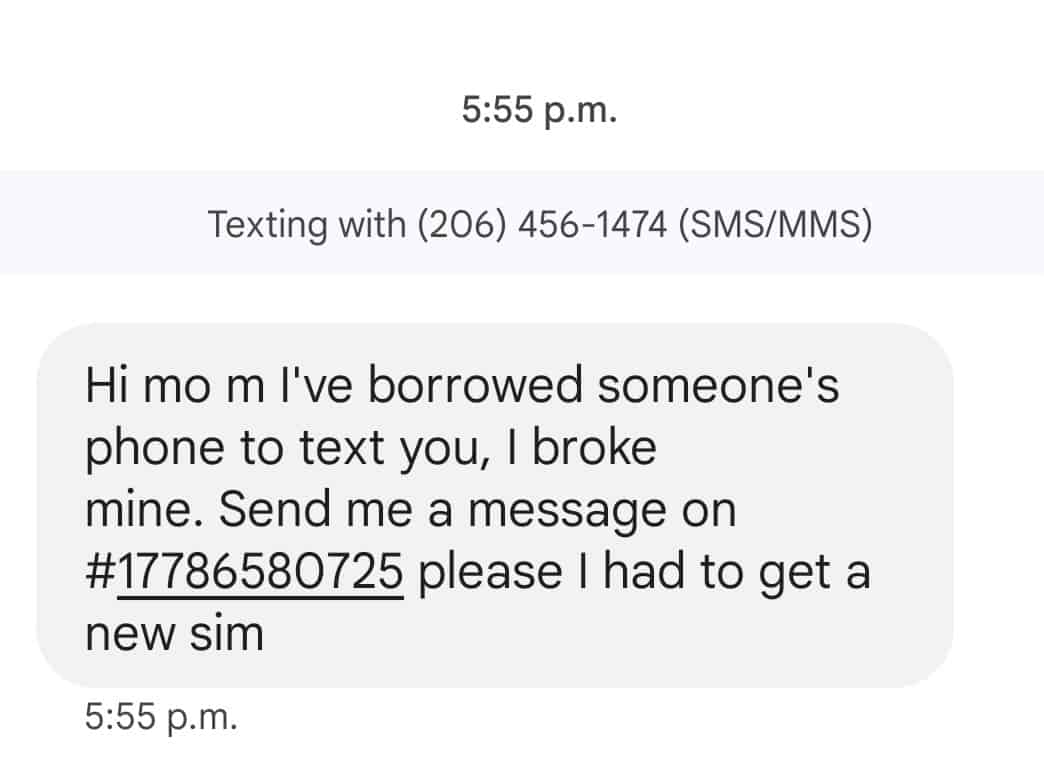

‘Mom Help’ scams

Similar to the “I dropped my phone in the toilet,” scam, fraudsters aim to pull at the heartstrings of vulnerable parents, —tricking them into thinking their kid is in trouble and needs their help.

The message reads, “Hi, Mom I’ve borrowed someone’s phone to text you. I broke mine.”

The text then asks the parent to send a message to a different number, as their loved one had to buy a brand new sim card.

A message like this could send all kinds of panic signals to parents, causing them to make the haste decision and contact the new number.

In this case, the new number provided by the “child” in the text has a (778) area code, which belongs to the province of British Columbia.

This serves as a huge red flag for residents who are familiar with Ontario’s area codes: 416, 647, 437, 905 289, 365, 742 including the newest 942 launched in May (2023).

What you should do: Parents are advised to refrain from responding to such messages. Instead, they should promptly delete and block the text.

To confirm the well-being of their child, parents are urged reach out to them directly using their verified phone number.

Romance scams

Last year (Nov. 2022) Peel Police expressed their concern about a social media scam that can leave a victim heartbroken and drained of their bank account.

Scammers often create fake profiles on social media and dating sites, reaching out to individuals through email or direct messages. They aim to establish a “virtual” relationship, gaining trust and affection.

What you should do:

- Be cautious if they push for communication through personal channels like email or text, indicating a potential scam.

- Watch for tactics like sadness or anger to manipulate you into sending money, and efforts to isolate you from family and friends.

- Verify the location; if they claim to be nearby but work in another country, it’s likely a scam.

- Recognize if the conversation seems nonsensical and they appear busy, as scammers often target multiple people simultaneously.

- Be cautious if the scammer urgently requests money, pushing for swift action. This includes alleged medical emergencies, family aid, involvement in a business venture, or investment in cryptocurrency.

According to Peel Police a big one is if the scammer asks you to receive money on their behalf. If agreed to, you could unknowingly be committing a crime.

Utility Bill scam

Photo: canadabuzz.ca

Sometimes scammers will pose as a well known service provider offering tempting deals while promising significant discounts on bills like hydro, gas, and phone services.

They use deceitful tactics to extract personal billing information from homeowners. Once obtained, scammers create fake bill payments, sending homeowners bogus confirmations and making small deposits into their bank accounts.

Subsequently, they request larger sums to be transferred back through e-transfers. However, the scammers’ initial deposits and payments bounce, resulting in substantial financial losses for the victims.

Another variation of this type of scam is the deceiver will pose as the company threatening to disconnect services unless an urgent payment is made.

Fraudsters are also known to imitate popular delivery companies Canada Post, Amazon, and UPS to trick customers into paying them money or stealing personal information such as, addresses, bank numbers, and Social Insurance Numbers (SIN)

What you should do:

- Always verify your account information with the company’s Customer Care Representatives directly using the contact details available on your bill if you suspect suspicious activity.

- Never make a payment for a charge that isn’t listed on your most recent company bill.

- Refrain from providing any personal information, including your company bill or account number.

- Do not click on links provided in text messages.

- Do not allow the fraudster to arrange a time to visit your home.

Online sales scam

Similar to the Facebook Marketplace scam the victim will reach out to an advertisement, looking to purchase a large item such as heavy machinery or farm equipment from sellers who are located in an different country.

The scammer shares stolen images and details of the item from other sources, and when the victim reaches out, they agree on a price.

The fraudster then asks for payment via wire transfer to a bank, but after receiving the money, they cut off communication, leaving the victim without the equipment.

What you should do: Be skeptical if a seller pushes you to make an instant payment. Also look out for messages or posts with poor spelling and grammatical mistakes.

Grandparent scam

A fear inducing scam on the elderly to have them think someone they love is in danger.

It involves a phone call to an elderly person from a scammer who claims to be their grandchild, a lawyer, or a police officer.

They then make the victim believe their grandchild has been arrested and needs help, in the form of bail money, otherwise they will go directly to jail. The OPP recommends the following precautions for individuals to prevent falling victim to these scams.

What you should do:

- Do not provide your home address

- Do not provide any banking or personal information

- Ask for a number to call them back

- Ask for the address of the courthouse or police station they are being held at

- Phone your local police service and report the incident immediately

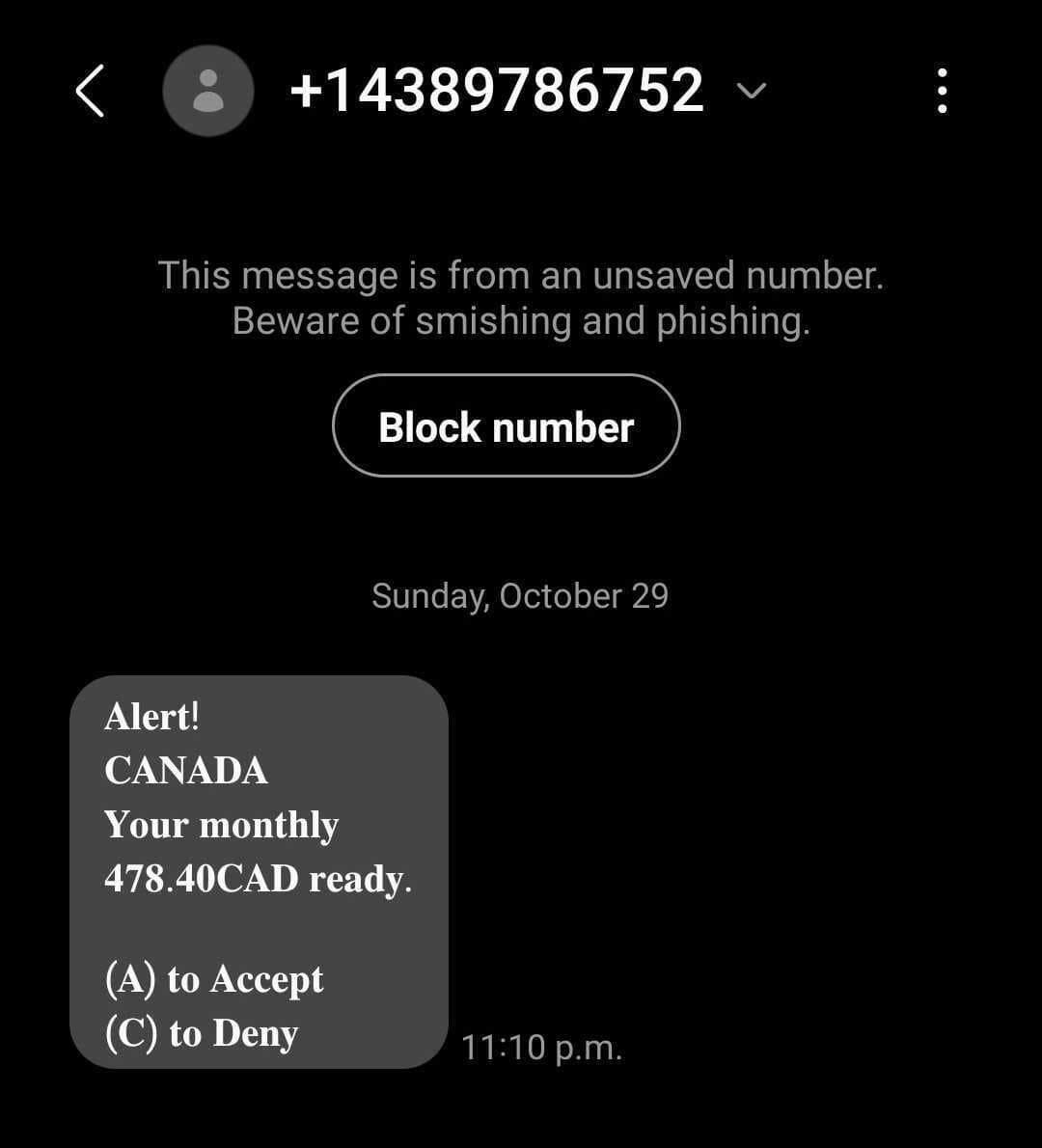

GST/HST Credit and Climate Incentive Program scam

As the time for CRA payments approaches, fraudsters send misleading text messages, falsely claiming that recipients are eligible for a monthly payment from the Canadian government, often amounting to hundreds of dollars.

These messages represent a classic phishing attempt, seeking to lure victims into divulging personal information.

What you should do: Individuals should stay cautious refrain from clicking on links or attachments, as it could expose the victim’s device to viruses or malware— a software intentionally crafted to disrupt, damage, or gain unauthorized access to a person’s electronic devices.

Furthermore, “the CRA will not use text messages or instant messages to start a conversation with you about your refund,” the Canada Revenue Agency states on their website.

Lottery scam

The fraudster will contact residents and telling them they had won millions in a lottery.

The victims are tricked into sending money to the scammer under the false pretense that it’s meant to cover the taxes for their supposed winnings to be released.

The Peel Regional Police Fraud Bureau say the most vulnerable people are often targeted, manipulated, and taken advantage of in many fraud-related schemes for the fraudster’s profit.

What you should do: Police advise residents to always avoid sending money or personal information to someone you haven’t met.

Home repair scam

Often perpetrated by door-to-door solicitors who offer quick, low-cost repairs. In most cases, the contractors take payment and never return to do the work.

In some variations, they do shoddy work, don’t finish the job, or dramatically increase the price after the original agreement.

What you should do: Be mindful of strangers who show up to your house convincing you of needed home repairs. Do not sign any contracts agreeing for the services or give money.

Pizza delivery scam

Sometime fraudsters work as a group to hustle their victims.

This scam involves one person posing as a customer and another as a driver in a parking lot. The customer approaches a stranger for help and says the driver is not accepting cash as a method of payment.

When the victim agrees to use their own debit card in exchange for cash from the customer that’s when the fraudsters know it will be a successful transaction.

Once the victim inserts their card into the machine – it copies their PIN.

The driver then hands back a fake debit card that looks like the victim’s and the pizza purchaser hands the victim the cash.

And just like that the scammers are all set to use the victims card and pin for their own purchases.

What you should do: Be mindful of your surroundings and possible distractions. Never enter your card in a debit or credit machine away from a store.

Employment scams

The scammer will send out a text claiming to be from a private lender, offering the recipient a position as a courier.

The message will describe the job as having flexible hours and paying 10% of each cash delivery, which supposedly ranges from $500 to $5,000.

What you should do: The Canadian Anti-Fraud Centre, which keeps track of major scams and fraud throughout the country, advising residents to never share personal information with unverified people or groups. That includes information such as your name, address, birthdate, social insurance number, and credit card or banking information.

Additionally, individuals should block the number and avoid responding to the message as it could lead to a scammer getting ahold of important personal information.

INsauga's Editorial Standards and Policies