Hamilton Public Library offers free tax service for modest income-earning residents

Published March 14, 2022 at 12:12 pm

The Hamilton Public Library is providing a special service in the coming weeks to help members of the community who earn a modest income file their taxes.

In a press release issued late last week, HPL announced that at six of their branches, teams from the Community Volunteer Income Tax Program will be offering their services for free to help residents prepare and file their tax returns.

Drop-off and by-appointment services will be available from 10 a.m. to 4 p.m. on select Wednesdays and Saturdays starting March 16 to April 27. Participating branches include Barton, Central, Dundas, Red Hill, Terryberry and Turner Park libraries.

A full schedule for the program and information on what one needs to attend can be found on the HPL website.

For the drop-off service, participants hand over their documents to a tax-trained volunteer who verifies one’s identity and asks a few questions about completing the return. It takes about 15 minutes, and the turnaround time is about two weeks, the release said.

Those wanting to take advantage of the by-appointment service can register for the 45-minute appointment where a trained volunteer prepares the return which is then reviewed by Chartered Professional Accountant volunteers and then electronically filed.

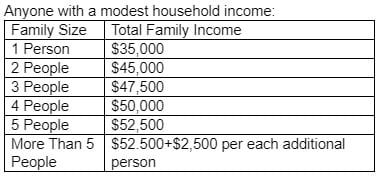

The free tax prep service is intended to support residents of Hamilton who earn a modest income. HPL provided the following chart to determine eligibility:

These free tax services are not for individuals who are/have:

- Self-employed

- Business or rental income and expenses

- Capital gains or losses

- Employment expenses

- Interest income greater than $1,000

- Filed for bankruptcy or are deceased