Mississauga defers more tax payments because of COVID-19 pandemic

Published May 7, 2020 at 9:09 pm

At a May 6 meeting, Mississauga city council voted unanimously to provide further financial assistance to residents financially impacted by the COVID-19 pandemic.

At a press conference, Mayor Bonnie Crombie confirmed that the city will be deferring final tax instalments for 90 days and stopping late payment charges and fees related to requests for tax payment changes.

The city is also continuing with its annual tax rebate for low-income seniors and low-income persons with disabilities. For 2020, the annual rebate has been increased to $436.

Council previously provided cash flow assistance by deferring the April, May and June interim tax instalment dates by 90 days.

“We are doing what we can as a city to provide as much relief to residents and businesses as possible,” said Crombie in a statement.

“Today’s decision to defer property tax instalments and waive penalty fees will help taxpayers recovering from the shock of this crisis manage their cash flow in a difficult time. As a city, we do not have the financial resources of the federal and provincial governments to offer full relief, but we are doing what we can within our power while remaining financial prudence.”

A recently released report suggests the city could face an almost $60 million deficit if physical distancing orders remain in effect until the end of June. The city says it’s looking at all options available for recovering and balancing its 2020 operating and capital costs, and has called on both the provincial and federal governments for help.

So, what can residents expect in terms of the new tax schedule?

As decided at the March 20 council meeting, interim property tax payments were deferred for 90 days and notices were distributed to taxpayers at the end of March.

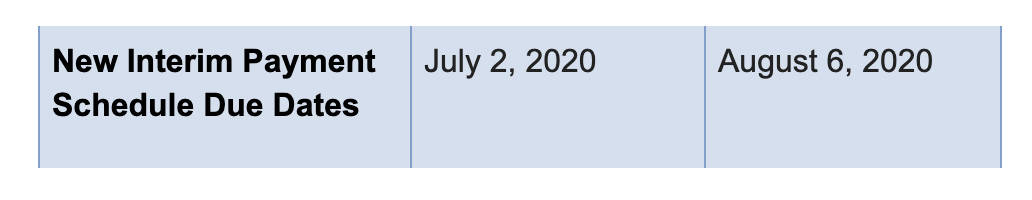

For those paying by regular instalment, interim property tax payments of April 2 and May 7 were deferred to July 2 and August 6.

Monthly Pre-Authorized Payments

Monthly Pre-Authorized Payments

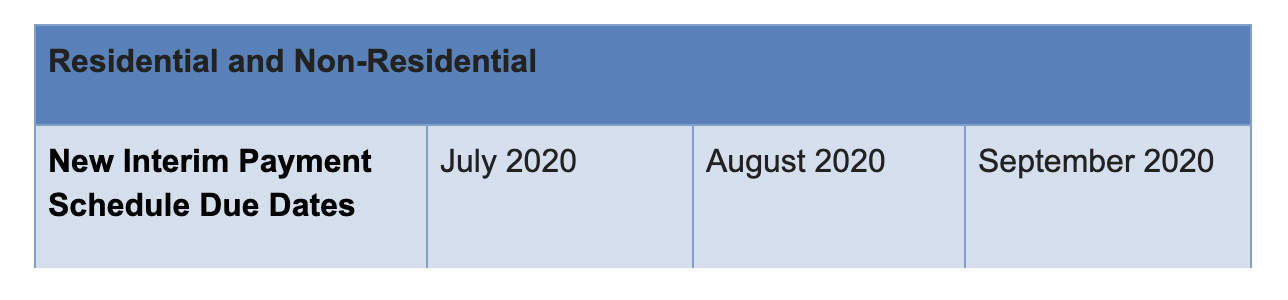

For those paying by monthly pre-authorized payments with the city, interim property tax payments in April, May and June were deferred to July, August and September.

Final Tax Payment Schedules

Final Tax Payment Schedules

The city says the timing of final tax payments for residential and non-residential property owners will depend on their chosen method of payment and if they continued with their interim tax payments as originally billed.

Regular Instalment Payments

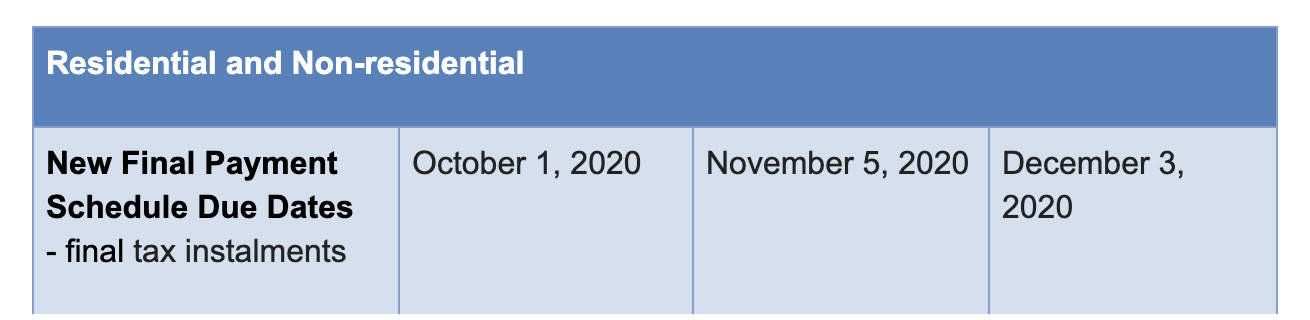

Final tax payments have been deferred by 90 days for taxpayers currently paying by instalments. Payments will now be made in October, November and December.

For residential properties, final tax instalments would normally be due in July, August and September. For non-residential properties, final tax instalments normally would be due as one single payment in August.

Monthly Pre-Authorized Payments – Interim Payments were Deferred

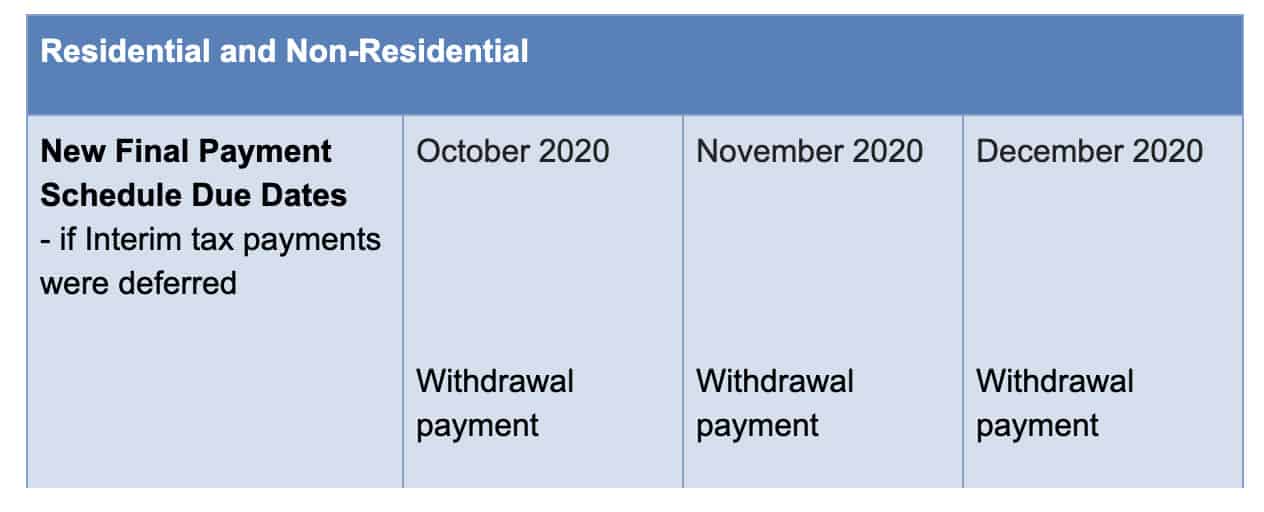

For taxpayers who had monthly withdrawals deferred, final payments will be made in three equal withdrawals one in October, one in November and one in December.

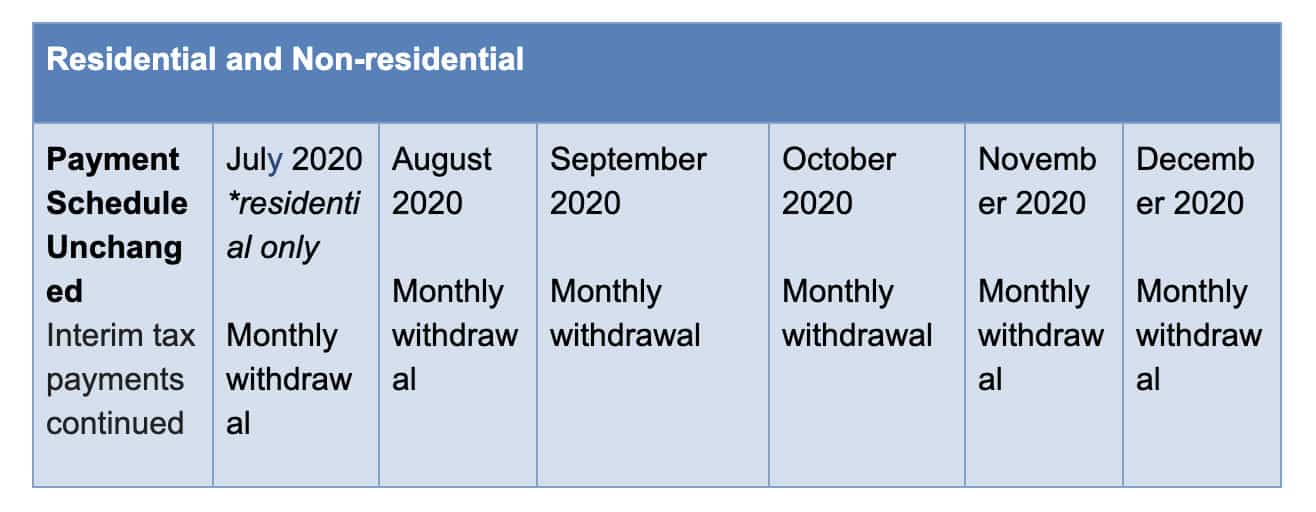

Monthly Pre-Authorized Payments – Payments Continued

Taxpayers who have chosen to continue to make regular monthly payments for their interim taxes will continue with monthly withdrawals on their normal schedule.

Property assessment is determined by the Municipal Property Assessment Corporation (MPAC).

Property assessment is determined by the Municipal Property Assessment Corporation (MPAC).

MPAC assessments are updated every four years and increases are phased-in over a four-year period. The last re-assessment was conducted in 2016. The next MPAC reassessment was planned to be completed this year for the 2021 taxation year; however, due to the COVID-19 pandemic, the province postponed the assessment update.

The property assessment used for the 2021 tax year will be the same as the 2020 tax year.

insauga's Editorial Standards and Policies advertising