These Organizations Don’t Pay Any Property Tax in Mississauga

Published November 20, 2018 at 7:10 pm

While Mississauga residents pay less property tax than many other GTA municipalities (in fact, they pay less than homeowners in Brampton, Barrie, Ajax and Pickering), some groups actually pay no property tax at all.

As you might recall, the Ontario government recently reiterated its commitment to “ease the burden on Ontario’s Royal Canadian Legion halls” by ensuring they pay no property tax. The province said it plans on tabling legislation shortly.

And while that news was warmly received by residents who believe Legion halls–which offer services for military veterans and often host social and family-based events– should most certainly be exempt from taxes, not everyone knows that a few other organizations are also exempt from paying some taxes and fees to their municipality.

According to Connie Mesih, director material management – Revenue and Material Management Divisional, City of Mississauga, other organizations exempt from paying property taxes are:

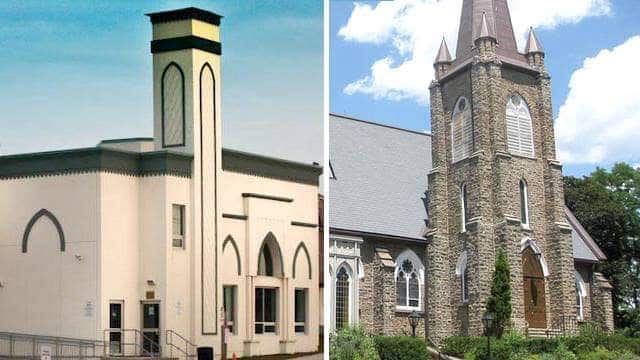

- Churches and all other places of worship (mosques, temples, etc)

- Cemeteries, burial sites, crematoriums

- Non-profit child care centres

- Hospices

- Long-term care homes

- Houses of refuge

- Charitable, non-profit philanthropic corporations organized for the relief of the poor

“The City of Mississauga aligns itself with the Assessment Act, which legislates properties that are exempt from taxation,” says Mesih.

After the province made the announcement, Mississauga Mayor Bonnie Crombie reminded residents that, over four years ago, the city exempted Legion halls from paying municipal property tax.

#DYK over 4 years ago, the @citymississauga exempt @RoyalCdnLegion halls in #Mississauga from paying municipal property tax? This decision will exempt all Legions across the province, helping ensure they can continue to provide important services to veterans & their families. https://t.co/M0VJXFE4pR

— Bonnie Crombie @BonnieCrombie) November 7, 2018

What other institutions do you think should be exempt from paying property taxes in Mississauga?

insauga's Editorial Standards and Policies advertising