Hamilton goes from sellers’ market to relatively balanced to end 2022

Published January 5, 2023 at 11:26 am

Hamilton’s housing market continued its trajectory toward a balanced market to finish 2022.

Market activity was down 32 per cent in December compared to the record-high one year prior.

According to the Realtors Association of Hamilton-Burlington (RAHB), rising lending rates, limited supply, and earlier price gains were all contributing factors.

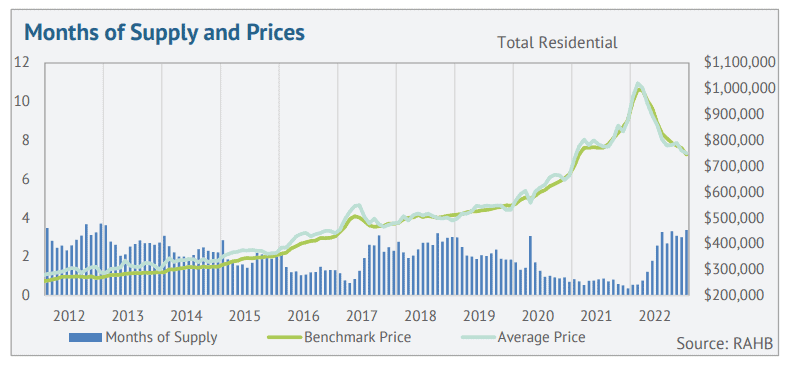

As 2022 progressed, new listings increased, and inventory levels rose from record low levels — shifting a strong sellers’ market to one relatively balanced.

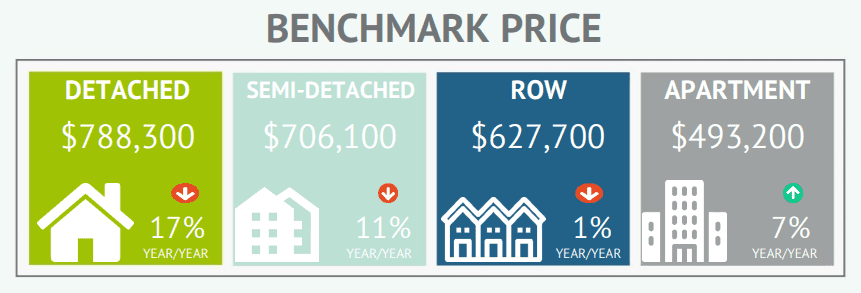

The adjustment in the market also weighed on home prices, which started to trend down in March after hitting a record high. As of December, benchmark prices dropped by 25 per cent from the peak and 15 per cent compared to December 2021. Despite the adjustment in prices, levels remain over 16 per cent higher than prices reported at the end of 2021.

The average home in Hamilton sold for $750,601 in December.

In December, the pullback in sales was enough to support inventory gains across the RAHB network (which includes parts of Niagara). While inventories have nearly doubled, levels reported in 2022 are still nearly 20 per cent below long-term averages for the region. Moreover, supply levels remained below typical for homes priced below $600,000.

“The pandemic and historically low interest rates created an exponential surge in housing demand. Supply could not keep pace, resulting in price growth that far exceeded expectations over two years,” said Lou Piriano, RAHB president. “2022 saw conditions start to shift back to a more balanced market. Improved supply is important to stabilizing both sales and home prices.”

Across the RAHB market area, easing sales and rising supply have shifted the market from the extreme sellers’ market conditions at the beginning of the year to one considered relatively balanced. The shift took some pressure off home prices, which hit a record high in February but declined 25 per cent by December.

While the price adjustment within the year was significant, it is important to note that as of December, prices remain over 16 per cent higher than pre-pandemic levels. On an annual basis, prices are still nearly 10 per cent higher than in 2021.

“If higher lending rates continue, they will weigh on home sales in 2023; however, the dip in prices coupled with better supply choice could start to support a more stable market for the foreseeable future,” Piriano added.

insauga's Editorial Standards and Policies advertising