Poll Finds Many Canadians Have Practical Bucket Lists

Published August 30, 2019 at 4:27 am

Almost everyone has a bucket list. You may think that some items on yours are crazy, most of them may be more realistic than you think!

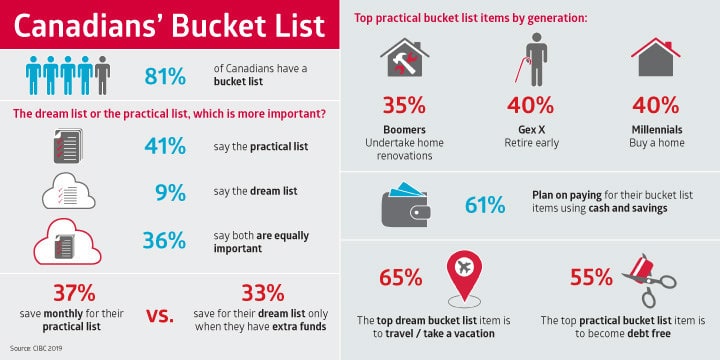

According to a new CIBC poll, 81 per cent of Canadians have a bucket list of things they hope to accomplish one day. However, more than two-in-five (41 per cent) say practical goals are more important than the indulgent ones.

The poll shows that when asked which bucket list is more important to them, most picked their practical ones.

It also found that while two-in-five (39 per cent) are saving for both their bucket lists, more than one-third (36 per cent) are not saving at all.

“Whether it’s skydiving in the tropics or buying the house you’ve always wanted, the key to reaching your goals is to save,” said Carissa Lucreziano, the Managing Director, CIBC Financial Planning and Advice. “The most important first step is to have a plan in place to get yourself there.”

Among those planning to accomplish a bucket list item:

- The top dream bucket list item is to travel/take a vacation (65 per cent), with Western Europe being the most popular destination (61 per cent).

- The top practical bucket list item is to become debt-free (55 per cent).

- 61 per cent plan on paying for a bucket list item using cash and savings, as well as a credit card (14 per cent) or a line of credit/loan (7 per cent).

- 41 per cent hope to make positive lifestyle changes, including taking up a new sport or focusing more on their health.

The poll also shows that 19 per cent of millennials are saving for their practical bucket list, with more than half (55 per cent) saying paying off debt is their top priority.

However, according to the poll, the majority of them are saving in ways that may take them longer than others, with more than half (59 per cent) using either their chequing account or keeping cash at home as their method of saving.

“When putting money aside for a specific goal in mind, it’s crucial to do it in the most effective way. Look for ways of saving that will help grow your money, such as a savings account, RRSP or TSFA,” said Lucreziano. “This way, your money has the opportunity to earn interest so you can reach your goals sooner rather than later.”

On average, millennials are saving the lowest amongst all Canadians for both bucket lists, with roughly a total of $11,000 saved for their dream bucket list, and approximately $14,900 for their practical bucket list thus far.

Other findings of the poll included:

- For their practical bucket list, 37 per cent of Canadians are saving every month, compared to their dream bucket list, with 33 per cent contributing when they have money to spend.

- 35 per cent of Boomers hope to undertake home renovations, while an early retirement is among the top of the list for Gen X (40 per cent).

- Two-thirds (68 per cent) of Canadians describe themselves as ‘I like to be responsible but leave a little room for fun.’

What do you think of the findings of this poll?

Photo courtesy of CIBC