Rents are much lower than home mortgages right now in Mississauga: report

Published March 22, 2023 at 1:14 pm

People dreaming of buying a new home in Mississauga may want to wait — the monthly cost difference between renting and buying is huge right now.

That’s the word from real estate website and brokerage Zoocasa.

Just a few months ago, Zoocasa noted a slight difference in monthly costs for renting versus buying. But in the October report, Zoocasa compared the rents on a one-bedroom unit — $2,070 and the average monthly mortgage payment coming in at $2,768.

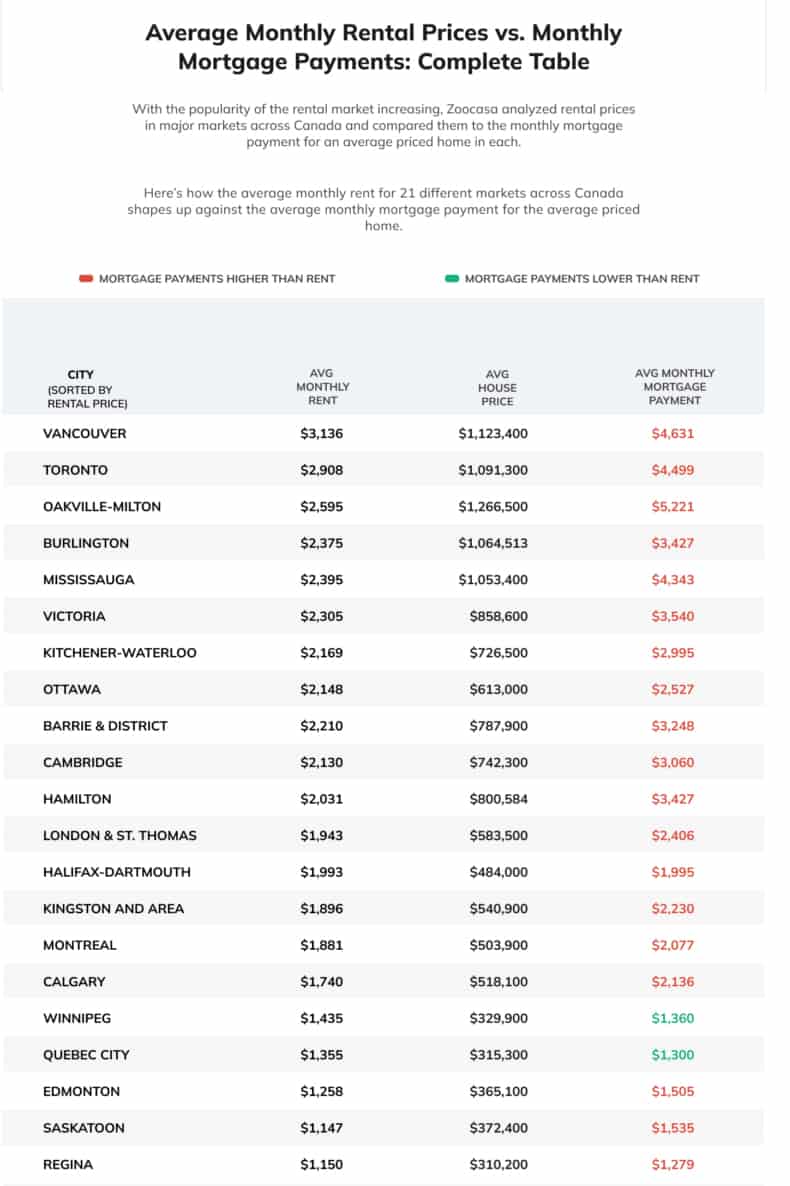

In the latest report (March 22), the averages are calculated by combining average rents for one- and two-bedroom units, and the mortgage is based on an average home. No doubt, rising interest rates are contributing to the increase in mortgages but home ownership costs are considerably higher than renting.

The average monthly rent (combining one and two bedroom) in Mississauga sits at $2,395, according to the report. The average home price is $1,053,400 with an average mortgage payment a whopping $4,343.

This makes it much less expensive, when considering monthly costs, to rent rather than buy.

The calculations are from the latest numbers from rentals.ca and the Canadian Real Estate Association, Zoocasa notes. The monthly mortgage payments were calculated by assuming a 20 per cent down payment at a mortgage rate of 4.69 per cent amortized over 30 years on the average-priced home.

Zoocasa notes that additional costs for each were not considered, such as utilities or property taxes.

Housing costs are pretty high overall in Mississauga compared to cities across Canada but still slightly lower than other cities in the GTA.

Of the 21 cities analyzed in the report, Mississauga has the fifth highest rents and the average price to buy a home is nearly as high as Toronto, Oakville and Burlington.

“Compared to mortgage prices, the rental markets that have the biggest price difference between rent prices and mortgage payments are in the cities with the most expensive home prices – Vancouver, Toronto, Oakville-Milton, and Mississauga,” Zoocasa notes.

But it’s not all bad news. The rental prices are the most affordable in Mississauga at $2,395, and the most significant difference in rent and mortgage payments is in Oakville-Milton, with a difference of $2,626 between the two.

Zoocasa found mortgage payments were lower than rents in just two cities – Winnipeg and Quebec City. The average rent in Winnipeg is $1,435, while the monthly mortgage payments for the average home would amount to $1,360 a month.

See the full Zoocasa report here.

INsauga's Editorial Standards and Policies