If you’re looking for value, stay away from Oakville-Milton housing market

Published April 16, 2024 at 11:13 am

If you’re looking for the most bang for your buck in the Canadian real estate market, one recent report says the last place you should look is Oakville and Milton.

Zoocasa, a consumer real estate search platform, teamed up with the financial experts at MoneySense.ca to rank 45 markets across the country in terms of value and buying conditions.

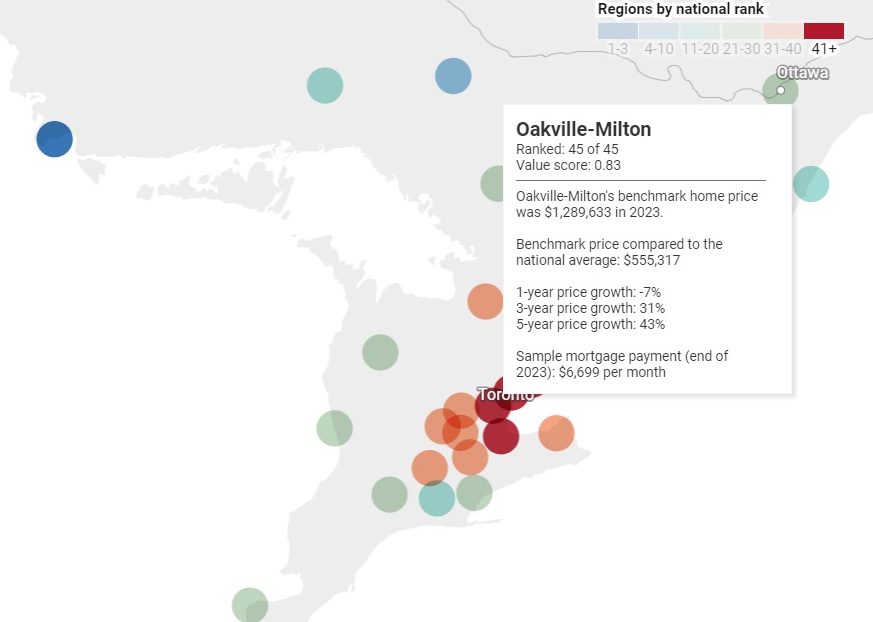

With an average 2023 home price of $1,289,633 and a three-year growth rate of 31 per cent, Oakville/Milton ranked dead last on the list. Only barely edging it out was the Burlington/Hamilton market, finishing 40th out of 45, with an average home price of $844,108 and a three-year growth rate of 29 per cent.

“After years of unprecedented competition, 2023 brought a shift back to a slower home-buying process. Motivated buyers had the opportunity to deliberate more carefully and negotiate at a more measured pace, ” said Carrie Lysenko, Chief Executive Officer of Zoocasa.

“However, a stabilization in the market could lead to increased activity and a resurgence in buyer confidence this year.”

For value, the report recommends heading to the east coast, with five of the top seven locations in the Maritimes, including Moncton, Saint John and Fredriction.

The best value in Ontario can be found in Sault Ste. Marie, North Bay, Bancroft and Sudbury.

Most of the lowest value is found in Ontario and BC, with Oakville/Milton barely edging out Mississauga, Vancouver and Toronto for last place.

There is some optimism, however, the housing market will heat up again this summer. Many forecasters are predicting interest rate drops by the Bank of Canada and housing supply continues to increase.

You can see the full report here.