60% of people need a side hustle or second job to afford a home in Ontario

Published April 29, 2024 at 11:36 am

A new survey finds many Ontario residents believe they will need a second job or side hustle to afford a home in the province.

The finding is just one of many in the recently released 30th annual Home Ownership Poll from Canadian bank, RBC.

As home prices are expected to increase this spring, it will become even more difficult to buy a place. Just last year, a report found it would take an annual income of $127,118 to afford a home in Mississauga. And most places in the GTA require about the same or more.

So it is not surprising that people might consider getting another job to achieve homeownership dreams.

“Despite it being harder to save for a home, potential buyers are searching for additional ways to supplement their savings,” the RBC report notes.

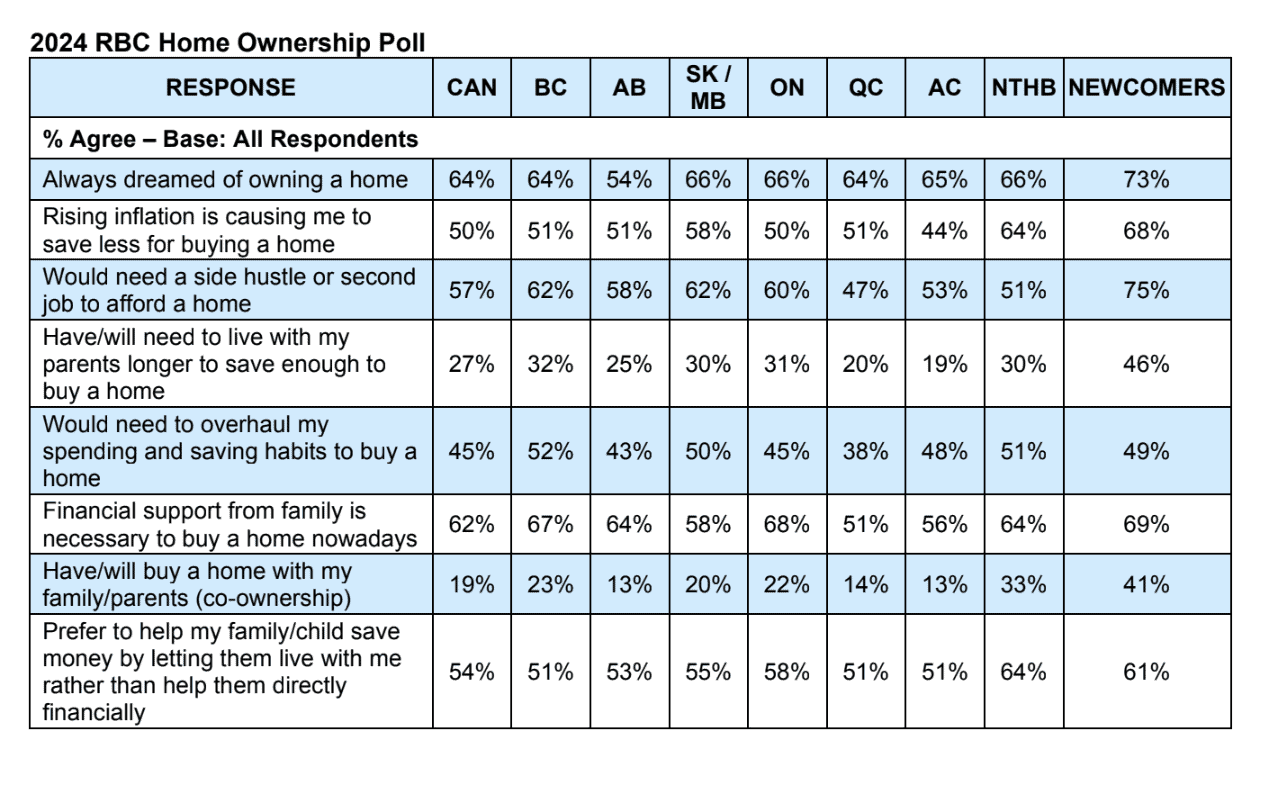

The majority (57 per cent) of potential buyers in Canada say they would need a side hustle or second job, the survey found. In Ontario, that number jumps to 60 per cent.

More than a quarter (31 per cent) have had to or would have to live with their parents longer to afford a home in Ontario. Almost half (45 per cent) also say they would need to overhaul their spending and saving habits to buy a home.

More than a quarter (31 per cent) have had to or would have to live with their parents longer to afford a home in Ontario. Almost half (45 per cent) also say they would need to overhaul their spending and saving habits to buy a home.

Family also continues to play a big role, with a whopping 68 per cent saying financial support from family is necessary to buy a home in Ontario and 22 per cent saying they have or will need to buy a home with their family/parents.

“Canadians have a lot of headwinds to face as they look to purchase a home today, whether they are a first-time buyer or searching for their next home,” says Janet Boyle, senior vice president, home equity finance and newcomer strategy, RBC. “While affordability anxiety remains, our research found that many home buyers are exploring different approaches to realize their dream of home ownership.”

But support from family might not always be available with 39 per cent of respondents in Canada saying they want to give family members money for housing or rent but can’t afford to do so. The majority of family members (54 per cent) also say they would prefer to have their child/family live with them to help them save money rather than provide financial support.

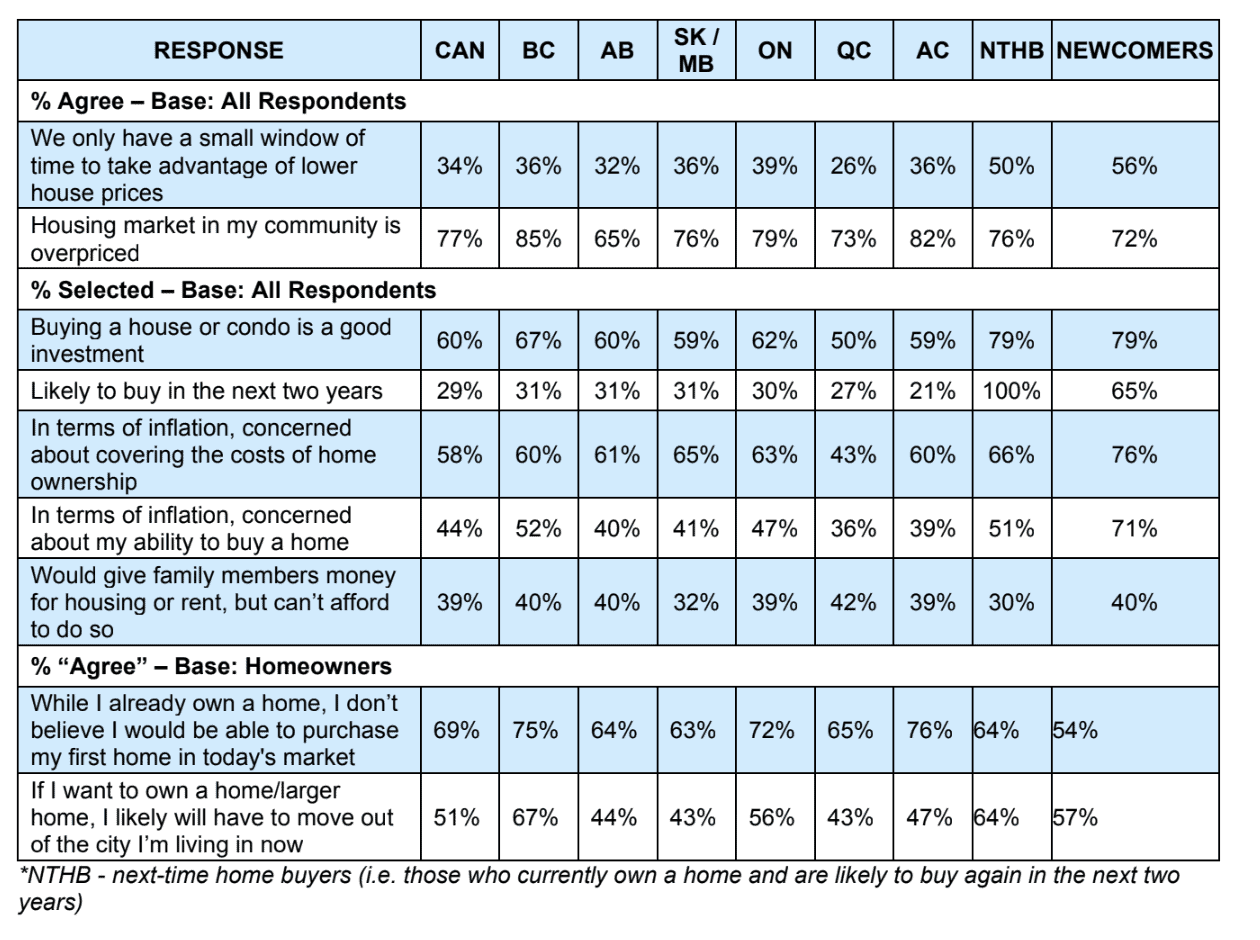

Despite affordability challenges and inflation most Canadians still want to buy a home and confidence in making the move to purchase a home is rising, according to the survey.

Most people under the age of 65 surveyed in Ontario (62 per cent), believe buying a house or condo is a good investment.

But only 30 per cent plan on buying in the next two years.

Half (50 per cent) of Canadians say inflation is eroding their ability to save for a home.

This challenge is acutely felt among those planning to purchase a home within the next two years. Among these potential buyers, there has been a 37 per cent decrease in the total amount they have saved to put towards buying a home.

Among newcomers who arrived in Canada in the past five years, 73 per cent say they have always dreamed of

owning a home and 65 per cent say they are likely to purchase one in the next two years (compared to 29 per cent nationally).

The survey of 2,824 Canadians aged 18 to 64 was done online between Jan. 25 and Feb. 23 using Leger’s online panel.

For more information, see the full survey results here.

Lead photo: RDNE Stock project

insauga's Editorial Standards and Policies advertising