Rental prices falling amid COVID-19 pandemic in Mississauga

Published July 1, 2020 at 2:25 am

It took a little longer than some might have expected, but rental prices appear to have dipped a bit in May in Mississauga–about two months into the COVID-19 shutdown.

According to the recently-released National Rent Report from Rentals.ca and Bullpen Research & Consulting, the average price in Mississauga for an apartment or condo rental declined 3.3 per cent month-over-month to hit $2,072.

While Mississauga’s decrease was steeper, the report says the average monthly asking rent for all property types in Canada was down 1.4 per cent in May over April to $1,814. Toronto rents have also declined over the last three months following several months of increases.

The report says the COVID-19 pandemic continues to affect the rental market across the country, with rent down 7.2 per cent since September, when rates peaked at $1,954 per month. According to the report, the average monthly rental rate in Ontario was down 0.6 per cent monthly.

“Tenants have been more dramatically impacted by pandemic-related job loss than homeowners, and are not currently looking for apartments or other rental accommodation,” said Ben Myers, president of Bullpen Research and Consulting, in the report.

“This sharp drop in demand has resulted in landlords dropping their asking rents in most major markets across the country.”

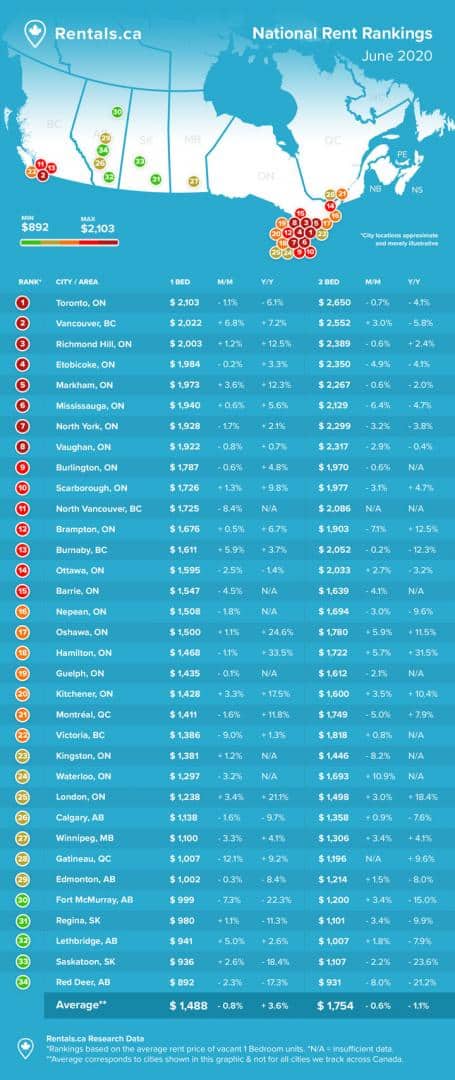

According to the report, Mississauga came in sixth on the list of 34 cities, with the average monthly rent for a one-bedroom home sitting at $1,940 in May. The city came in eighth for average monthly rent for a two-bedroom at $2,129.

While one-bedroom units increased in price from $1,927 to $1,940 month-over-month, two-bedroom units became slightly more affordable, falling from $2,273 to $2,129. The rent for a one-bedroom apartment in the city is still up 5.6 per cent year-over-year, but the rate for a two-bedroom unit is down 4.7 per cent.

The report says the average rent for apartments and condominium units in Toronto (pre-amalgamation boundaries) declined by 0.5 per cent in May to $2,290 per month, which follows the 5.9 per cent monthly decline in April. Rents were also down in Winnipeg, Montreal and Victoria.

In contrast, rents in London climbed 2.9 per cent in May.

According to the report, people are still looking for rental units.

“There was a significant increase in website traffic on Rentals.ca in May,” said Matt Danison, CEO of Rentals.ca, in the report.

“It appears prospective tenants are doing their research to prepare for a move in the near future.”

Although prices have declined, Toronto led all 34 cities on the list for average monthly rent in May for a one-bedroom home at $2,103, and for a two-bedroom at $2,650 (all property types).

Nine Greater Toronto Area cities finished in the top 10 for most expensive rent for a one-bedroom home in Canada, with Richmond Hill, Etobicoke, Markham, Mississauga, North York, Vaughan, Burlington and Scarborough continuing to boast some of the highest rental rates in Canada.

Nearby Brampton finished twelfth with average monthly rent in May for a one-bedroom home at $1,676 and fourteenth for average monthly rent for a two-bedroom at $1,903.

The report says that renter preferences on where to live are difficult to predict since the onset of the COVID-19 pandemic, but working from home could be having a small effect in some cities.

Local Logic, which covers data on a number of Canadian real estate portals, found that in the Toronto and Vancouver Census Metropolitan Areas (CMA) there was a slight decrease in the share of transit-friendly searches in May. Local Logic data also suggests that Canadians looking to live in metropolitan areas are seeking neighbourhoods outside of city centres.

The report also suggests that as borrowing criteria tightens, more residents will choose to rent rather than buy homes.

Homebuyers insured by the Canada Mortgage and Housing Corporation (less than 20 per cent down payments), can no longer borrow their down payments, and must have a credit score of 680 or above.

“Even if house prices decline and tenants are enticed to buy, they might not qualify for a mortgage with CMHC insurance. This will reduce ownership demand, and increase rental demand,” the report reads.

The National Rent Report charts and analyzes monthly, quarterly and annual rates and trends in the rental market on a national, provincial, and municipal level across all listings on Rentals.ca for Canada.

insauga's Editorial Standards and Policies advertising