The Worst and Best Neighbourhoods for Car Insurance Rates in Mississauga

Published September 29, 2016 at 2:53 am

When it comes to car insurance, there are a lot of variables that determine your premium. On average, men pay more than women and older drivers pay less than younger ones. In most cases, people with rich accident, ticket or claim histories pay more than people with clean records. People with long daily commutes and extensive yearly mileage also pay more than drivers who tend to stay local. You may also pay more based on your choice of vehicle.

When it comes to your premium, there are a few factors you cannot control, such as your age and gender. There are also some that you can, namely your claim and accident history (drive as carefully as you can to avoid tickets and collisions and don’t file claims for minor damage to your vehicle). There’s also a third factor that you can kinda/sorta control, but might not want to for perfectly legitimate reasons: your location within the city.

“Where you live may come with a higher premium because premium depends on location,” says Cathy Iovine, a registered insurance broker with Axion Insurance. “If your area has a high rate of claims or if your area is very highly populated [you might pay more]. Highly populated areas have higher insurance rates because you’re more likely to be involved in an accident if there are more vehicles on the road.”

So, what neighbourhoods in Mississauga carry higher premiums? In a nutshell, the more congested regions are typically more costly.

“Subdivisions are less congested than, say. Square One,” Iovine says. “In City Centre, it’s more bumper to bumper. Rates get better and better the further you can move out. The Heartland area is growing as well, so that one is a little higher.”

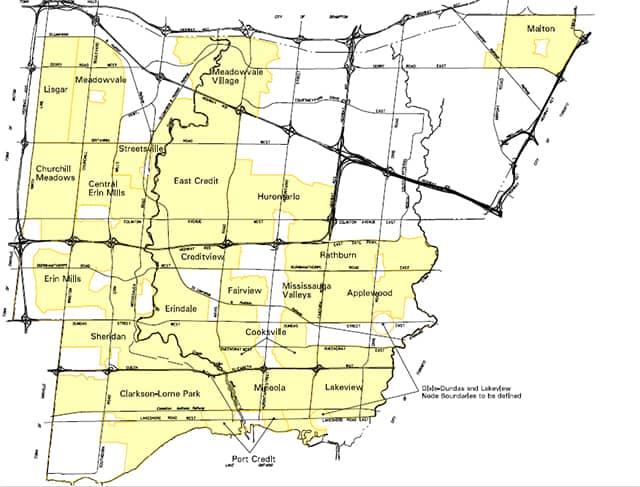

We decided to take a look at Mississauga’s 22 neighbourhoods and find car insurance quotes through kanetix.ca, a website that allows you to search for car insurance by plugging in your postal code.

Since we can’t be perfectly scientific here (like we said, your premium depends on your gender, age, driving history, vehicle, commute and insurance provider), we decided to find the lowest rates available for the average 30-year-old driver with a 2012 compact car, 12 years driving experience, yearly mileage of 15,000 km and a clean record based on the city’s neighbourhoods.

Here’s a look at car insurance in Mississauga, with neighbourhoods ranked from best to worst in terms of premiums.

Remember, these are general numbers based on simplified criteria.

1

1

Erindale

$1,558 Yearly or $130 Monthly

Meadowvale

$1,558 Yearly or $130 Monthly

Port Credit

$1,558 Yearly or $130 Monthly

Streetsville

$1,558 Yearly or $130 2

2

Clarkson-Lorne Park

$1,602 Yearly or $134 Monthly

Mineola

$1,602 Yearly or $134 Monthly 3

3

Central Erin Mills

$1,628 Yearly or $136 Monthly

Erin Mills

$1,628 Yearly or $136 Monthly

Lisgar

$1,628 Yearly or $136 Monthly  4

4

Lakeview

$1,725 Yearly or $146 Monthly

5

Cooksville

$1837 Yearly or $153 Monthly

Fairview

$1,837 Yearly or $153 Monthly

Meadowvale Village

$1,837 Yearly or $153 Monthly

Mississauga Valleys

$1,837 Yearly or $153 Monthly

Rathwood

$1,837 Yearly or $153 Monthly

6

Churchull Meadows

$1865 Yearly or $155 Monthly  7

7

Applewood

$1,869 Yearly or $156 Monthly

8

East Credit

$2,001 Yearly or $169 Monthly

9

Sheridan

$2,128 Yearly or $178 Monthly  10

10

Hurontario

$2,178 Yearly or $185 Monthly 11

11

Malton

$2,262 Yearly or $191 Monthly