Top 5% of Hamilton earners can afford single-family home: report

Published April 6, 2023 at 11:05 am

The picket fence dream is still alive in Hamilton — except only about 5 per cent of the city’s residents can afford it alone.

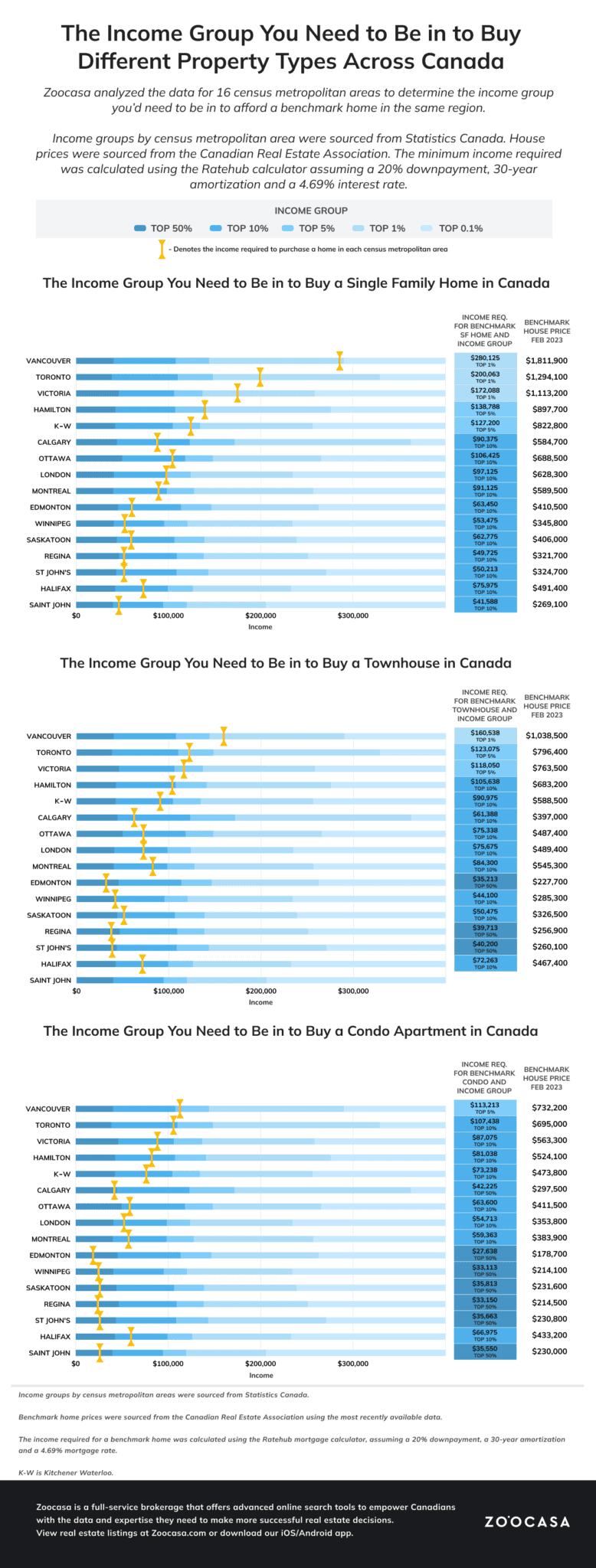

According to Zoocasa, an annual income of $138,788 is required to purchase a single-family home based on February’s benchmark price of $897,700. The annual income represents just 5 per cent of the local population.

The online real estate service analyzed 16 Canadian municipalities and compared the prices of single-family homes, townhouses, and condo apartments to different income groups.

The method being used assumes a 20 per cent down payment, 30-year mortgage amortization, and 4.69 per cent interest rate.

Not surprisingly, homes in the Prairies and on the East Coast are more affordable than in Ontario or British Columbia, according to Zoocasa. Buyers would need to be in the top 1 per cent of earners to afford a single-family home in Vancouver, Toronto, and Victoria. An income of $280,125 is required to afford a home at the benchmark price of $1,811,900 in Vancouver.

At the other end of the scale, buyers in Montreal, Edmonton, Winnipeg, Saskatoon, Regina, St John’s, Halifax, and Saint John would need to be in the top 10 per cent of earners.

“It is important to note that income scales differently in each city,” explains Zoocasa. “So while someone in the top 10 per cent of earners in St. John would need an income of $41,588 to afford a home, in Ottawa, someone in the top 10 per cent would need $106,425 to afford a home.”

“Housing prices being higher means that the cities with a greater median income will have both pricier income groups and higher required incomes.”

Back in Hamilton, if you don’t mind sharing a picket fence, a townhome may be more suitable. At a benchmark price of $683,200, a single earner would require a yearly salary of $105,638, which represents about 10 per cent of the local population.

Meanwhile, a prospective townhome buyer would need to be in the top 50 per cent of earners to buy a home in Edmonton, Regina, or St John’s, but a buyer in Vancouver would require an income of $160,538 to afford a townhouse, planting them firmly in the top 1 per cent of earners.

With Hamilton in the midst of a condo development boom, prices will likely reflect an influx of supply over the next few years. Now, though, you’ll still need to be among the city’s 10 per cent of earners. An annual salary of $81,038 is required to purchase a condo at the benchmark price of $524,100.

The affordability chart from Zoocasa can be viewed below.