What you need to save to a buy a home in Mississauga on a median income

Published October 31, 2019 at 9:07 pm

If you asked Santa for more affordable housing in Mississauga this past holiday season, you might end up disappointed (although we can hope that all levels of government will continue to work together to increase supply and take the pressure off of prices in the GTA) that he can’t quite deliver.

At least not yet.

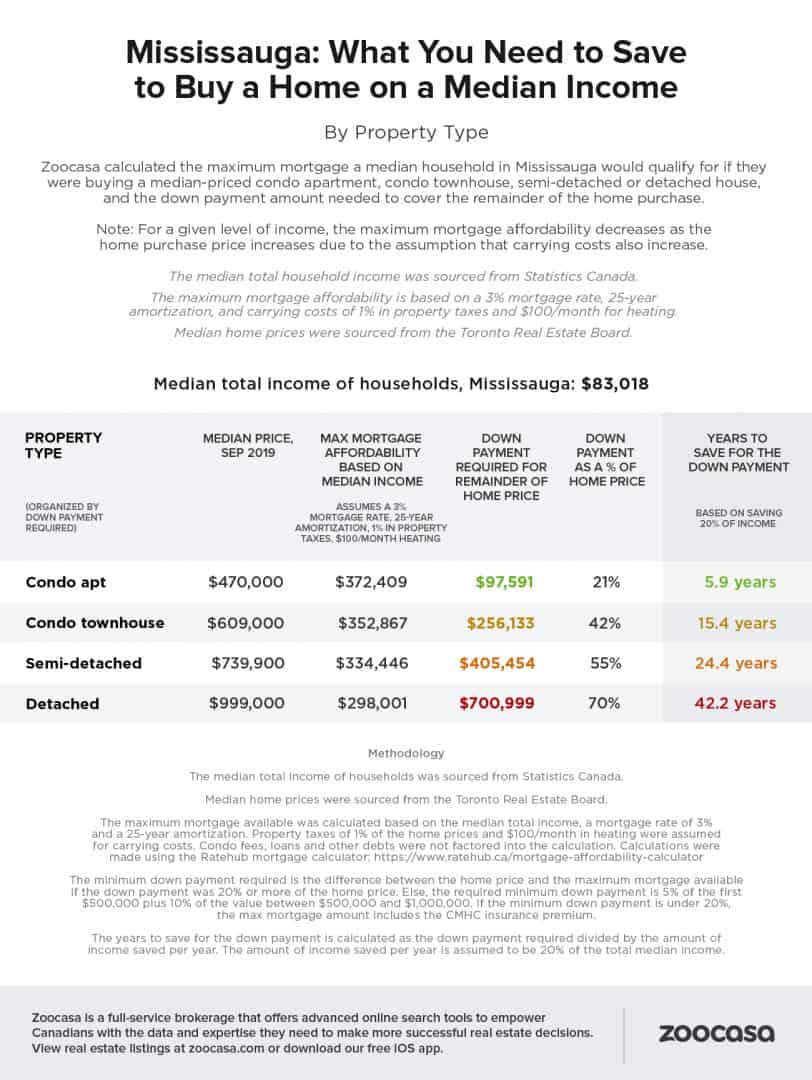

While we can all hope for some future relief, we know that housing is expensive right now–and real estate website and brokerage Zoocasa has broken down exactly what you’d need to save to buy a home in Mississauga on a median income (which is $83,018).

Spoiler alert: You would need to save for over 40 years to accumulate the necessary $700,000+ downpayment on a detached home that’s pushing $1 million.

Penelope Graham, Zoocasa’s managing editor, points out that the Region of Peel (which is comprised of Mississauga, Brampton and Caledon) has been a booming real estate destination in recent years. The boom, fueled by strong immigration, new home development, and the region’s status as a transportation hub, has led to some exciting developments in Brampton and Mississauga–but how affordable are homes for households earning the median income?

According to a new analysis from Zoocasa, housing options in Mississauga and Brampton are quite limited for those on such an income. With median home prices outpacing incomes, buyers of average means need to pull together a hefty down payment to make up for the shortfall between purchase prices and the actual mortgage amount they’d qualify for.

The calculations reveal that in Mississauga, a household with the city’s median income of $83,018 would not be able to purchase median-priced real estate of any kind without having to save for years to amass the necessary down payment funds.

Even median prices for condos for sale in Mississauga well outpace earnings and affordability at $470,000. Such a homebuyer would qualify for a maximum mortgage amount of $372,409 meaning they’d need to come up with the remaining $97,591 – an amount that would take them 5.9 years to save up.

The affordability gap only widens per home type. Homebuyers would also be $256,133 short on a townhouse, requiring a savings timeline of 15.4 years. As well, they’d be saving for multiple decades to afford single-family Mississauga houses, at 24.4 years for a semi-detached house, and 42.2 years for a detached house, respectively.

That said, all hope is not lost.

Sandy Dhillon, a Zoocasa sales representative with expertise working in the Peel Region notes that while the market can be competitive, first-time buyers looking for a home today are more likely to find affordable homes in Malton (townhouses, semi-detached and detached houses), Erindale (semi-detached houses) and Lakeview (semi-detached houses).

Zoocasa says that to determine housing affordability for median-income households in Peel Region, median income data was sourced from Statistics Canada, and median housing prices sourced from the Toronto Real Estate Board.

The maximum mortgage amount for households in each city was then calculated assuming a 3% interest rate, 25-year amortization, 1% of the home’s cost for property taxes, and a $100-heating bill. (Condo fees, loans, and other debt obligations were not factored into the calculation.)

That mortgage amount was then compared to median home prices in each city to reveal the gap the home buyer would need to cover via a down payment. The study also crunched the number of years it would take a household to save for that down payment, assuming they set aside 20% of their income on an annual basis.

insauga's Editorial Standards and Policies advertising