Mississauga businesses say COVID-19 relief might not be enough to prevent some closings

Published December 23, 2021 at 3:08 pm

Mississauga businesses struggling to stay afloat in the wake of the latest government-mandated COVID-19 capacity restrictions say financial help announced yesterday is welcome, but it still might not prevent some of them from closing down.

Both Ottawa and the Ontario government unveiled new financial support programs for businesses that have been affected by the most-recent capacity restrictions.

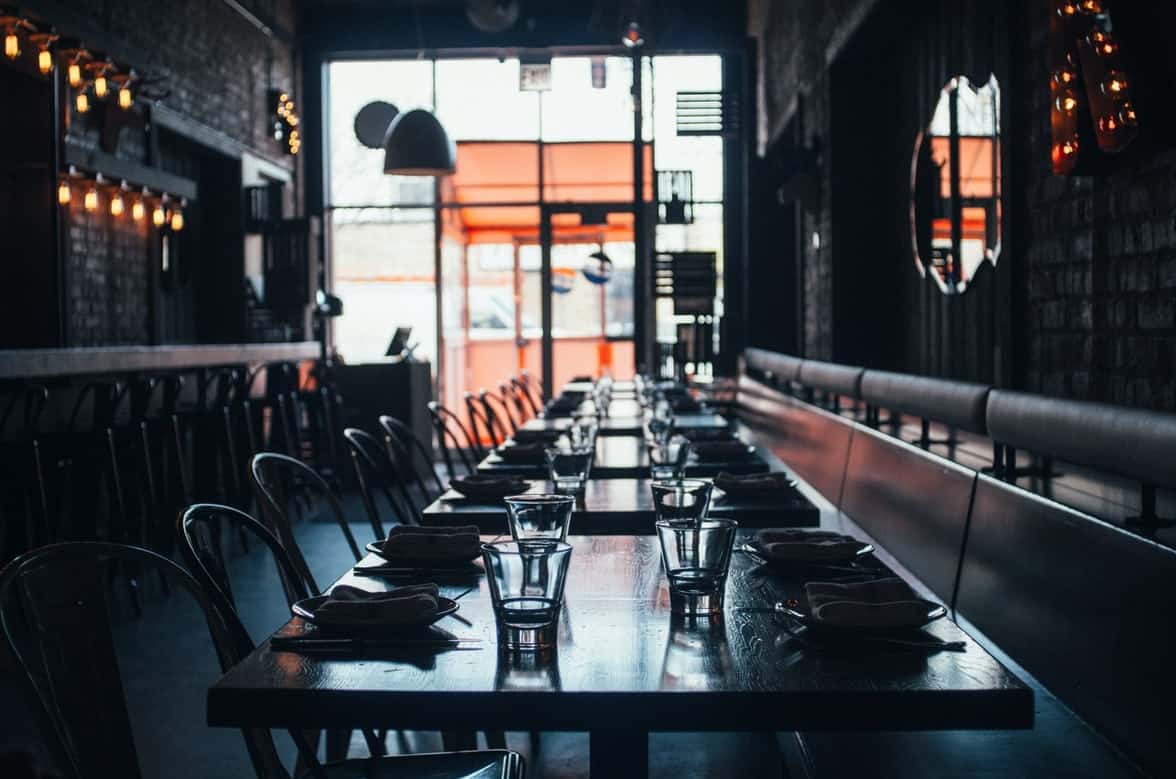

Last week, Ontario slashed capacity limits for most indoor settings to 50 per cent. That applies to restaurants and bars, personal care services, retailers and shopping malls.

Additionally, restaurants and bars have been told to close at 11 p.m., with last call for alcohol at 10 p.m.

We welcome measures announced for businesses today. However, the timeliness + extent of the supports may still be insufficient to help businesses that are already severely impacted. We urge gov'ts to expedite relief delivery + consider immediate measures. https://t.co/xsfKGGUyOT

— Ontario Chamber (@OntarioCofC) December 22, 2021

The restrictions, aimed at reducing spread of the highly transmissible Omicron variant of the virus, will have a “devastating impact” on many Mississauga businesses, according to the Mississauga Board of Trade (MBOT).

“While we thank and appreciate that the federal and provincial governments have responded quickly to the call for additional business supports, we are concerned that these may not go far enough in recognizing the reality of the impacts that these hardest-hit businesses will continue to experience over the next several months,” MBOT president and CEO Trevor McPherson said in a news release.

“Both governments have to realize they need to step up more to support the business community when they impose restrictions and lockdowns,” continued McPherson. “A number of small- and medium-sized businesses are at the brink of closing their doors permanently.”

MBOT and the Ontario Chamber of Commerce (OCC) have been calling on both senior levels of government to support businesses during the latest wave of the COVID-19 pandemic.

The Province is introducing a new Ontario Business Costs Rebate Program and a 6-month interest and penalty free period for most provincial taxes to support businesses that are required to operate at 50% reduced capacity.

Read more:https://t.co/cNrFRMsDCQ pic.twitter.com/nDQKbSr7R1

— Rudy Cuzzetto, MPP (@RudyCuzzetto) December 22, 2021

OCC president and CEO Rocco Rossi said the help announced by senior levels of government is good news overall, but is still lacking.

“Missing today were measures like an extension of the small business grant that would have provided immediate relief,” said Rossi. “Timeliness of when these supports are delivered is critical. We urge both governments to deliver the relief as quickly as possible.

“Our concern is whether these measures will be sufficient to prevent a wave of business closures.”

As an example, Rossi noted, applications to the Ontario Business Costs Rebate Program won’t open until mid-January.

By then, he added, many small businesses might be forced out of business.

The rebate program will allow eligible businesses to receive payments equalling about half of property tax and energy costs they incur while capacity restrictions are in place.

Government officials noted that while applications won’t open until mid-January, payments will be retroactive to Dec. 19.

MBOT, established in 1961, advocates for tens of thousands of Mississauga businesses of all sizes on policy issues that impact the well-being of the business community.

INsauga's Editorial Standards and Policies