This is how much home prices have increased in 10 years in Ontario

Published January 29, 2024 at 2:12 pm

Anyone in the housing market knows home prices have increased dramatically in the last few years, particularly in Ontario.

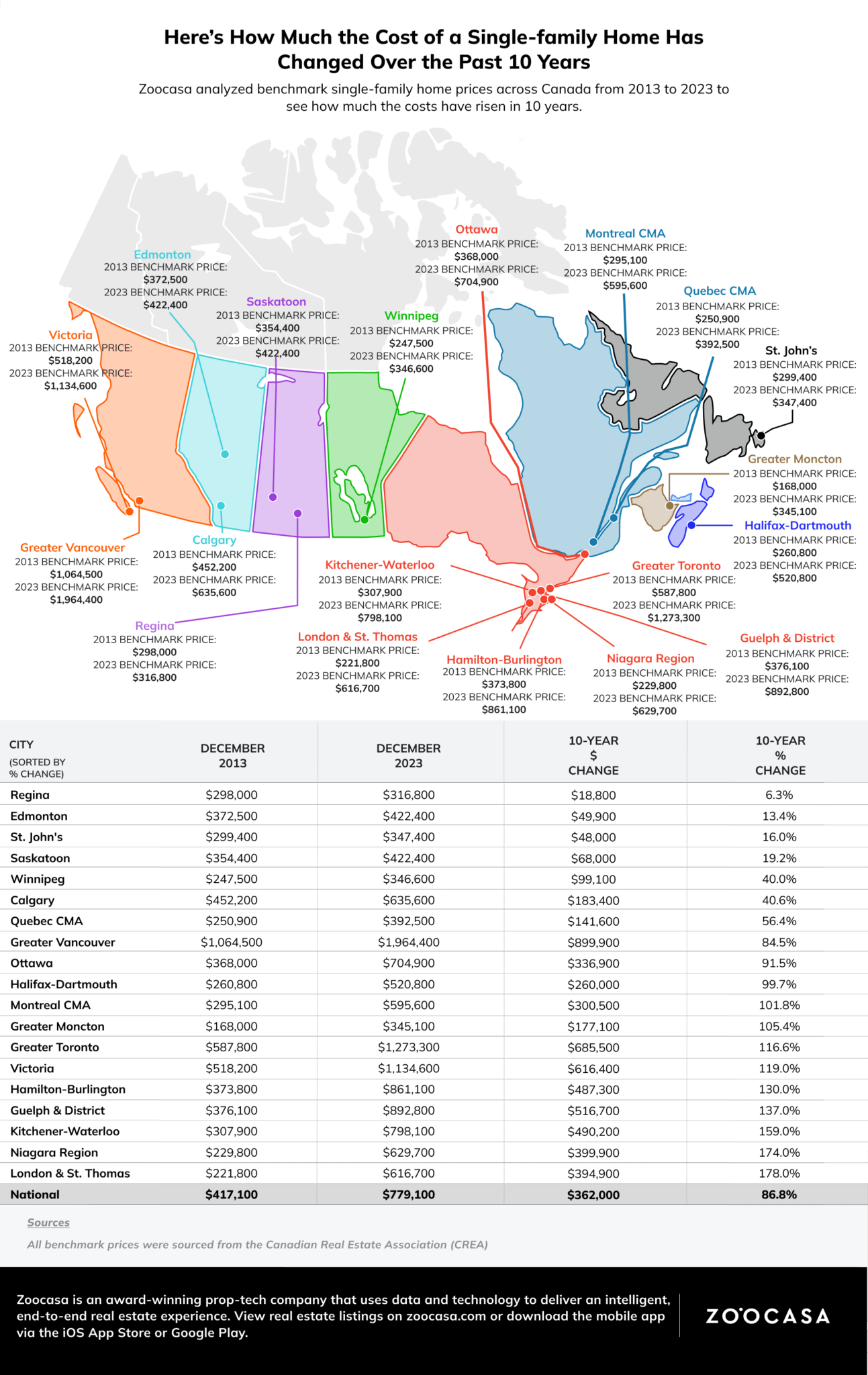

From 2013 to 2023, the benchmark price of a single-family home in most of Canada has doubled, a new report from real estate brokerage Zoocasa found.

Zoocasa analyzed benchmark prices in December for each year from 2013 to 2023 from the Canadian Real Estate Association.

The Prairie provinces saw the most stability in Canada. For example, the benchmark price of single-family homes in Regina increased by just $18,800 in the last 10 years.

But the report shows Ontario home prices have doubled and in some cases nearly tripled in 10 years — some cities seeing bigger increases than others.

The report found that while single-family home prices are the highest in Toronto and Vancouver, smaller cities have actually seen bigger price hikes in terms of percentages.

In Ontario, London and St. Thomas had the biggest increase with the benchmark price of a single-family home price rising by 178 per cent from $221,800 in 2013 to $616,700 in 2023.

That translates to a $394,900 increase in 10 years.

Zoocasa suggests that price growth was likely driven by priced-out GTA buyers moving into comparably more affordable markets.

Niagara Region, Kitchener-Waterloo, and Guelph and District, also experienced rapid price growth in the past decade.

The price of a single-family home in the Niagara Region shot up by 174 per cent from 2013 to 2023, while in Kitchener-Waterloo the price of a single-family home increased by 159 per cent.

That comes out to a $399,900 increase in price in Niagara Region and a $490,200 increase in price in Kitchener-Waterloo, the report notes.

Outside of Greater Toronto, Guelph and district single-family homes experienced the largest price increase in Ontario over the past ten years, rising by $516,700.

In Greater Toronto, the benchmark price of a single-family home increased by $685,500 from 2013 to 2023.

It’s not hard to find examples of homes selling for double or even triple the price of 10 to 20 years ago.

This home at 135 Glenview Dr., Mississauga, for example, sold for $540,000 in 2004 but just went for $1.85 million on Jan. 15 this year.

This home at 135 Glenview Dr., Mississauga, sold recently.

This four-bedroom home at 222 Eagleglen Way, Hamilton, sold for $430,000 in 2013 but just sold for $1,135,800 on Jan. 25.

This home at 222 Eagleglen Way, Hamilton, sold recently.

Making things more difficult for buyers is the increase in mortgage rates, which come with the Bank of Canada key interest rate hikes aimed at curbing inflation. Low interest rates combined with the pandemic drove prices up reaching a peak in 2022.

The Zoocasa report notes how much mortgages have increased.

Based on the single-family benchmark price for each year and assuming a homeowner put 10 per cent down with the 5-year fixed rate of 3.24 per cent in 2013 and 5.24 per cent in 2023, Niagara Region mortgage payments have increased from $1,036 in 2013 to $3,479 in 2023.

Using the same parameters, the monthly mortgage payment for a benchmark single-family home in Kitchener-Waterloo has risen from $1,387 in 2013 to $4,409 in 2023.

See the full report here.

INsauga's Editorial Standards and Policies