Rising interest rate means falling home prices in Burlington, Milton

Published May 26, 2023 at 4:24 pm

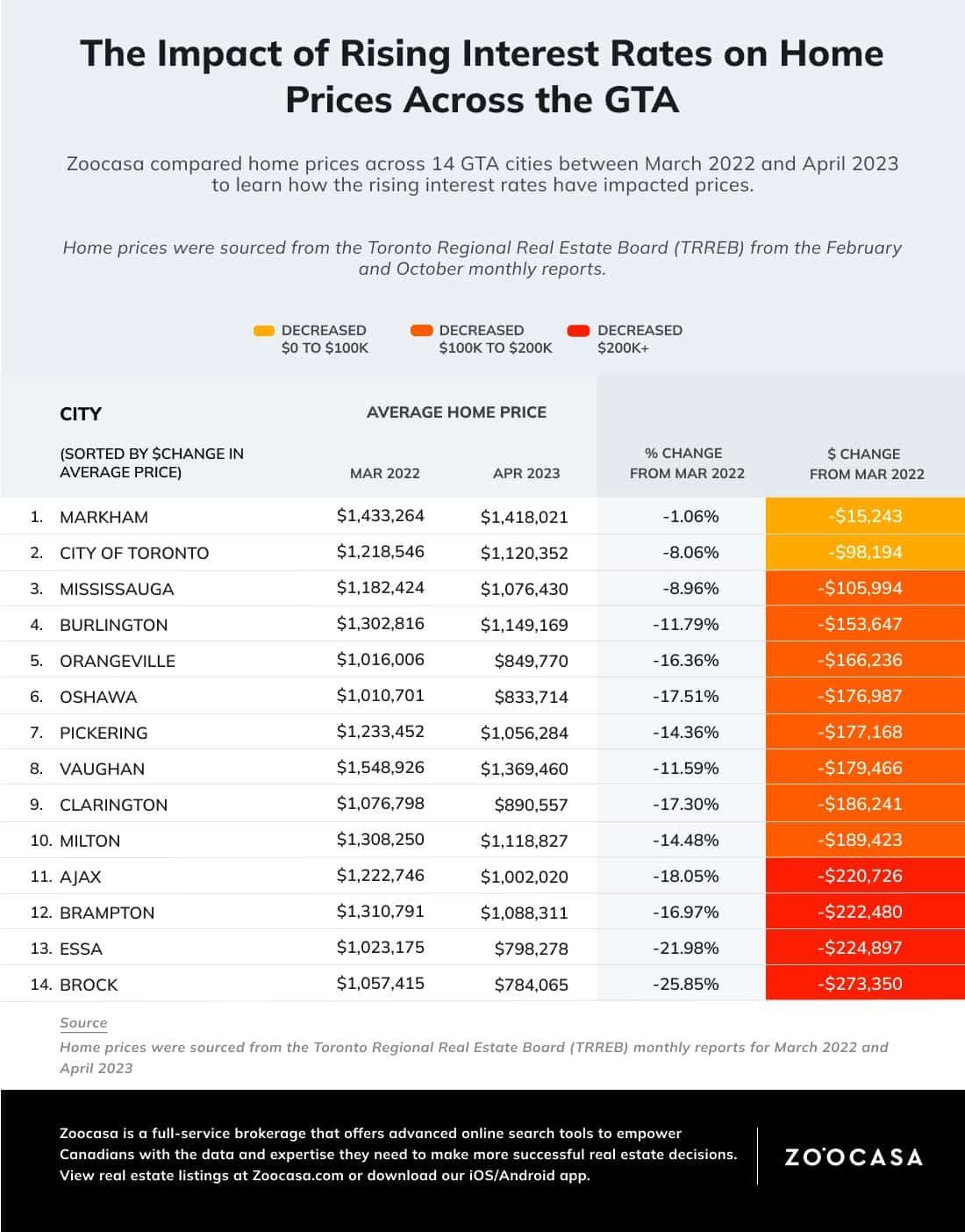

Rising interest rates have helped cool off the housing market in Burlington and Milton according to online real estate company Zoocasa.

In a report released this week, Zoocasa showed the average price of a home in Ontario dropped by $174,300, down 16.12 per cent when comparing March 2022 to April 2023.

Burlington’s average price drop, however, was below the provincial average. The average home price dropped 11.79 per cent, from $1,302,816 to $1,149,169.

In Milton, home prices dropped from $1,308,250 to $1,118,827, 14.48 per cent.

“The dominant story of the Canadian real estate market throughout 2022 was the impact of rising interest rates,” wrote Daniel Crook of Zoocasa in the report. “The lending rate was just 0.5 per cent in February but, after six increases throughout the year by the Bank of Canada, it ended up at 4.25 per cent. There was a further increase in January 2023 to 4.5 per cent, but the central bank has held steady since then.”

As rates have changed, so have prices. The record price highs seen early in the year were impacted by the rate hikes, but as 2023 has gone on those have slowly started creeping up again.

Despite the declines since rate hikes began, prices have been on the rise again during 2023.

Home prices increased by 4 per cent on a monthly basis from March to April. As markets have settled and buyers and sellers have adjusted to the impact, more homes have started moving, while the short supply means that demand outweighs the available supply, resulting in home prices steadily increasing.