Oakville and Milton lowest-ranked places to buy real estate in Canada: Report

Published April 25, 2023 at 3:18 pm

While Oakville and Milton are undoubtedly great places to live–especially for families–a new report suggests the two Halton towns might not be ideal places to purchase real estate due to sky-high costs and slower year-over-year growth.

According to a report by real estate search platform Zoocasa and MoneySense, the average home price in Oakville-Milton (the towns are combined in the report) hit $1,401,042 in 2022–76 per cent higher than the national average.

Over the past three years, the towns have seen prices grow by 51 per cent.

When it comes to year-over-year growth, that appears to be slowing. According to data in the report, Oakville and Milton saw 10 per cent growth in one year. Homes in the area are also, on average, $608,184 higher than the national average.

The area is last on the list of 45 Canadian regions ranked in order of attractiveness for purchasing real estate, below other Ontario municipalities such as Sault Ste. Marie, North Bay, the Niagara Region, Hamilton-Burlington and Ottawa. According to Zoocasa, the ranking considers average home prices, price growth over time, neighbourhood characteristics, and economics.

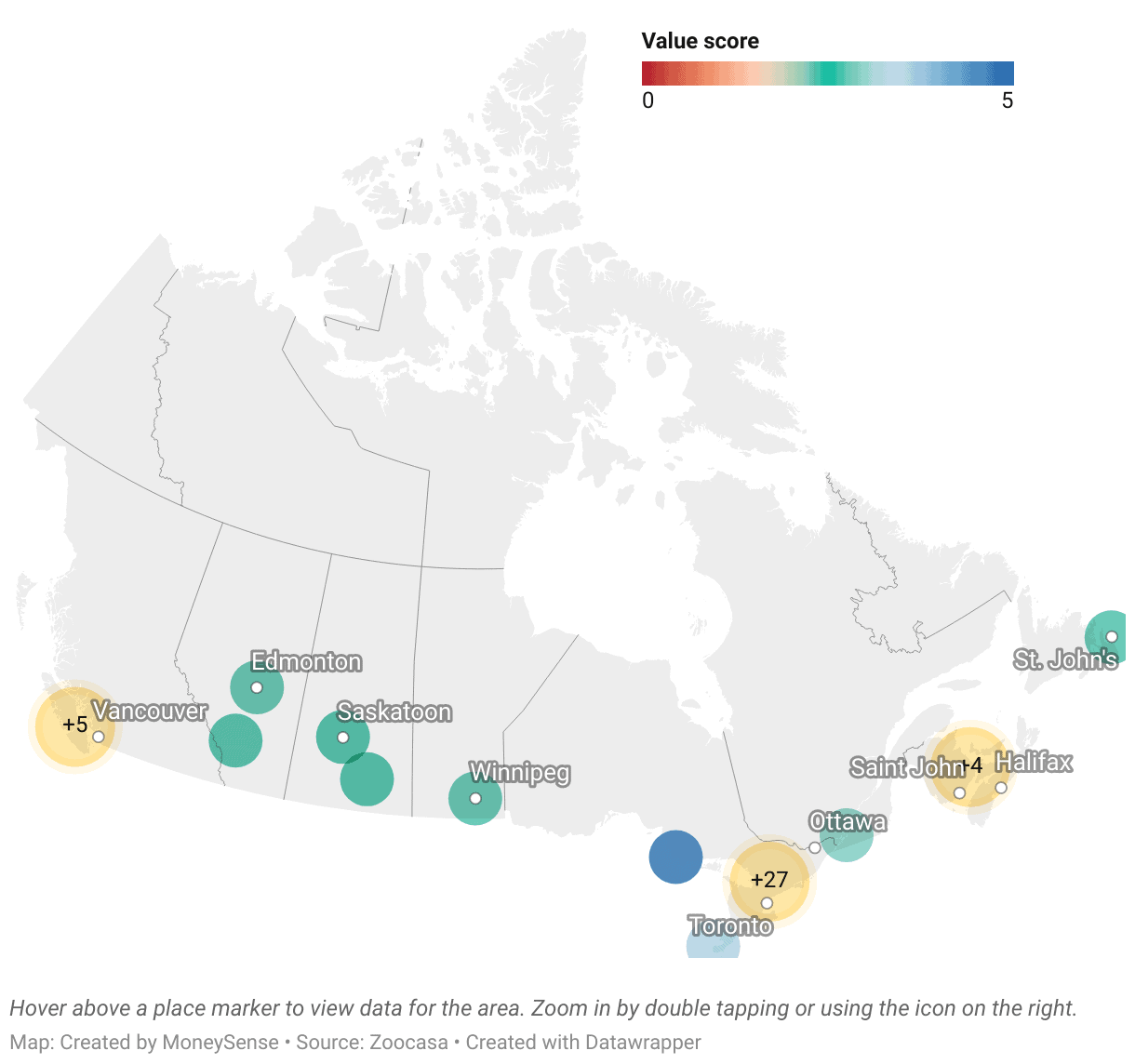

“Our value score compares Oakville-Milton’s composite benchmark price for 2022 to the national average. Markets with more affordable prices do tend to rank higher, as well as those that have experienced high and steady price growth over one year, three years and five years,” a Zoocasa spokesperson said in an email to insauga.com.

“Oakville-Milton’s ranking is impacted by its high composite benchmark price compared to the national average, as well as its comparatively low price growth. It’s still a fantastic region to purchase a home in for anyone who can afford to do so, but with this report, we aim to find the regions that offer the most value to Canadian buyers.”

Oakville-Milton has been at the bottom of the ranking for two years in a row. This year, the value score sits at 0.97 out of 5.

Data suggest Canadians are searching for more affordable homes–especially when inflation is high, and borrowing costs have increased.

That said, price growth has slowed across the board.

According to the Canadian Real Estate Association (CREA), the national composite benchmark price across all home types was $817,000 in January 2022. By December, it fell $100,000 to $717,000.

“Buyers took to the sidelines in 2022 and many chose to wait out the market, hoping for a positive change that would make real estate in Canada more affordable. Motivated buyers shifted their strategies, favouring more affordable property types including condominium apartments and townhouses,” Lauren Haw, broker of record at Zoocasa, said in the report.

“The 2023 market is dependent on affordability. If interest rates decline, buyer sentiment should shift in a more positive direction.”

The report says that regions showing the greatest value and growth potential include Greater Moncton, Sault Ste. Marie, North Bay, Fredericton, Saint John, NB, Halifax-Dartmouth, Bancroft and district, Tillsonberg, Sudbury and Windsor-Essex.

The report says that buyers might continue to be squeezed by a highly competitive market impacted by low inventory. With the Canadian government setting a record immigration target of 1.5 million new Canadians by 2023, increased demand for housing could continue to drive up prices in markets where housing is more scarce.

inhalton's Editorial Standards and Policies advertising