How much property tax are you paying in Brampton?

Published May 29, 2023 at 1:18 pm

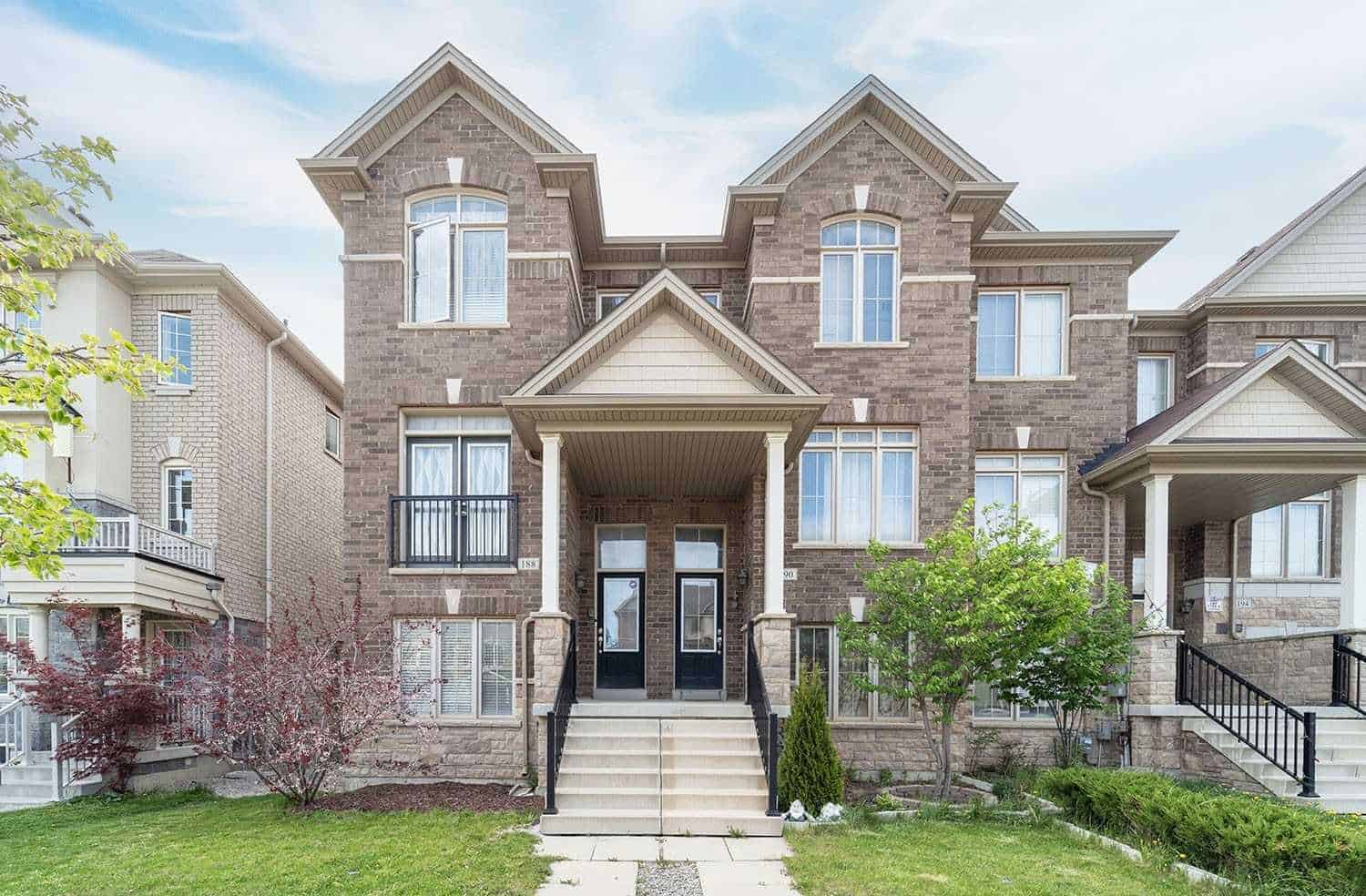

Average homeowners in Brampton are paying more to buy their homes compared to neighbours in Mississauga but are spending less in property taxes.

Those are the findings from the real estate website Zoocasa, which looked at 32 Ontario cities last month to see how different municipalities stack up when comparing property tax rates.

The report ranked cities based on the average amount of tax paid under the municipal tax rate and average home price in April and found Brampton came in at No.13 with an average sale price of $1,088,311.

With a property tax rate of just over 0.98 per cent, the amount of tax paid on the average Brampton home is approximately $10,674.

“In general, municipalities with higher average home prices have lower property tax rates, while the municipalities with more affordable average home prices have higher property tax rates,” Zoocasa said.

And despite having average home prices that are several thousand dollars below the rest of the GTA, communities on the west and north side of Toronto including Brampton have property tax rates near or above 1 per cent.

Both Mississauga fared better than Brampton for both average home prices and the tax rate with an average sale price of $10,076,430 last month and a tax rate of 0.82 per cent for an average of $8,932 in property taxes.

But rates in Caledon were higher with an average of $1,435,851 and a tax rate of 0.82 per cent for an average of $11,791.

Orangeville had the highest property tax rate on the list at slightly over 1.35 per cent, meaning residents can expect to pay $11,498 in taxes on an average-priced home of $849,770, while Markham had the lowest at approximately 0.64 per cent on an average price of $1,418,021.

Brampton was also in the top 10 of Canada’s most expensive cities for rental units last month as prices bounced back from record lows seen during the COVID-19 pandemic.

The average rental price for all property types across the country spiked some 20 per cent in April compared to rates seen during the same period in 2021, up to $2,002 from the April 2021 pandemic-low of $1,662.

insauga's Editorial Standards and Policies advertising