Rental Rates Falling Slightly in Mississauga: Report

Published April 26, 2019 at 6:16 pm

If you’re looking to rent an apartment in Mississauga, we have some good news and some bad news.

The good news is that the average monthly rent in Canada overall–and therefore Mississauga–declined slightly in March 2019. The bad news is that rental rates are still quite high in Mississauga and surrounding cities.

According to the April national rent report produced by Rentals.ca and Bullpen Research & Consulting, it does look like prospective tenants are finally seeing a little relief after three straight months of increasing rental rates,

The report says the average property on Rentals.ca was offered for $1,864 per month in March vs. $1,888 per month in February, a decrease of 1.3% month over month. The median asking rent in March of $1,750 per month is 2.7% lower than February ($1,800).

Prices also dropped in Mississauga.

In February, the average monthly rent in Mississauga sat at $1,922 for a one-bedroom apartment and $2,268 for a two-bedroom unit. At that point, rental units in Mississauga were only slightly more affordable than those found in Toronto, where a one bedroom was running tenants $2,234 per month (a two bedroom was costing them $2,651).

In March, Mississauga tenants found themselves paying $1,891 for a one-bedroom and $2,226 for a two-bedroom.

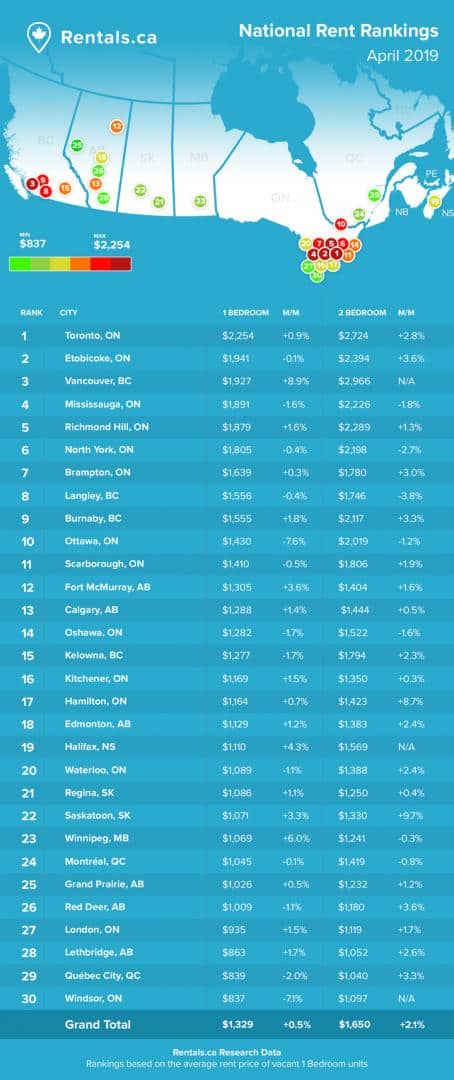

That said, the report still identifies Mississauga as one of the top five most expensive rental markets in Canada.

The report says that on a quarterly basis — first quarter 2019 over last quarter 2018 — the average property listed on Rentals.ca increased by 4.3 per cent to $1,869, while median national rents were up 6.9 per cent quarter over quarter at $1,764.

Mississauga was the fourth most expensive city for average monthly rent for a one-bedroom home and the fifth most costly for average rent for a two-bedroom. The top three most expensive rental markets for one-bedroom units are Toronto (1), Etobicoke (2) and Vancouver (3). The top five are rounded out by Mississauga (4) and Richmond Hill (5).

Brampton was the seventh most expensive on the list of 30 cities for average monthly rent for a one-bedroom at $1,639 and twelfth most costly for a two-bedroom at $1,780.

On a quarterly basis, average overall rents in Mississauga and Brampton changed little from last quarter 2018 to the first quarter of 2019. Rents were up $2 in Mississauga and $27 in Brampton in the first quarter of 2019.

While rental rates remain high (and inventory sits at about 0.8 per cent in Mississauga), it doesn’t look like elevated interest rates will be a problem for homeowners and, by extension, tenants in the near future.

The report notes that, due to economic uncertainty, there won’t likely be any interest rate hikes in 2019 as previously forecast. In fact, there is a good chance of a rate reduction.

The report also says the new First-Time Home Buyers Incentive that was recently announced as part of the national budget could reduce demand for rental units.

Ideally, this interest-free, down payment assistance program could help many tenants get into the home-ownership market–effectively freeing up units for people who need them.

The report suggests these two measures, plus the potential rate cut in 2019, should help keep rents stable if not lower, especially in Toronto where rents continue to increase monthly.

As for what else is happening with the rental market, Mississauga tenants should note that Toronto still has the most expensive average monthly rent for a one-bedroom home at $2,254, while Vancouver has the highest rent for an average monthly rent for a two-bedroom at $2,966.

On a provincial level, Ontario had the highest rental rates in March, with landlords seeking $2,162 per month on average (all property types), a decrease of 1.6 per cent from February ($2,197).

Not unexpectedly, the report notes that Toronto has the most active market in Canada for private landlords, as investors purchase pre-construction condominium apartments and rent them out at completion.

“The pace of rental growth subsided on a national basis last month, but monthly readings can result in some volatility,” said Matt Danison, CEO of Rentals.ca. “Data shows rents were up in most of the major provinces in Q1-2019, with Ontario up by 1.7 per cent quarterly, Alberta by 3.4 per cent, and BC by 8.7 per cent. Average rents declined by 3.5 per cent quarterly in Quebec.”

So, what can tenants expect going forward?

“I don’t expect rents to grow as quickly in the second quarter as they did in the first, but further housing market interventions are not off the table, especially as they relate to alternative or subprime lenders,” said Ben Myers, president of Bullpen Research & Consulting. “A move to further tighten credit could send another flood of tenants into the already tight rental market.”

The National Rent Report charts and analyzes national, provincial and municipal monthly rental rates and market trends across all listings on Rentals.ca for Canada.

INsauga's Editorial Standards and Policies