Mississauga still one of Canada’s priciest rental markets, but COVID-19 could affect prices soon

Published March 25, 2020 at 2:56 pm

Although Mississauga was still home to a red hot rental market in February, the effect of the COVID-19 pandemic has yet to be fully realized–especially since rental rates appear to be falling in Canada overall and have been prior to the pandemic and its associated lockdowns.

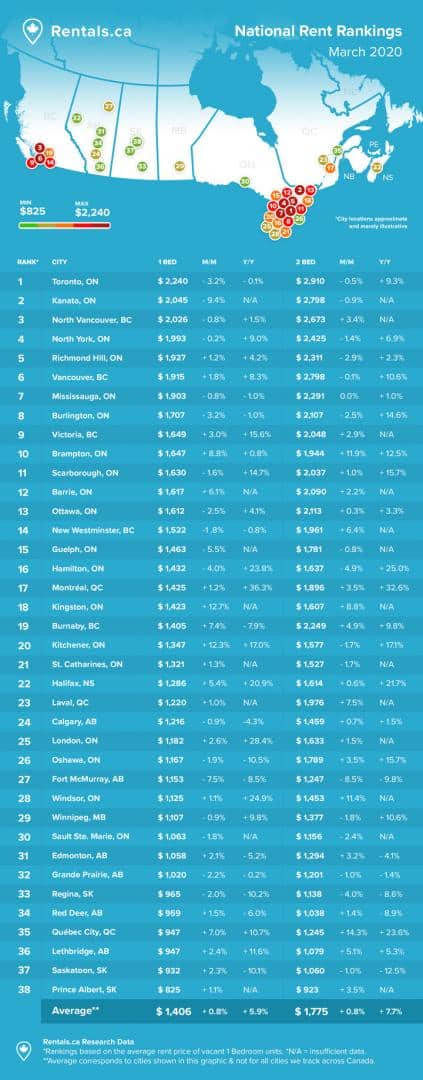

The national average rental rate dropped 3 per cent month-over-month and 3.4 per cent year over year, according to the March National Rent Report from Rentals.ca and Bullpen Research & Consulting.

The average monthly rent in February was $1,823, as measured by listings data on Rentals.ca.

The report says average monthly rent was down or flat for one-bedroom and two-bedroom homes in most cities, but a few municipalities bucked the trend including Brampton, Kingston, Burnaby and Quebec City.

Mississauga finished seventh on the list of 38 cities for average monthly rent for a one-bedroom at $1,903 and for average monthly rent for a two-bedroom at $2,291.

Not unexpectedly, the report says Toronto led all 38 cities on the list for average monthly rent in February for a one-bedroom home at $2,240 and a two-bedroom at $2,910.

Seven other municipalities in the GTA are among the most expensive for renters. According to the report, Burlington came in eighth for average monthly rent for a one-bedroom at $1,707 and tenth for average monthly rent for a two-bedroom at $2,107.

Brampton finished tenth for average monthly rent for a one-bedroom at $1,647 and fifteenth for average monthly rent for a two-bedroom at $1,944.

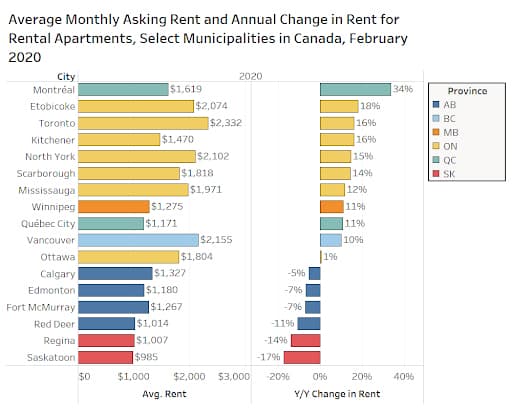

In Mississauga, rental rates are up 12 per cent year over year, and rates in Toronto are up 16 per cent.

While the market was hot in the GTA in February, the report says that rental rates are falling nationally.

The report says that the average rent per square foot across Canada was $2.30 in February, down 2.5 per cent from January and 6.8 per cent from a year ago. It also says that median rent decreased by 3.5 per cent from January to $2 per square foot, and was down 9% from February 2019.

“It might be too early to attribute the February decline to COVID-19 worries, but after a strong spring and summer for rent growth in 2019, rates have trended downward nationally,” the report reads.

The report says the change in the average rental rate from February of last year to February of this year for all properties types has varied dramatically in Canada’s major markets.

Rents are up by 4 per cent annually in Toronto to $2,524 per month (former city, pre-amalgamation) for all property types; rents are up 15 per cent in Vancouver to $2,334 per month; while rents in Montreal are up 31 per cent annually to $1,708 per month.

The story is different in other cities. According to the report, Ottawa rents declined by 5 per cent annually, Edmonton rents were down 6 per cent, and Saskatoon rents were down a whopping 16 per cent to $1,015 per month.

“Following two years of high rent growth in Canada outside of the commodity-driven markets, rental rates have softened considerably in 2020,” said Ben Myers, president of Bullpen Research & Consulting.

“In the face of a global health crisis, the number of people making major life decisions like moving or changing jobs will be significantly reduced, and landlords will have to decide to either lower rents, offer incentives, or simply wait and hope for some return to normalcy in a couple of months.”

On a provincial level, Ontario had the highest rental rates in February, with landlords seeking $2,212 per month on average for all property types.

The report also mentions something that many people are expecting–a significant number of tenants are likely choosing to stay in their residence until health concerns regarding COVID-19 are reduced and economic uncertainty dissipates.

The market will also see less demand, as immigration will temporarily grind to a halt while the borders are closed.

The report also notes that some young adults living at home or planning a move for a job or school are stuck, not knowing when school will resume and when, or if, their employment will start.

That said, the market won’t necessarily come to a standstill.

“But some people could have already taken another job and/or given notice to their landlord, and they will need to find a place to live. Potential home buyers might also put off purchasing a home and continue to stay in the rental market to upgrade, boosting rental demand,” the report reads.

Rentals.ca says it will continue to closely monitor lease rates, listings activity, and trends during the Covid-19 pandemic.

“We are going to see a drop-off of walk-in showings for apartments across Canada during the Covid-19 pandemic,” said Matt Danison, CEO of Rentals.ca. “Landlords and property managers will need to embrace virtual leasing as much as possible to keep their staff and potential renters safe during this difficult time. Rentals.ca has committed to help by significantly lowering the cost of 3-D and virtual tours until July 1 to help with social distancing.”

The National Rent Report charts and analyzes monthly, quarterly and annual rates and trends in the rental market on a national, provincial, and municipal level across all listings on Rentals.ca for Canada.

insauga's Editorial Standards and Policies advertising