Home prices shooting back up in Mississauga

Published January 7, 2020 at 9:41 pm

It looks like homebuyers have more than adjusted to the measures designed to cool the red-hot housing market that dominated headlines in 2017–and it also looks like sky-high prices, bidding wars and desperate buyers are back.

The Toronto Real Estate Board (TREB) says that December 2019 residential sales were up by 17.4 per cent year-over-year to 4,399.

TREB says that total sales for 2019 amounted to 87,825 – up 12.6 per cent compared to the decade low of 78,015 sales reported in 2018. Prices are also on the rise, as the MLS home price index composite benchmark was up by 7.3 per cent on a year-over-year basis in December 2019.

The average selling price in December 2019 was $837,788 – up almost 12 per cent year-over-year. For 2019, the average selling price was $819,319 – up by four per cent compared to $787,856 in 2018.

In Mississauga, the average price of a detached home sat at $1,221,652 in December. A semi-detached cost $772,374, a condo-townhouse cost $615,921 and a condo cost $513,331.

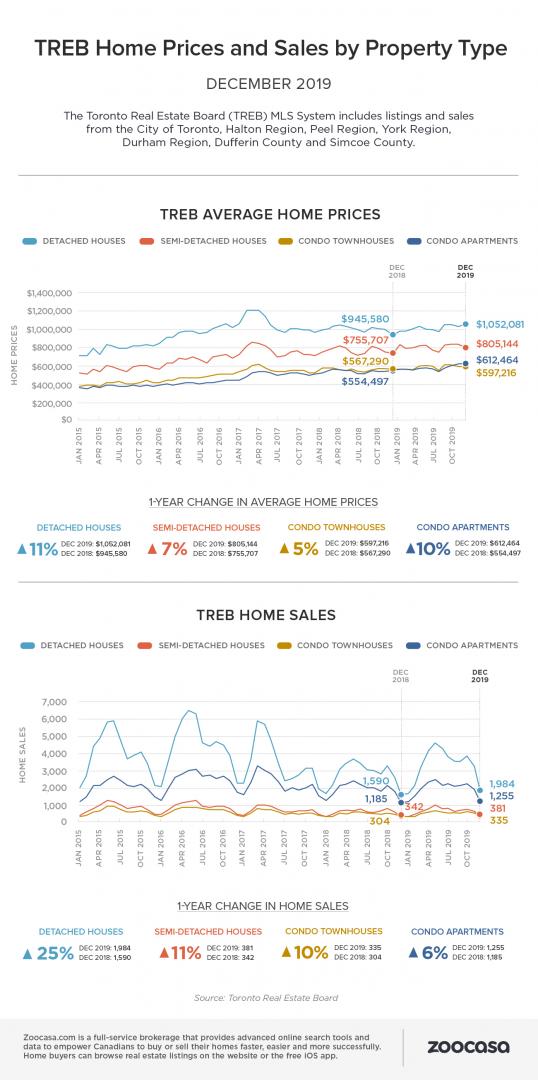

Graphic courtesy of Zoocasa

Real estate brokerage and website Zoocasa says the year ended on a competitive note in the Mississauga, Brampton, and Halton real estate markets, with home sales surging year over year while the supply of fresh listings tumbled.

“While it’s seasonally typical for the number of new listings to shrink over the holiday season – no one wants their home to linger on the market through the quietest days of the year – the number sales outpaced new listings in every municipality, leading to extremely tight sellers’ markets for the buyers who did brave the elements in search of a home transaction,” says Penelope Graham, managing editor, Zoocasa.

“As well, buyer activity and price growth were up strongly across the board, as the 2019 market ended the year in a much stronger position than its soft 2018 performance.

Graham says Mississauga experienced healthy year-over-year growth in sales, with a total of 392 transactions in December, up 8.8 per cent from 2018. Coupled with flat negative growth in new listings – Graham says just 335 came to market over the course of the month, down 0.29 per cent – competition for those who may otherwise hit the winter market for a price deal for houses (or condos) for sale in Mississauga was fierce.

Graham says an extremely steep sellers’ market sales-to-new listings ratio of 117 per cent helped push the average home price up by 18.6 per cent to $799,593.

TREB says that on an annual basis, 2019 sales across the GTA were in line with the median annual sales result for the past decade–but it appears that tight market conditions are reemerging following a brief respite brought on by the federal government’s mortgage stress test (which requires buyers to qualify at higher rates than they’ll ultimately be paying) and the province’s Fair Housing Plan (which introduced a tax on foreign buyers and speculators).

“We certainly saw a recovery in sales activity in 2019, particularly in the second half of the year. As anticipated, many home buyers who were initially on the sidelines moved back into the market place starting in the spring,” said Michael Collins, president, TREB, in a statement.

“Buyer confidence was buoyed by a strong regional economy and declining contract mortgage rates over the course of the year.”

As for what’s driving the high prices, TREB says the number of new listings entered into TREB’s MLS system was down by 2.4 per cent year-over-year–meaning buyers are competing for a limited supply of houses.

TREB says that for the past decade, annual new listings have been largely in a holding pattern between 150,000 and 160,000, despite the upward trend in home prices over the same period.

“Over the last ten years, TREB has been drawing attention to the housing supply issue in the GTA. Increasingly, policymakers, research groups of varying scope and other interested parties have acknowledged that the lack of a diverse supply of ownership and rental housing continues to hamper housing affordability in the GTA,” said Jason Mercer, TREB’s chief market analyst, in a statement.

“Taking 2019 as an example, we experienced a strong sales increase up against a decline in supply. Tighter market conditions translated into accelerating price growth. Expect further acceleration in 2020 if there is no relief on the supply front.”

insauga's Editorial Standards and Policies advertising