Mississauga rental prices expected to grow faster than Toronto’s in 2020

Published December 15, 2019 at 11:17 pm

If you’re struggling to find a place to rent in Mississauga, you should prepare for a challenging market marked by even higher prices in 2020.

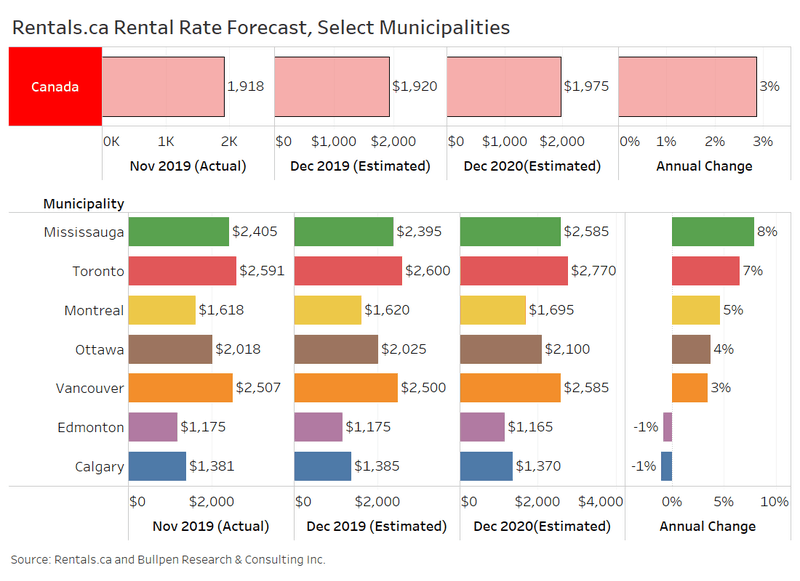

In fact, the recently-released Rentals.ca December 2019 Rent Report, produced by Rentals.ca and Bullpen Research & Consulting, suggests that rents could climb 8 per cent in Mississauga next year.

When it comes to significant increases, Mississauga leads the pack. Other cities where rental rates are expected to increase include Toronto (7 per cent), Montreal (5 per cent), Ottawa (4 per cent) and Vancouver (3 per cent).

Rents in Calgary and Edmonton could drop 1 per cent, according to the report.

The report predicts that average monthly rents for Canada overall will increase by 3 per cent in 2020.

As for where rates stand right now, the average rent for Canadian properties in November 2019 was $1,918 per month, an increase of 9.4 per cent annually.

In November of 2018, the average rental rate was $2,232 for all property types listed on Rentals.ca in Mississauga. According to the report, that rate increased to $2,405 for November 2019, an increase of 10.2 per cent annually.

Overall in 2019, the average rent was $2,504 per month.

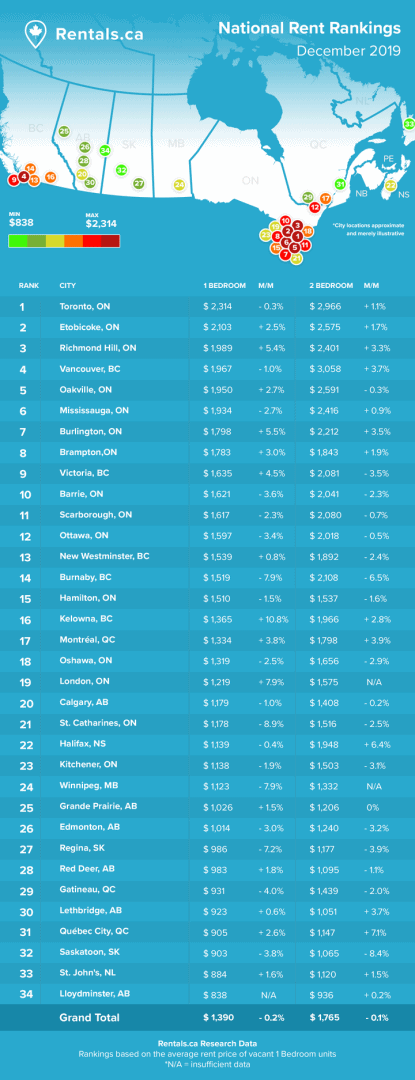

Mississauga finished sixth of 34 cities listed for average monthly rent in November for one-bedroom units at $1,934 and fifth for a two-bedroom at $2,416.

Toronto remains the priciest city for renters looking for a one-bedroom home, with the average monthly rent sitting at $2,314. Vancouver has the most expensive average monthly rents for a two-bedroom, topping the $3,000 mark at $3,058.

What prices can Mississauga tenants expect in 2020?

The report says the linear forecast calls for the average rent in 2020 to surpass $2,600, but Rentals.ca and Bullpen forecast that December 2020 rent will be $2,585 per month on average, an 8 per cent annual increase.

The report says this forecast is a slight moderation from the correct 10 per cent annual growth forecasted from December 2018.

“Mississauga will continue to move parallel to the former City of Toronto with prospective renters fleeing Toronto for less expensive units or larger properties,” the report reads.

The good news is that the price increases could, in time, be modified by an influx in new rental inventory.

The report says the impact of the mortgage stress test has started to fade and developers and investors are looking to increase rental supply to offset the increase in rental demand. At a time when fewer people can afford to purchase homes (and when more and more people are moving into the GTA), developers are working on developing more purpose-built rental housing–and that’s good news for tenants.

At the end of the third quarter, the Canada Mortgage & Housing Corporation reported that almost 72,000 rental units were under construction in Canada, the highest rate in over 30 years.

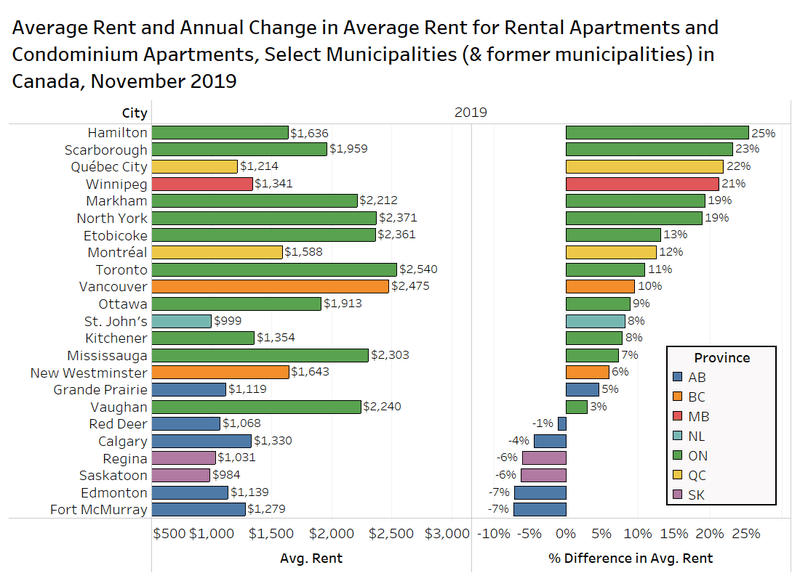

The majority of listings on Rentals.ca are rental and condominium apartments and the chart below looks at the average rent and the annual change in average rent for a select number of Canadian municipalities (and former municipalities prior to amalgamation) in November 2019.

Average monthly rent for Mississauga rental and condominium apartments only increased 7 per cent year over year.

According to the report, Hamilton and Scarborough led the pack with year-over-year rent growth of 25 per cent and 23 per cent, respectively for apartments with rental or condo tenure.

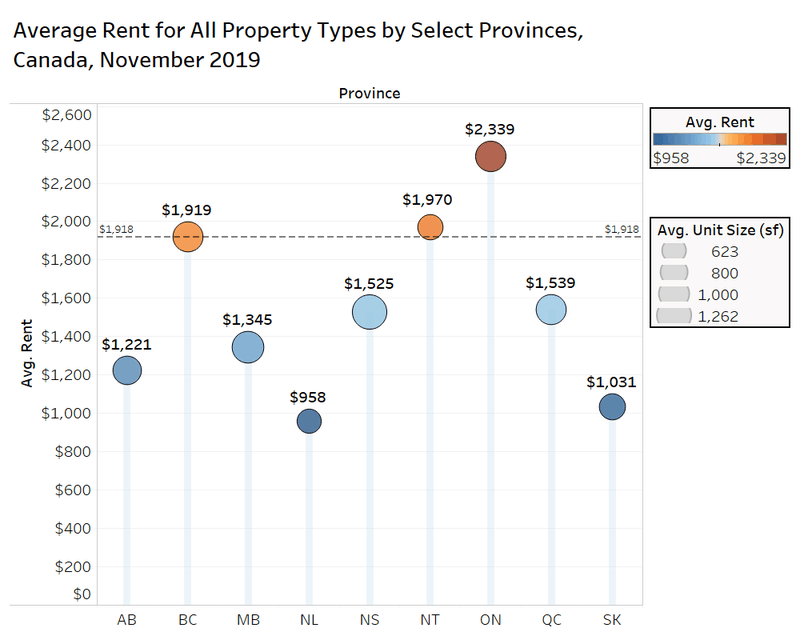

On a provincial level, Ontario had the highest rental rates in November, with landlords seeking $2,339 per month on average (all property types), up from $2,334 in October, and 9.1 per cent annually from $2,144 in November of 2018.

The report says the annual increase in rents is supported by some of the smaller municipalities such as London, Hamilton, Kanata, Burlington, and Kitchener, which are all experiencing double-digit rent growth when considering all property types.

The report also notes that developers are looking to cater to more affluent renters, including those shut out of the ownership market by increasing prices, younger renters choosing to be tenants for lifestyle reasons, and boomers and empty-nesters trading down from a larger dwelling.

“After years of focusing on the ownership housing market,” said Ben Myers, president of Bullpen Research & Consulting, “The media has focused more attention on the rental market as the mortgage stress test, expanded rent control, changing Airbnb legislation, rapid population growth, and record rental housing construction continues to disrupt the balance between supply and demand nationally. We expect the market to continue to be undersupplied overall in Canada in 2020.”

Some moderation is expected in 2020.

“After two years of unprecedented rent growth, we expect some moderation in 2020,” said Matt Danison, CEO of Rentals.ca. “There should be some supply relief in the Greater Toronto Area in 2020, but Rentals.ca and Bullpen expected average rental rates for all property types in Toronto and Mississauga to increases by 7 per cent to 8 per cent next year.”

The National Rent Report charts and analyzes monthly, quarterly and annual rates and trends in the rental market on a national, provincial, and municipal level across all listings on Rentals.ca for Canada.

Cover photo courtesy of @idris.yyz

insauga's Editorial Standards and Policies advertising