Hamilton housing costs expected to surpass $900,000 average in 2022: report

Published December 2, 2021 at 10:37 am

If you were hoping for some relief from the skyrocketing housing costs in 2022, the latest report looks bleak.

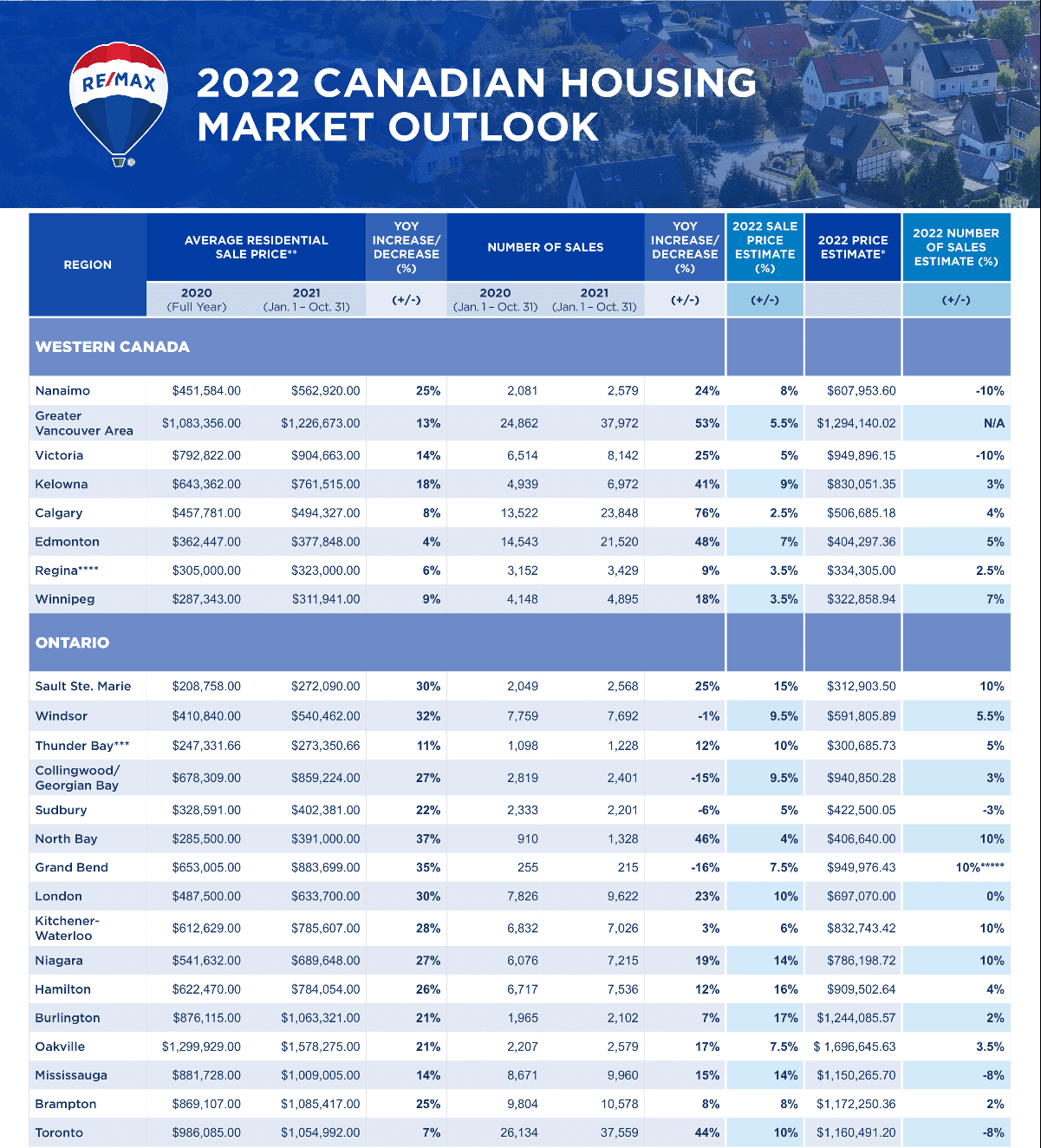

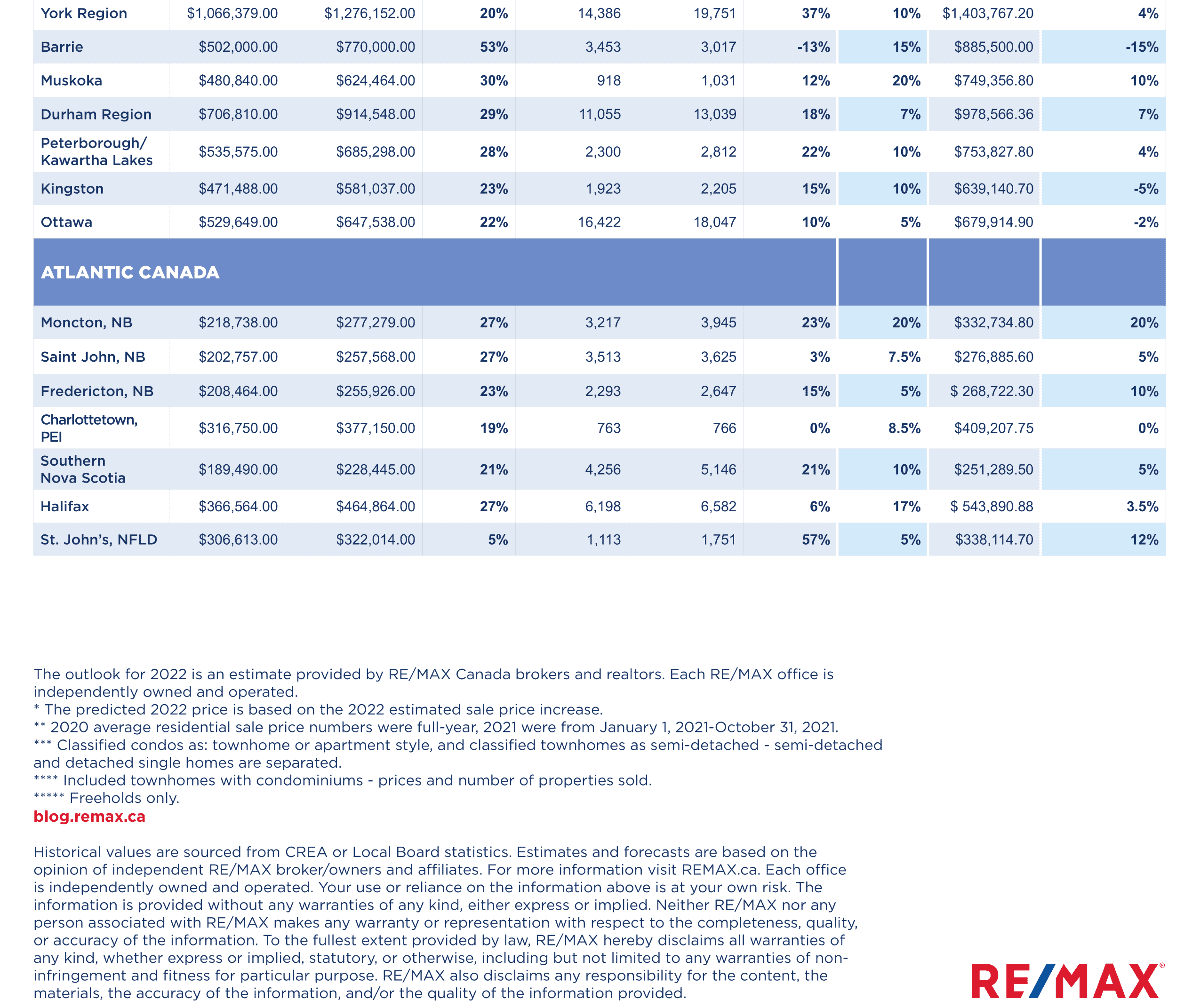

According to the Remax 2022 Canadian Housing Market Outlook, Hamilton will see a jump of 16 per cent over the next several months. The average home is projected to cost $909,502.64, up from $784,054 in 2021 and $622,470 in 2020.

Hamilton is, again, expected to be a seller’s market in 2022 with “move-up and move-over” buyers driving demand.

Townhomes saw the largest increase in average price year-over-year in 2021 at 24 per cent.

Canada could see the overall market go up 9.2 per cent compared to 2021. Remax says “inter-provincial migration” continues to be

a key driver.

“Based on feedback from our brokers and agents, the inter-provincial relocation trend that we began to see in the summer of 2020 still remains very strong and is expected to continue into 2022,” said Christopher Alexander, President, Remax Canada. “Less-dense cities and neighbourhoods offer buyers the prospect of greater affordability, along with liveability factors such as more space.”

“In order for these regions to retain these appealing qualities and their relative market balance, housing supply needs to be added. Without more homes and in the face of rising demand, there’s potential for conditions in these regions to shift further,” he added.

The Remax report suggests that market activity across Ontario is anticipated to remain steady in 2022, with a continued average price

growth. It anticipates average sale price increases in smaller markets such as North Bay (four per cent); Sudbury (five per cent); Thunder Bay (10 per cent); Collingwood/Georgian Bay (10 per cent); and Muskoka (20 per cent), where the move-over trend has remained strong.

Meanwhile, the report indicates that in larger markets within the province, there’s a possibility that more immigration could weigh on supply levels and prices, including Ottawa (five per cent); Durham (seven per cent); Brampton (eight per cent); Toronto (10 per cent); Mississauga (14 per cent).

insauga's Editorial Standards and Policies advertising