Here are the 6 scams targeting people in Mississauga, Brampton and across Canada right now

Published March 24, 2023 at 2:33 pm

Some of the latest frauds use sophisticated digital tools to target people in Mississauga, Brampton and across Canada.

March is Fraud Prevention Month and Interac released six emerging and top scams that Canadians have contended with over the past six months.

Interac, an interbank network that links financial institutions and Canada’s debit card system provider, sees the scam trends through reports to the financial institutions they work with, Rachel Jolicoeur, Interac’s fraud prevention and strategy director tells insauga.com.

Jolicoeur adds that the Canadian Anti-Fraud Centre keeps stats on fraud. There have been 6,610 frauds reported and 3,923 fraud victims reported so far this year, according to the Fraud Centre.

But Interac’s Fraud Prevention team tracked six of the most prevalent types of fraud and has developed practical tips for Canadians to protect themselves.

Here are the top six scams from Interac:

Rental Scams

This scam became more prevalent in the GTA as rental properties became scarce and increasingly unaffordable. People desperate to find a place to live may fall prey to this scam where a fraudster tries to gain access to personal and financial information.

“There’s a demand for affordable housing, specifically in the GTA. So they (scammers) kind of take to that knowing that their rate of success is probably greater than if they were to do that in Truro, Nova Scotia,” says Jolicoeur.

Domaine Squatting

This is a frightening and sophisticated scam where fraudsters place realistic ads for banks that come at the top of Google search results.

“So it would show you interac.ca making it appear legit,” says Jolicoeur. “But really what they’re doing is that inside that link, there’s a bunch of redirects. And it’s leading you to a phishing website that does look similar to possibly your online banking or an organization where you would normally input your information.”

This is a new scam and it’s “very sophisticated,” Jolicoeur adds.

She suggests people type in the website address for their bank and bookmark it, rather than relying on an internet search.

Online Marketplace Scams

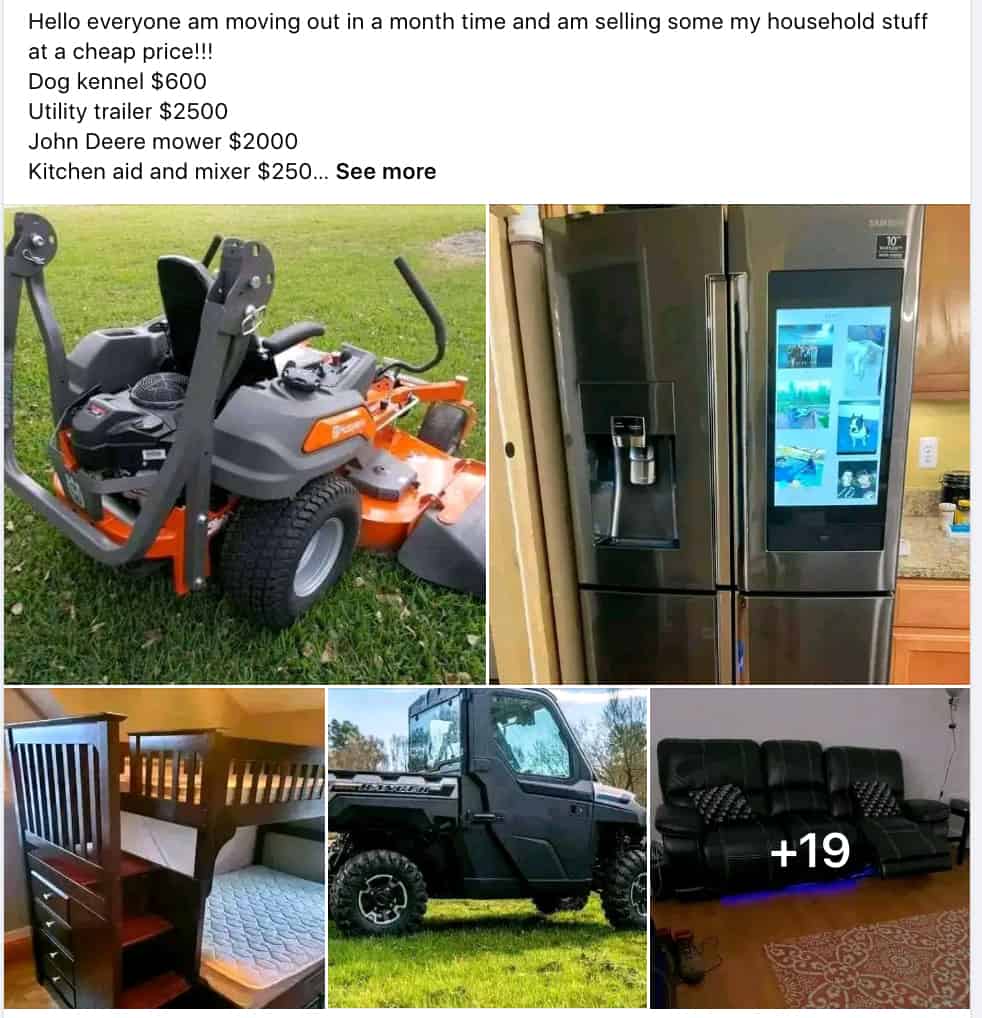

This scam is common on Facebook — recently Mississauga community groups had multiple posts for a so-called moving sale for big-ticket items. When people asked about the items for sale, they were asked to pay the full amount or a deposit to hold the item.

“And then they never hear back from the person or they never shipped the product, or they’re not there when it’s when it’s time for pickup,” says Jolicoeur.

Often times scammers will target the community when a certain item is in high demand and is out of stock everywhere. An example is a popular gaming console or bicycles during the height of the pandemic.

“If it’s too good to be true, then most likely is.”

This is a popular moving scam on Facebook.

Phishing or smishing

This type of scam has been very common in recent years. Fraudsters use emails or texts that look like legitimate companies sent to victims to attempt to take over a victim’s banking account.

Investment scams

Similar to phishing, victims think they have been sent an “Investment Opportunity” via social media message from a “trusted social media contact” but in fact, the scammer just wants personal financial information.

Cryptocurrency investment scams are common these days. A recent variation on this was the wrong number scam. The text message looks like the person got the wrong number but if you respond, you may get roped into providing personal information or a so-called investment opportunity.

Employment Scams

These kinds of fake job postings bait a potential job candidate into providing their personal information (including their SIN) for accepting the false job offer.

Recently posts offering jobs with Amazon have popped on social media.

“They’ll post sometimes as reputable companies,” says Jolicoeur.

In this case, people can reach out to the company on their official website’s career section or Human Resources department to verify if there are jobs.

Tips for staying safe

Take a moment, stop, and think before clicking a link, sending money or providing information, says Jolicoeur.

“How likely is it? Is there a bit of a red flag here?”

Try and verify if it is legitimate by going to the company or organization’s official website or even making a call to be sure.

Also, don’t be afraid to talk about it with family or friends.

“So sharing the awareness and the education is how we’re going to combat these criminals and reduce the amount of fraud.”

Report frauds to Canadian Anti-Fraud Centre and/or the police.

INsauga's Editorial Standards and Policies