Why Students Aren’t Scrimping for School

Published September 5, 2017 at 9:34 pm

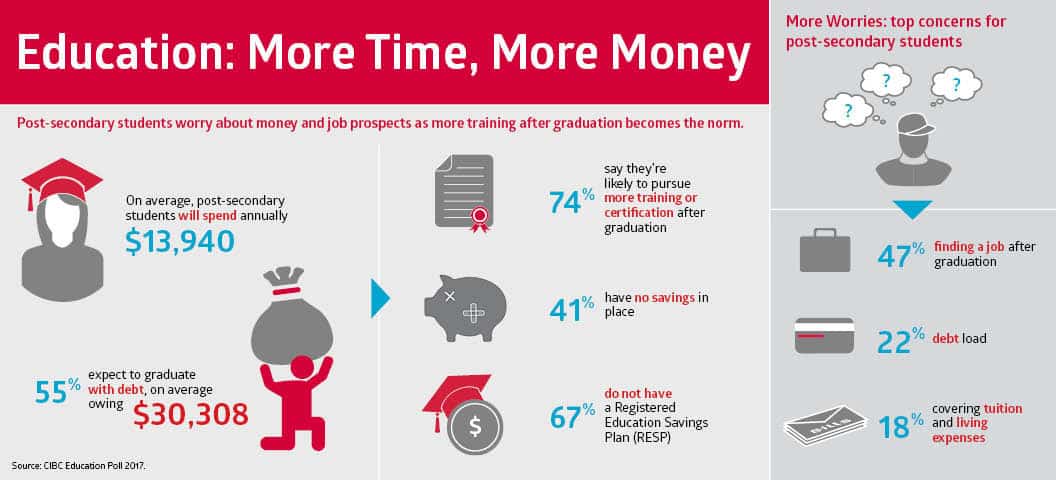

Canadian students are investing more and more time and effort – and money – in their education, but their financial investments in savings for college and university aren’t keeping pace, a new CIBC poll finds.

“Students are telling us that they’re worried about finding a well-paying job after graduation, and the need for more training and higher costs of some degrees is adding to the already high education bill,” said CIBC Imperial Service VP David Nicholson in a news release.

Nearly three quarters of Canada’s post-secondary students say they’re likely to pursue additional training or certification after graduation, according to the poll, which surveyed 1,506 Canadians currently enrolled in full- or part-time studies.

The long game in education is apparently the new norm.

Yet just over 40 per cent of them have no savings in place for further education and two-thirds don’t have a Registered Education Savings Plan (RESP).

While the average student spends nearly $14,000 per year on education, more than half say they will graduate with $30,308 in debt.

Roughly a quarter don’t know how much they’ll spend per year, and roughly another quarter don’t know how much they’ll owe by the time they’re done with school.

While students don’t have long-term savings for education, students are “increasingly pragmatic” about their career paths, the survey finds.

The report found enrolment growth in “STEM” programs (Science, Technology, Engineering and Math) offering careers in higher-paying fields had risen at almost double the pace of other less costly programs over the past decade.

While STEM students expect to owe roughly $17,000 more than their non-STEM peers by the time they graduate, they also expect to earn just over $16,000 more in high-demand, higher-paying STEM fields.

For more than 80 per cent of students, getting job-specific training and finding gainful employment are the primary goals. Eighty per cent say an undergraduate degree is not enough.

Higher pay isn’t the only motive for STEM students.

Fifty-nine per cent of them are confident they’ll secure a well-paying job, compared with 42 per cent of their non-STEM peers.

The lack of savings isn’t due to education being a low priority. The poll measured students’ top financial concerns and found for nearly half of respondents, the top concern was finding a well-paying job in their field upon graduation. Having extra pocket money for fun was one of the lowest priorities, a top concern for only five per cent of students polled.

Another 2016 CIBC report found the share of young Canadians in the labour force is falling.

That’s one less source of savings, which could make sound planning all the more important.

While the report doesn’t fault students for taking the long-term view in their priorities, it suggests saving early and having a clear picture of education expenses can help keep those costs in check.