Mississauga house prices drop as market cools

Published October 6, 2022 at 11:51 am

Over the past few years, prospective homebuyers have been inundated with bad news about their purchasing prospects as house prices climbed significantly year-over-year. Now, however, buyers might be relieved to see that while houses in Mississauga are not exactly cheap (and interest rates are no longer rock bottom), the rapid increases we saw over the past few years seem to have ceased (for now).

That said, all is not rosy for those looking to buy.

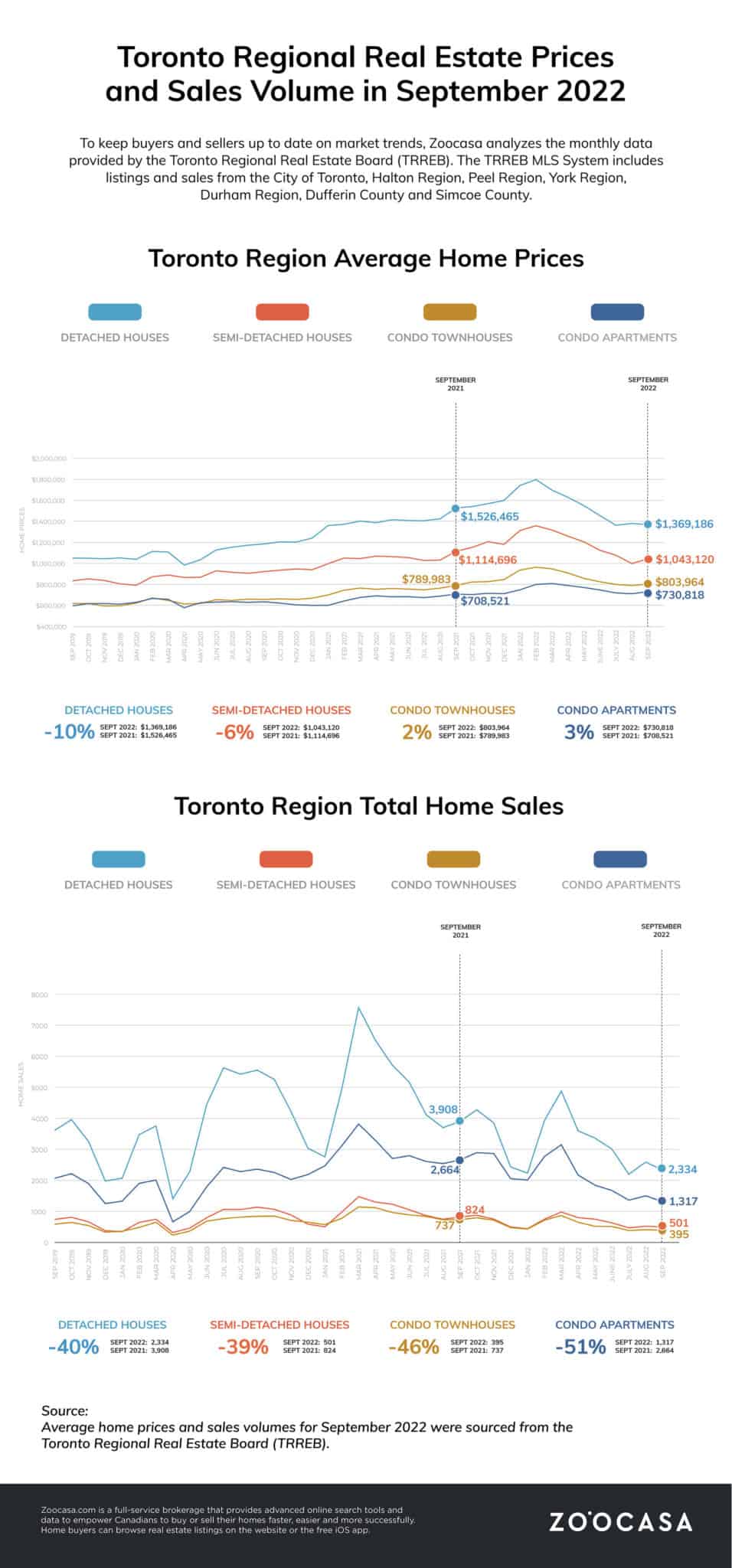

According to real estate website and brokerage Zoocasa, both sales and prices are down in the city since August.

Zoocasa says the number of sales in Mississauga in September declined by 4.3 per cent month-over-month and that the average price (currently sitting at $1,032,889) marks a dip of 4.1 per cent from August.

Year-over-year, sales are down a more dramatic 45.9 per cent from September 2021, according to the latest report for the Mississauga Real Estate Board.

On a year-to-date basis, home sales totalled 5,768 units over the first nine months of the year. This was a substantial decline of 36.1 per cent from the same period in 2021.

“Market activity continued the recent downward trend, with September sales totals coming in significantly below the historical averages,” said Nelson Goulart, president of the Mississauga Real Estate Board.

The overall composite benchmark price for all home types in Mississauga was $1,089,700 in September 2022, a small reduction of 3.6 per cent compared to September 2021. The benchmark price for single-family homes was $1,360,200, falling by 5.9 per cent on a year-over-year basis in September. By comparison, the benchmark price for townhouse/row units was $798,500, a modest gain of 1.6 per cent from year-ago levels, while the benchmark apartment price rose 8.8 per cent to 70,700 compared to a year earlier.

The average price is up 12.99 per cent for all home types from $1,010,204 in September 2021 to $1,141,419 in September 2022.

Homes also aren’t flying off the market as quickly as they were during the height of the pandemic, with residences currently sitting on the market for an average of 25 days–one day more than the Peel Region average.

Zoocasa says that because inventory isn’t moving quickly, sellers are pricing their homes more competitively (which is good news for buyers). That said, inventory is moving faster in Mississauga compared to Brampton and Caledon. According to Zoocasa, 466 homes traded hands in September, the highest number of sales in Peel Region. Last month, 1,027 new listings hit the market in Mississauga.

Zoocasa says detached homes were the most in-demand property type, with a total of 169 sales. Semi-detached and condo apartments trailed behind at 80 and 75 sales, respectively.

But while buyers are seeing declines in housing prices, the decreases are offset by increased borrowing costs and a persistent lack of inventory.

Zoocasa says that overall, the GTA housing market is off to a slow start this fall, primarily driven by a lack of supply. According to the Toronto Regional Real Estate Board’s (TRREB) most recent data, prospective buyers and sellers are still adjusting to the increased interest rates announced in September and some are hesitant to buy or sell because another Bank of Canada announcement is expected this month.

As for the Peel Region overall, Zoocasa says the average price in Mississauga, Brampton and Caledon has dipped 1.8 per cent month-over-month. Much like the rest of the GTA, the lack of supply is causing headaches for buyers and could prompt the return of the bidding wars that have been commonplace since 2017.

Detached houses are currently the most in-demand property type in the region. Zoocasa says that of the 936 sales in September, 421 were of detached homes. The average price of a detached home in the region was $1,319,828. Semi-detached properties were the second most in-demand, with 164 sales and an average price of $968,063.

In a news release, TRREB said the current situation with interest rates could also impact current homeowners who have to renew their existing mortgages.

“While higher borrowing costs have impacted home purchase decisions, existing homeowners nearing mortgage renewal are also facing higher costs,” said TRREB President Kevin Crigger.

Crigger suggests the federal government could remove the stress test when existing mortgages are switched to a new lender, allowing for greater competition in the mortgage market. Further, allowing for longer amortization periods on mortgage renewals would assist current homeowners in an inflationary environment where everyday costs have risen dramatically.

With files from Karen Longwell

INsauga's Editorial Standards and Policies