Niagara Falls, St. Catharines well down the list for land transfer taxes

Published May 10, 2023 at 10:46 am

When you are spending hundreds of thousands of dollars on a home, it’s easier to forget the smaller costs that crop up along the way.

However, before you are handed the keys and walk through the front door, there are closing cost and one of the biggest is the land transfer tax (LTT).

Fortunately, for buyers in Niagara Falls and St. Catharines, both cities are on the low end of the land transfer tax list.

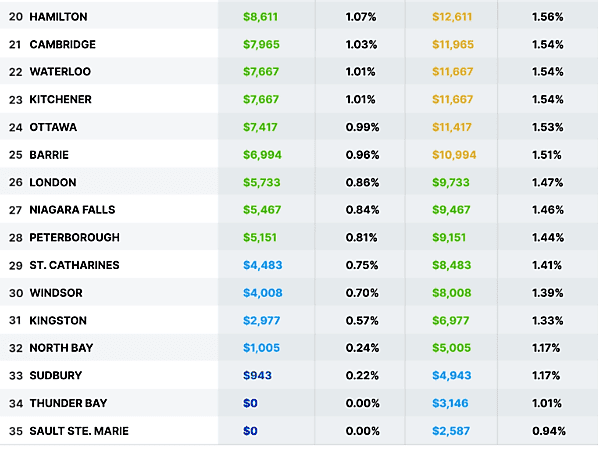

Real estate brokerage, Zoocasa.com, studied 35 different Ontario cities and in the end, Niagara Falls finished 27th while St. Catharines came in even lower at 29th.

LTT is charged by the province, is determined based on the total purchase price of the home and must be paid upfront. However, there are rebates for first-time home buyers in Ontario of up to $4,000. The tax simply means the land your home sits upon has legally been transferred to your name.

Based on the average home price of $600,400 in St. Catharines, the land transfer tax is $4,483. In Niagara Falls, with the average home running a little higher at $649,600, the LTT is $5,467.

Those are a mere pittance compared to the LTTs in Toronto ($29,289), Oakville ($24,077) and Caledon ($21,192), the top three on the list.

However, they’re considerably larger than the bottom end where Sudbury shells out $943 while the LTTs in Thunder Bay and Sault Ste Marie are $0. Here’s the bottom half of the list.