Property tax rate in Mississauga higher than Halton and Toronto

Published May 29, 2023 at 12:59 pm

When choosing where to buy a new home many people look at the neighbourhood or the proximity to schools and transport — but some may not think about taxes.

Mississauga’s property tax rate sits somewhere in the middle in the GTA — higher than Toronto and Halton Region but lower than Brampton and Durham Region, according to a report from real estate brokerage and website Zoocasa.

With the hike in mortgage rates, along with higher living expenses in general, taxes are important to consider when buying a home.

“Part of what makes a location attractive could be accessibility, nearby amenities, and lower property taxes,” Zoocasa notes.

Property taxes vary from city to city and are set by individual municipalities to cover the costs of various services in the community such as transportation, infrastructure, maintenance, and park services.

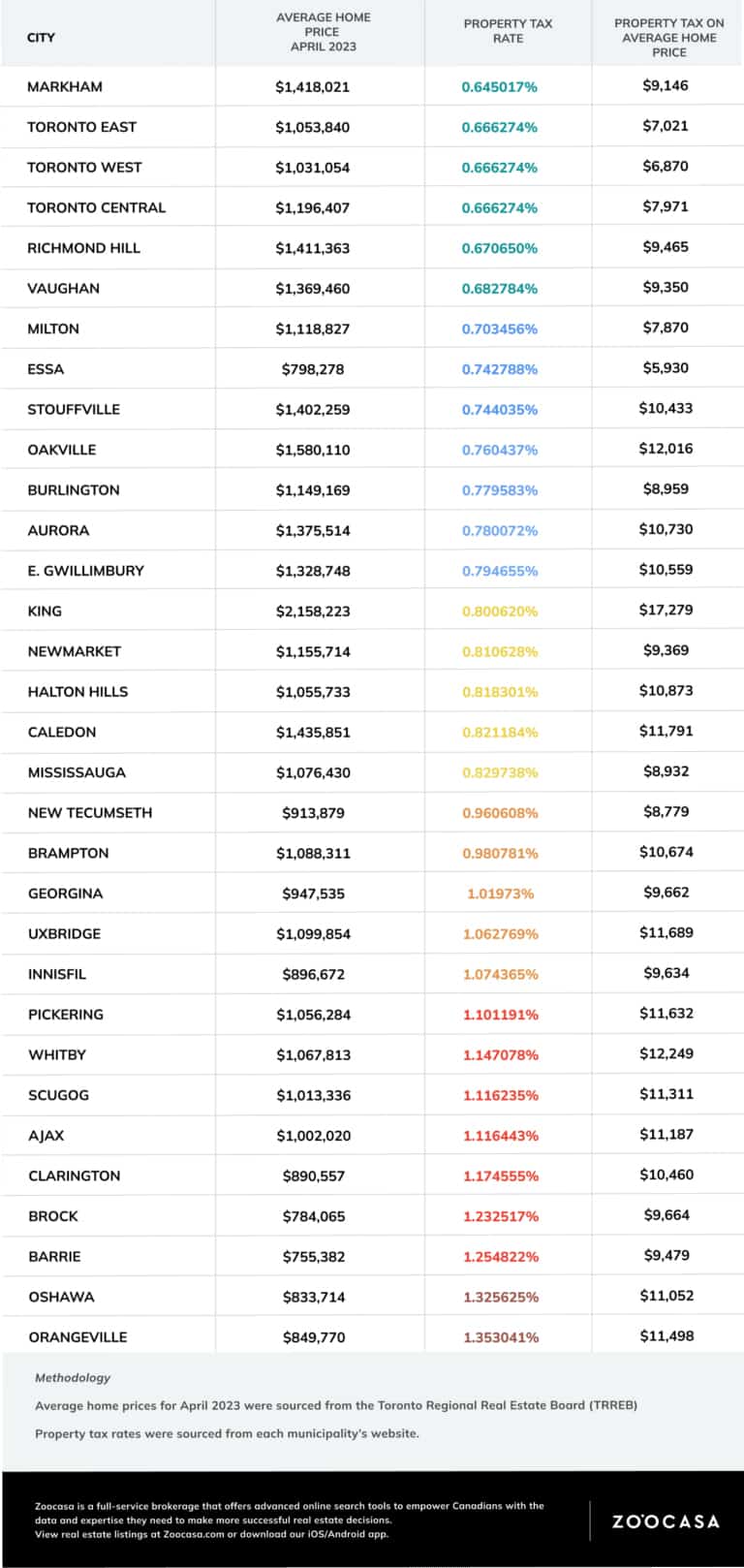

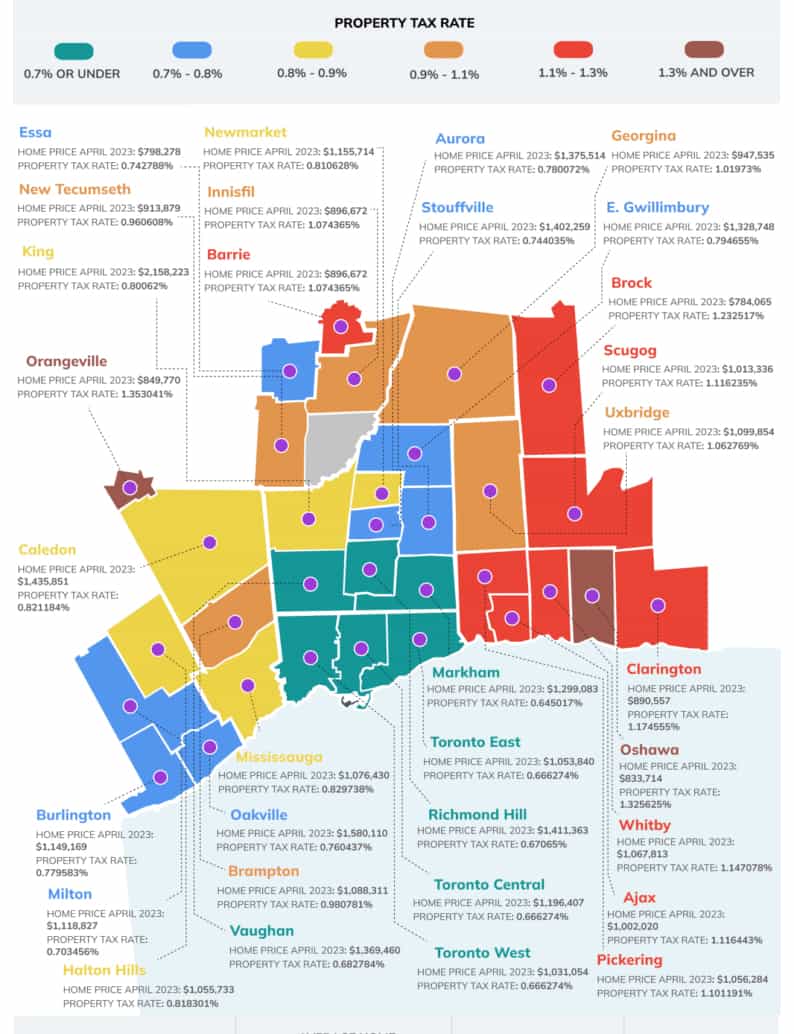

Zoocasa has mapped out 32 cities in the GTA to see which cities have the highest and lowest property tax rates.

The average amount of tax paid is based on the municipal tax rate and average home price.

For an average home in Mississauga, valued at just over $1 million, the homeowner would pay $8,932 a year. The tax rate is 0.829738 per cent.

It’s important to note that while Toronto has a lower tax rate, the average home price is higher and land transfer taxes are also much higher in Toronto.

Neighbouring Oakville also has a much higher average home price.

In general, municipalities with higher average home prices have lower property tax rates, while the municipalities with more affordable average home prices have higher property tax rates, Zoocasa notes.

For example, Markham has the lowest property tax rate at 0.645017 per cent, meaning a homeowner would pay $9,146 on an average-priced home of $1,418,021.

Durham Region has some of the highest tax rates with the tax rate in every municipality over one per cent. Oshawa has the second highest tax rate among all 32 cities at 1.325625 per cent.

The average-priced Oshawa home comes in at $833,714 so the yearly rate would be just over $11,000. So homeowners are paying about $2,000 more a year in Oshawa than in Mississauga, despite the lower average home price.