Single-home buyers and condo living on the rise; here’s what you need to earn in Mississauga

Published February 12, 2020 at 11:53 pm

If you really want to enjoy your Valentine’s Day this year, you might want to consider getting a house with your significant other.

Due to the fact real estate prices keep climbing, two incomes are better than one.

However, couples who do decide to buy property together should be sure they’re committed to each other, because once two names are on a property deed it can be a nightmare trying to separate them.

This could be a contributing factor as to why more and more people are choosing to live alone.

According to a recent blog post from real estate company and website Zoocasa, purchasing a home solo can be hard–but it can be done (but perhaps not quite so easily in a big GTA city).

According to the data from the latest census, the number of people living by themselves has risen from 1.7 million in 1981 to 4 million in 2016.

Additionally, the number of people living alone who own their homes has also risen 18 per cent since the ’80s to 50 per cent.

This could be attributed to the fact apartment living offers amenities that are ideal for many single lifestyles, such as cheaper prices, smaller living spaces–which require less maintenance, and repairs are often covered by a condo board.

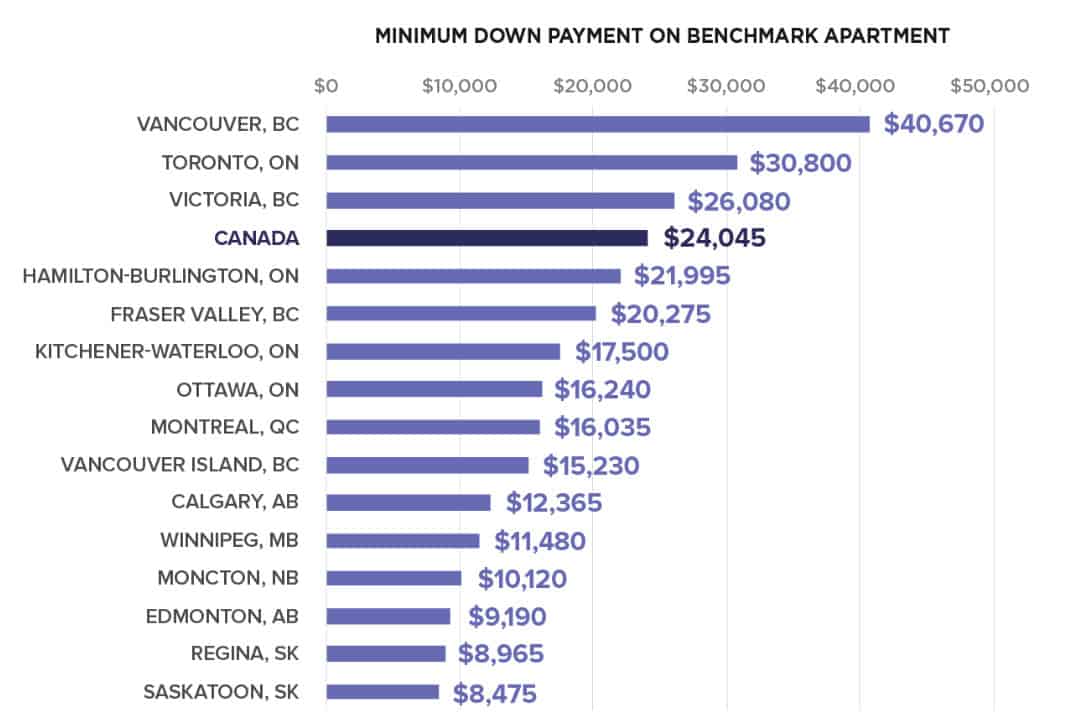

Unsurprisingly, bigger cities have higher real estate prices–the three cities with the most expensive real estate are Vancouver, Toronto, and Victoria.

In Vancouver, a benchmark apartment costs $656,700, meaning the minimum down payment necessary to purchase one would be $40,670–nearly $7,000 more than the average annual income of $33,804. This means prospective buyers who earn the average annual income would have to save for 14.4 months to be able to pay for the down payment.

In Toronto, a benchmark apartment that costs $558,000 would require a minimum down payment of $30,800, which is slightly less than the average annual income of $35,294. This means those earning $30,800 per year interested in buying an apartment would have to save for 10.5 months before they could pay for the down payment.

In Victoria, a benchmark apartment costing $510,800 would require a minimum down payment of $26,080, meaning someone earning the average annual income of $33,546 would need to save for 9.3 months to be able to afford the deposit.

While Mississauga isn’t singled out in the post, a previous Zoocasa post revealed that in Mississauga, a household (or buyer) with the city’s median income of $83,018 would not be able to purchase median-priced real estate of any kind without having to save for years to amass the necessary down payment funds.

Even median prices for condos for sale in Mississauga well outpace earnings and affordability at $470,000. Such a homebuyer would qualify for a maximum mortgage amount of $372,409 meaning they’d need to come up with the remaining $97,591 – an amount that would take them 5.9 years to save up.

The affordability gap only widens per home type. Homebuyers would also be $256,133 short on a townhouse, requiring a savings timeline of 15.4 years. As well, they’d be saving for multiple decades to afford single-family Mississauga houses, at 24.4 years for a semi-detached house, and 42.2 years for a detached house, respectively.

That said, all hope is not lost.

Sandy Dhillon, a Zoocasa sales representative with expertise working in the Peel Region notes that while the market can be competitive, first-time buyers looking for a home today are more likely to find affordable homes in Malton (townhouses, semi-detached and detached houses), Erindale (semi-detached houses) and Lakeview (semi-detached houses).

Below is the rest of the 15 most expensive real estate markets in the country as well as the length of time it would take for those earning the average income in the city to save up enough money to pay for the minimum required deposit.

Photos courtesy of Zoocasa

insauga's Editorial Standards and Policies advertising