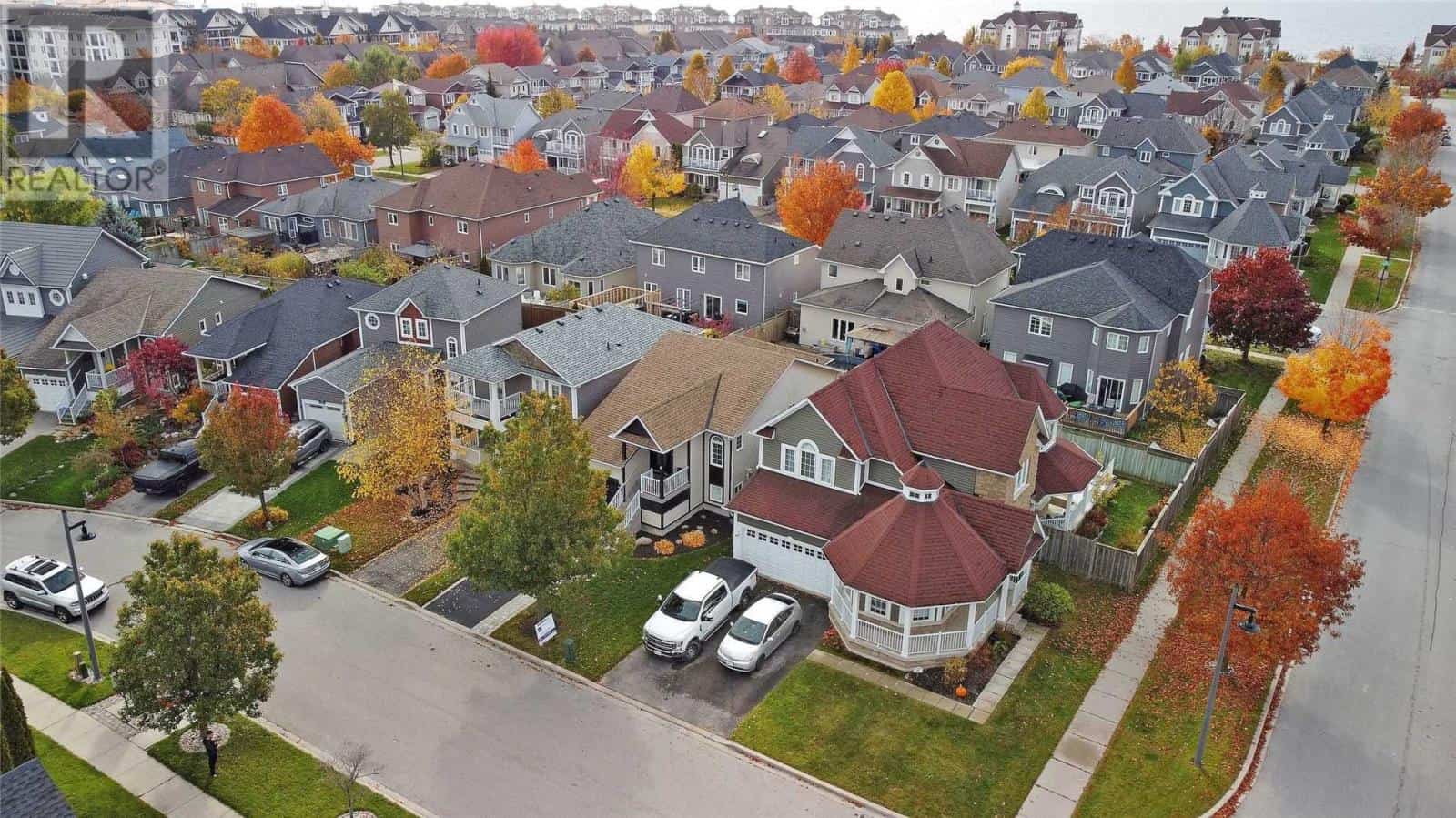

Declining housing prices lead to ‘balanced’ markets from Clarington to Pickering

Published November 16, 2022 at 1:05 pm

With housing prices steadily declining in Canada this year – with higher interest rates and a saturated market ripe for adjustment contributing factors – the housing sector went from a seller’s market in 2021 to a balanced market in most Ontario cities.

Real estate agency Zoocasa analyzed 34 cities and regions around the province and discovered with record prices of last year long gone most markets have experienced fluctuations in average prices, levels of inventory, and transactions.

They compared the sales-to-new-listings ratio (SNLR) for the month, calculated by dividing the total sales by the number of new listings in each region, and broke the numbers into three categories:

- An SNLR under 40 per cent suggests a buyer’s market where new listings outweigh and buyers have more options

- An SNLR between 40 per cent and 60 per cent is a balanced market where demand and supply are balanced

- AN SNLR over 60 per cent means a seller’s market where demand outpaces supply, benefiting sellers

All five of Durham’s municipalities were in the upper end of the ‘balanced’ market range, with Oshawa and Clarington very close to a seller’s market at 59 per cent. Whitby stood at 58 per cent, Ajax at 57 per cent and Pickering at 56 per cent.

Last year all five were sellers’ markets with Clarington at 83 per cent, Whitby at 82 per cent, Oshawa 81 per cent, Ajax at 80 per cent and Pickering at 79 per cent.

The only buyer’s market in Ontario is Niagara Falls at 29 per cent while most communities in northern Ontario remain in a seller’s market situation.

Balanced markets, meanwhile, are widespread across Ontario, creating a level playing field between buyer and seller and reflecting the stalemate seen between the two sides with interest rate hikes taking priority over financial decisions.

insauga's Editorial Standards and Policies advertising