To rent or to buy: Which is the cheaper option right now in Mississauga?

Published October 20, 2022 at 3:11 pm

To rent or to buy? That is the question for Mississauga residents who aren’t sure if they should invest in a home or potentially save on monthly living expenses at a time of high inflation and economic uncertainty.

According to real estate website and brokerage Zoocasa, it is actually a bit cheaper to rent a home rather than buy one right now in Mississauga.

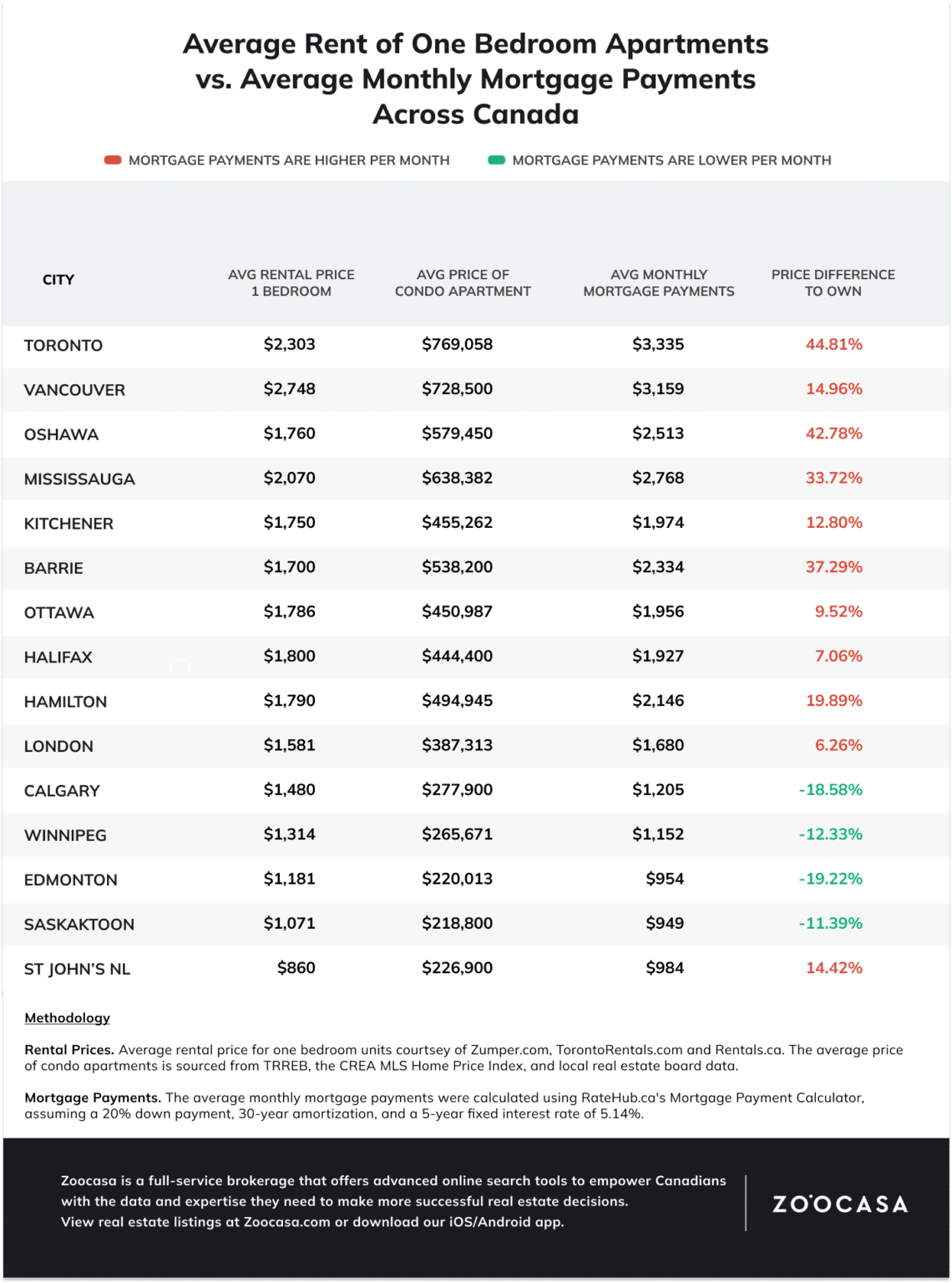

In Mississauga, the average rental price of a one-bedroom unit sits at $2,070. By comparison, the average price of a condo unit sits at $638,382, with the average monthly mortgage payment coming in at $2,768. That means that tenants are spending almost 34 per cent less on a monthly basis than those who purchased a condo unit of comparable size.

But while renting is cheaper than buying, rental rates are far from affordable.

In the report, Zoocasa says that the rise in interest rates is a significant factor in the increase in rental rates. While home prices have dropped from the record highs we were seeing throughout 2021 and early 2022, the cost of borrowing has increased, leaving some prospective buyers reluctant to purchase a property.

According to the report, the average benchmark price in the GTA hit $1,334,544 in February of this year but fell almost 19 per cent to $1,086,782 in September. While that decrease is significant, the Bank of Canada (BoC) has increased interest rates five times this year in a bid to combat inflation, which recently slowed to 7 per cent. Another announcement from the BoC is expected at the end of this month.

Zoocasa’s report says the rise in demand for rentals is reflected in the housing market, with fewer properties changing hands across the GTA. The report notes that when interest rates were low in September 2021, there were 9,046 sales across the GTA. This September, sales were down to 5,038–a decline of 44 per cent.

With more people priced out of the housing market, demand for rentals is increasing–and so are the rates.

The report notes that some major Canadian cities remain more affordable for those looking to purchase a home. In Edmonton, the average price of a condo is $220,013, and the average monthly mortgage payment is $954. A comparable rental, on the other hand, costs $1,181 a month. Zoocasa says that Winnipeg and Saskatoon are also cheaper for buyers, with owners spending 12.33 per cent and 11.39 per cent less than renters.

insauga's Editorial Standards and Policies advertising