Single income not enough for buying a home in Niagara Region

Published February 8, 2023 at 11:18 am

The bad news is if you’re a single income family, you are very unlikely to ever be able to afford a house in Niagara Region.

The slightly less bad news is you’re in the exact same boat as single-income residents in most major Canadian markets such as Vancouver, Toronto, Calgary, Ottawa, Montreal and even nearby Hamilton-Burlington.

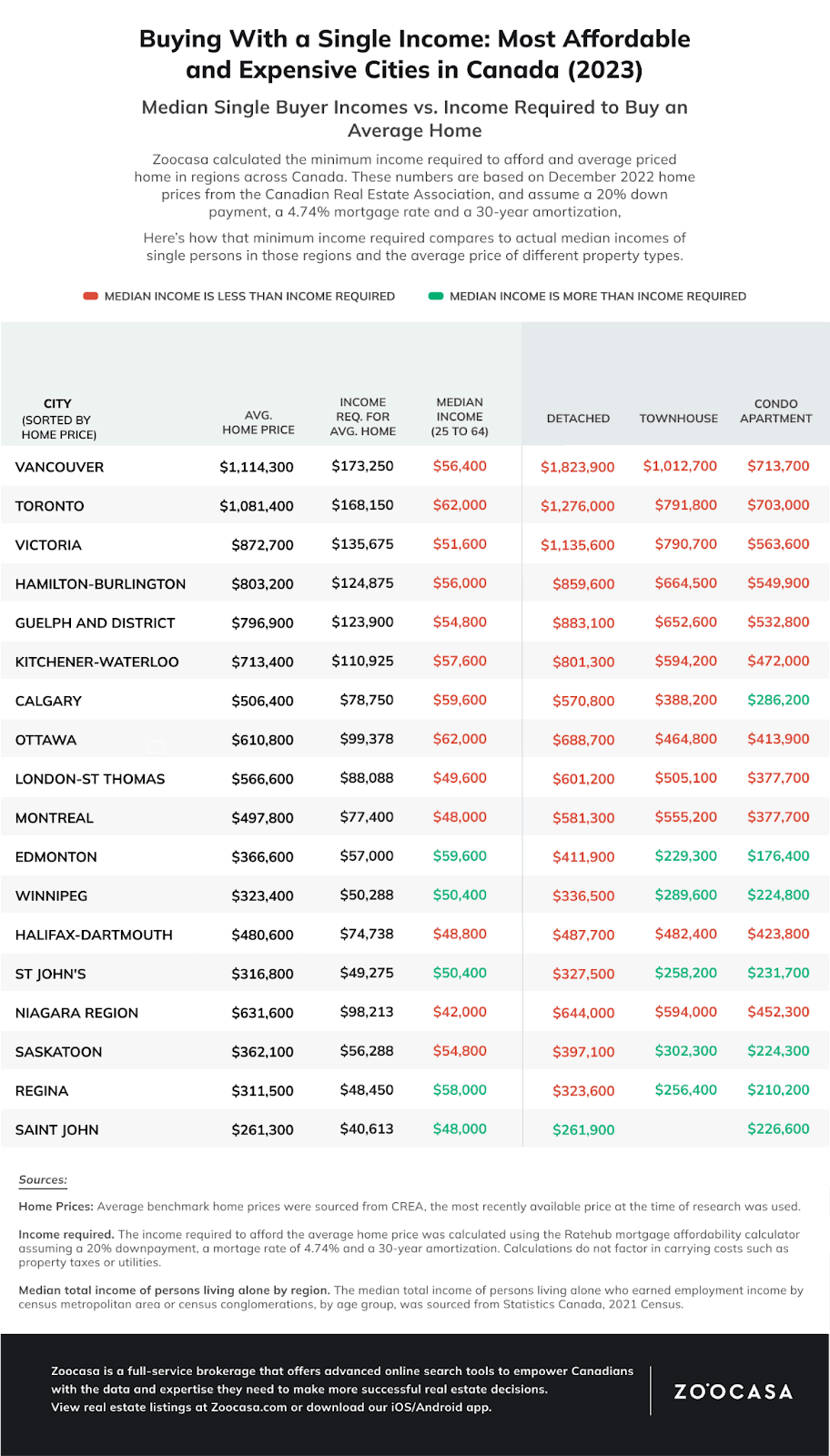

In fact, when real estate brokerage and market assessor Zoocasa crunched the numbers, only a handful of Canadian cities could afford homes on single incomes as they looked at the median incomes, how actually needed to buy a home based on the median prices.

In the Niagara Region, the average house price was set at $631,600, meaning the single income would need to be $93,213/year to afford a house in that range.

However, the median single income in Niagara isn’t even remotely close, presently pegged at $42,000/year.

According to Zoocasa, the best bet was to either look to the east or west as St. John’s, Nfld, Regina, Winnipeg, Edmonton and Saint John, NB were the only Canadian cities where income was high enough to top the amount needed for a single income to buy a home.

To calculate the income needed, Zoocasa said, “To determine the minimum income required to qualify for a mortgage on the average home, we assumed the buyer would make a 20 per cent down payment and receive a mortgage with the current average interest rate of 5.14 per cent amortized over 30 years.”

“Those findings were then compared to median income data of ‘persons living alone who earned employment income’ as reported by Statistics Canada in its latest available census data from 2021,” they noted.

To see the statistics from across Canada, check out this chart.

INsauga's Editorial Standards and Policies