Will COVID-19 affect Mississauga house prices?

Published April 1, 2020 at 9:06 pm

The year began with packed open houses, rabid bidding wars and sky-high prices, and no expert thought that anything–except perhaps an unprecedented influx of new inventory–could cool the red-hot market in Mississauga and the GTA.

Until COVID-19 came along and brought the world economy to an abrupt and staggering halt.

Over the past two weeks, the lives of Canadians have been completely upended. Schools have closed, companies have issued mass lay-off notices, public spaces have shuttered and gatherings of more than five people have been banned.

As we all stay home as much as possible to “flatten the curve” and stop the virus from overwhelming the health care system (and killing an untold number of residents), we worry about what will become of our economy if social distancing measures remain in place for months to come.

We’re also worried about what might happen to our housing market–especially if we had plans to buy or sell (or both) this year.

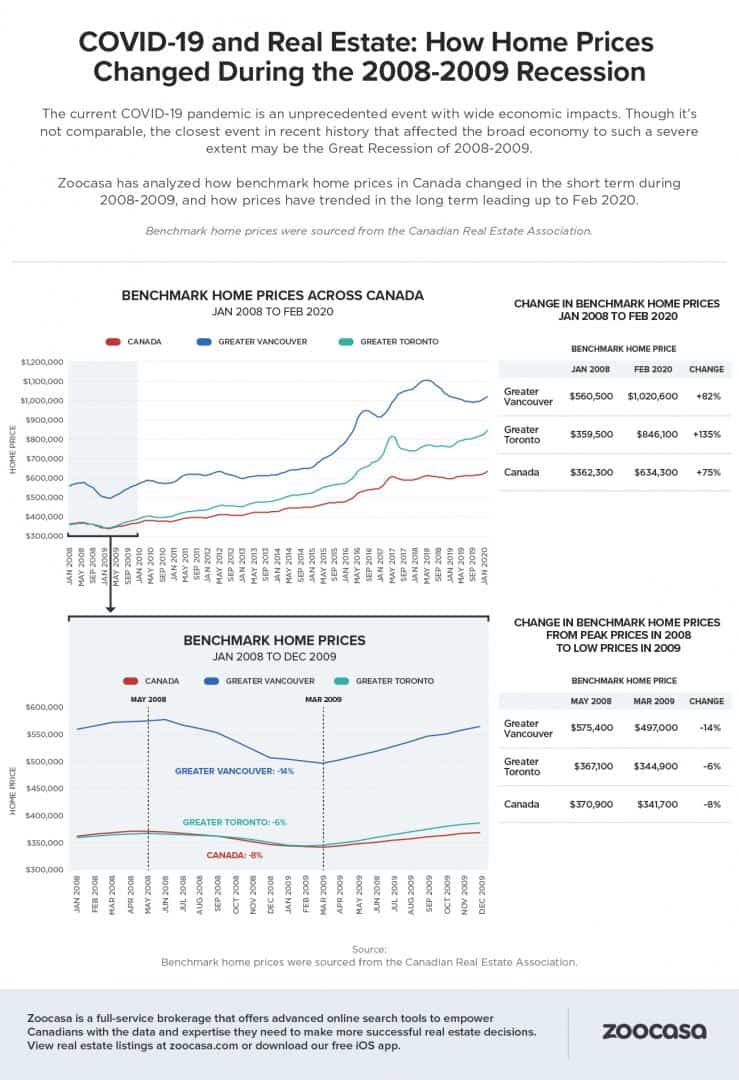

While it’s impossible to predict what will happen, real estate brokerage and website Zoocasa is attempting to look at how COVID-19 could shape the housing market in the short- and long-term by comparing the current crisis to the 2008/2009 recession.

The blog post also says that real estate, an industry that requires human interaction, will inevitably be affected by physical distancing measurers.

Zoocasa points out that while real estate brokerages and agent services have been considered essential services in Ontario, agents are being urged to stop operations altogether in order to comply with best social distancing practices. In fact, the Toronto Region Real Estate Board has asked agents to cancel all open houses and make all showings virtual.

“The bottom line is, as long as these health risks are present, it’s widely expected that anyone without an urgent need to buy or sell a home will put their real estate ambitions on hold for the time being,” says Penelope Graham, managing editor, Zoocasa, in the blog post.

“That bodes a lot of questions for the market in general; what will be the immediate impact? When the threat of COVID-19 dissipates, will prospective home buyers still be there to pick the market back up?”

To get an idea of how COVID-19 could shape the housing market, Zoocasa makes some comparisons to the great recession.

“Though the circumstances are very different, the closest economic event that’s comparable to the impact of COVID-19 is the 2008 – 2009 global recession, which was spurred by mass defaults in mortgage debt and resulted in similar monetary policy moves from central banks to mitigate the damage, along with bank bailouts and stock market upheaval,” Graham writes.

“While Canada has been lauded for fiscally weathering that recession better than many nations, home prices did see a drop during its deepest crevice, between the springs of 2008 and 2009.”

According to an analysis by Zoocasa, benchmark real estate prices dipped across Canada by 8 per cent, from $370,900 to $341,700. Losses remained under double-digit percentages for Toronto homes for sale, down 6 per cent from $367,100 to $344,900.

After the recession ended, the market began firing on all cylinders–which suggests that it’s quite resilient when not affected by a global crisis.

Zoocasa says that post-recession, Canadian home values surged 75 per cent–from $362,300 to $634,300. Toronto home prices rose 135 per cent from $359,500 to $846,100.

So, what can homeowners–and buyers–expect in a world rocked by COVID-19?

Lauren Haw, Zoocasa’s CEO and Broker of Record, points out that the fundamentals of the housing market, especially in large cities such as Toronto and Vancouver, generally don’t change.

“There has long been a lot of pent-up buyer demand in these markets, particularly due to a long-term lack of inventory,” she says.

“Combined with continued population growth in these regions, it’s expected that the market will experience a strong bounce back once the health risks have subsided, and buyers return to the market with restored purchasing power.”

So if you were worried about a crash, fear not–a market this hot is likely to bounce back.

INsauga's Editorial Standards and Policies