POLL: Mississauga is the Third Most Expensive City in Canada to Live In

Published September 30, 2019 at 10:37 pm

A new poll indicates what Mississauga residents have known for quite some time–the city is incredibly expensive to live in.

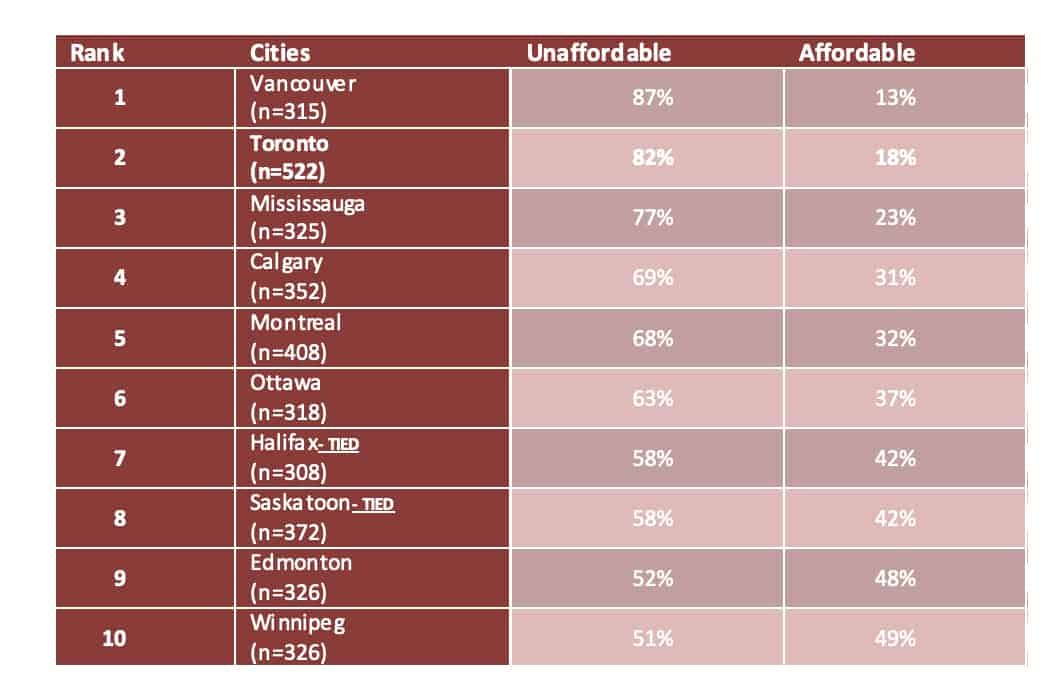

In a random sampling of public opinion taken by The Forum Poll among 3572 Canadian voters, two-thirds (67 per cent) of Canadians think their city is becoming unaffordable and a third (33 per cent) think their city is still affordable.

According to the poll, Mississauga is the third most unaffordable city in Canada among the 10 cities surveyed. The majority of Mississauga residents (77 per cent) think the city is unaffordable with a quarter (23 per cent) saying the city is affordable.

The poll found that Mississauga residents who are more likely to say their city is unaffordable include those aged 18-34 (86 per cent), those earning less than $20k (92 per cent), those with some college or university (86 per cent), and renters (93 per cent).

The poll found that Mississauga residents who are more likely to say their city is unaffordable include those aged 18-34 (86 per cent), those earning less than $20k (92 per cent), those with some college or university (86 per cent), and renters (93 per cent).

The story is different for older residents.

The survey finds that Mississauga residents who are more likely to say their city is affordable include those age 65 and over (34 per cent), those earning $60k-$80k (33 per cent) or $80k-$100k (31 per cent), those with secondary school education or less (40 per cent), and homeowners (30 per cent).

The poll asked residents if the lack of affordable housing–recent data from rentals.ca indicates that the average monthly rent for a one-bedroom was $1,929 in August and the average monthly rent for a two-bedroom was $2,336–are planning to leave the city.

The poll found that respondents were split on staying or leaving Mississauga due to its unaffordability, with half (47 per cent) saying they had considered leaving and the other half (53 per cent) saying they had not.

Overall, Canadian respondents who have considered leaving their cities include those aged 18 to 34 (55 per cent), or 35 to 44 (52 per cent), males (51 per cent), those earning $80k and less, those with secondary school education or less (51 per cent), and those with some college or university education (53 per cent).

Overall, Canadian respondents who have considered leaving their cities include those aged 18 to 34 (55 per cent), or 35 to 44 (52 per cent), males (51 per cent), those earning $80k and less, those with secondary school education or less (51 per cent), and those with some college or university education (53 per cent).

Those with no plans to leave their cities include those aged 65 and over (73 per cent), females (55 per cent), those earning $100k-$250k (65 per cent), those who have completed college or university (55 per cent), and post-grads (55 per cent).

While rent is a huge expense, Mississauga residents spend a lot on life in general.

According to the poll, Mississauga residents spend an average of $332 on groceries per month. Mississauga residents with the highest average spending on groceries per month include those aged 45 to 54 ($401), those earning $100k-$250k ($399), those with some college or university ($346), or post-grads ($347), and homeowners ($343).

According to the poll, Mississauga residents spend an average of $332 on groceries per month. Mississauga residents with the highest average spending on groceries per month include those aged 45 to 54 ($401), those earning $100k-$250k ($399), those with some college or university ($346), or post-grads ($347), and homeowners ($343).

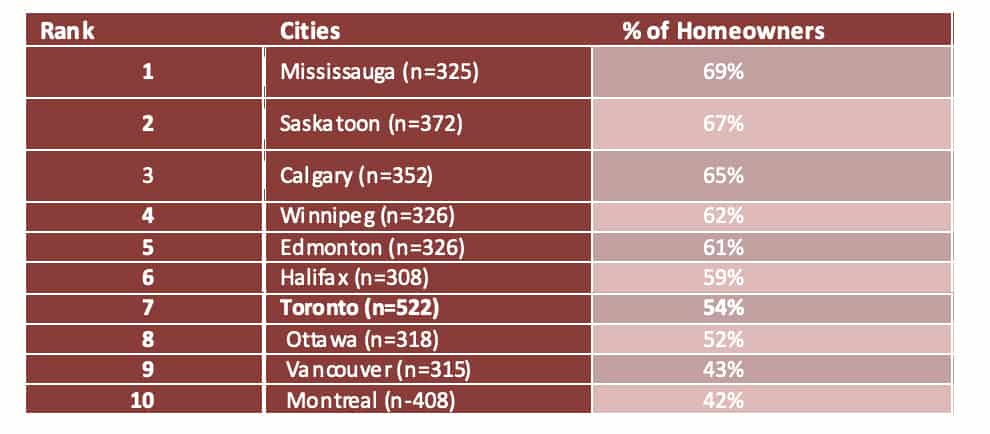

And while the city is tough for tenants and prospective buyers, the city is actually home to a vast amount of homeowners.

The survey finds that while 6 in 10 Canadians own their homes (and 4 in 10 rent), 7 in 10 Mississauga residents are homeowners.

Canadians more likely to own their homes include those aged 55 to 64 (74 per cent), those earning $100k-$250k (82 per cent), and post-grads (65 per cent).

Canadians more likely to rent their homes include those aged 18 to 34 (65 per cent), those earning less than $20k (81 per cent), and those with secondary school education or less (54 per cent).

The poll finds that Mississauga residents more likely to be homeowners include those age 45 and over, males (73 per cent), those earning $100k-$250k (95 per cent), those with some secondary school education or less (78 per cent) or post-grads (81 per cent).

Mississauga residents more likely to be renters include those aged 18 to 34 (58 per cent), females (34 per cent) earning $20k-$40k (58 per cent), and those with some college or university (44 per cent).

So, where is everyone living?

While the city is experiencing a huge condo boom, it appears most residents still live in low-rise buildings.

The poll finds that 6 in 10 Mississauga residents live in houses and 2 in 10 live in apartments.

The largest proportion of residents, excluding Montreal, live in houses. The three largest population centres in Canada (Toronto, Vancouver, and Montreal) are all at the bottom of the list—with higher proportions of residents living in townhouses, apartments, and condominiums than the other cities surveyed.

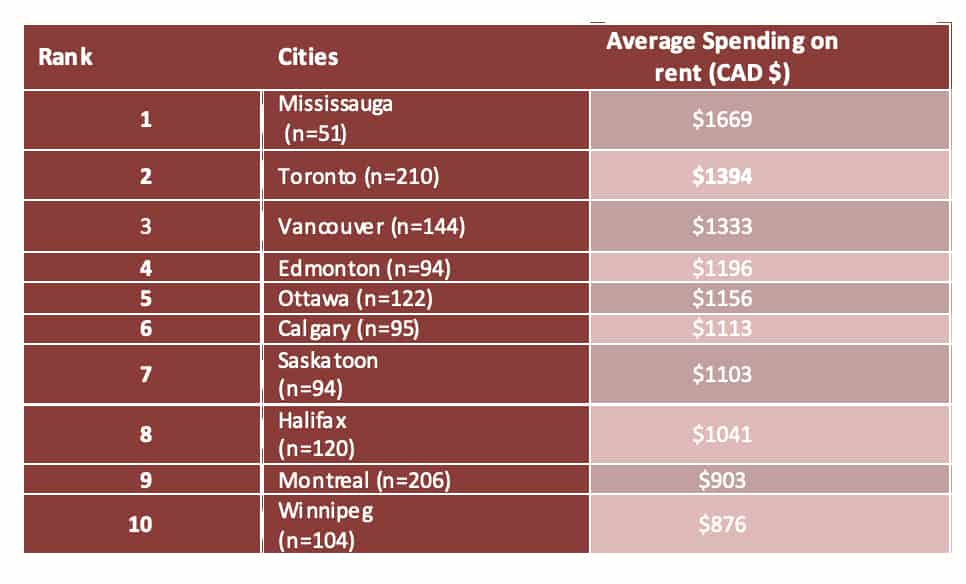

The most interesting thing in the poll is the rental data.

According to Forum, Mississauga is the most expensive city to rent in.

The poll says renters across Canada were asked how much they spend on rent per month. The average renter spends $1172 on rent per month. A few (6 per cent) spend less than $300, one-tenth (9 per cent) spend $300-$500, another tenth (13 per cent) spend more than $500 but less than $750, a fifth (22 per cent) spend $750-$1000, a quarter (25 per cent) spend more than $1000 but less than $1500, a sixth (15 per cent) spend $1500-$2000, a few (7 per cent) spend more than $2000 but less than $3000, a few (2 per cent) spend $3000-$4000, and another few (1 per cent) spend more than $4000.

The survey says Canadians that have the highest spending on rent per month include those aged 35 to 34 ($1299), the highest earners ($1573), and post-graduates ($1245).

Mississauga residents spending more on rent include those aged 35 to 44 ($1810), females ($1952), those earning $20k-$40k ($2174), and those with secondary school education or less($1603).

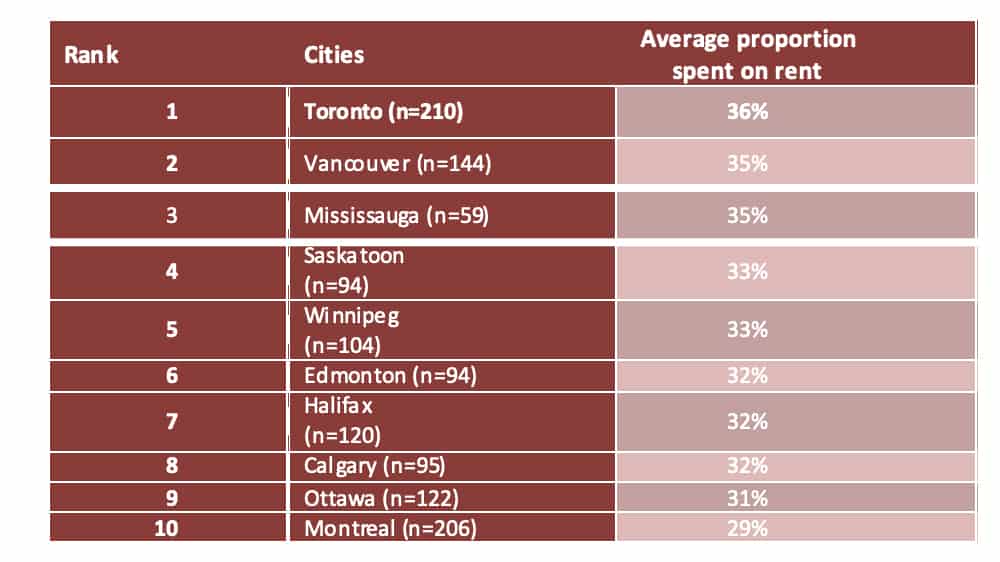

The poll also notes that Mississauga residents spend the third-highest proportion of their monthly income on rent. Canadians spend an average of 33 per cent of their monthly income on rent. Half of Canadians (49 per cent) spend more than 30% of their monthly income on rent and a sixth spend 50 per cent or more.

Forum says Mississauga residents spend the third-highest proportion of their monthly income on rent (35 per cent). Those Mississauga residents that are spending the most rent include those aged 55 to 64 (43 per cent), males (38 per cent), those earning less than $20k (40 per cent), $40k-$60k (38 per cent), or $80k-$100k (38 per cent), and those with secondary school education or less(51 per cent).

It’s not much easier for homeowners, either.

Mississauga residents have the fourth-highest average monthly spending on mortgages.

Residents that spend more include those aged 35 to 44 ($2,175), males ($1,759), those earning $100k-$250k ($2,198), and those who have completed college or university ($2,189).

The poll also says that Mississauga residents spend an average of 26 per cent of their monthly income on their mortgages. Those more likely to spend a higher proportion include those aged 18 to 54 (26 per cent of those are aged 18 to 34, 29 per cent of those are aged 35 to 44, and 27 per cent of those aged 45 to 54), those earning $60k-$80k (42 per cent), those with secondary school education or less (29 per cent) or those who have completed college or university (31 per cent).

“Mississauga is ranked the most expensive city in Canada to rent in,” said Dr. Lorne Bozinoff, president of Forum Research. “But despite the average monthly rent cost of $1669, and three-quarters saying the city is becoming unaffordable, Mississauga residents are split on whether they have considered leaving or not.”

The Forum Poll was conducted by Forum Research with the results based on an interactive voice response telephone survey of 3572 randomly selected Canadians in Toronto, Ottawa, Mississauga, Saskatoon, Edmonton, Calgary, Vancouver, Winnipeg, Halifax, and Montreal.

The poll was conducted from August 22 to 25, 2019. Results based on the total sample are considered accurate +/- 3%, 19 times out of 20, measured as the average deviation across all response categories.

To learn more, click here.

insauga's Editorial Standards and Policies advertising