It’s Getting More Expensive to Rent Condos in Mississauga

Published January 18, 2017 at 4:30 am

When it comes to housing and affordability in Mississauga and the GTA in general, the news is rarely encouraging and doesn’t appear to be getting much better.

According to data recently released by Urbanation, a firm that studies and collects information on the Toronto and GTA condo markets, condo rents in the 905 are up six per cent.

If you look at Toronto and the GTA in general, the 905 numbers aren’t quite as shocking. According to Urbanation, average condo apartment rents in TO shot up by 11.7 per cent year-over-year in the fourth quarter–the highest level of growth ever recorded by Urbanation and a “dramatic acceleration” from the 4.2 per cent rate recorded just one year ago.

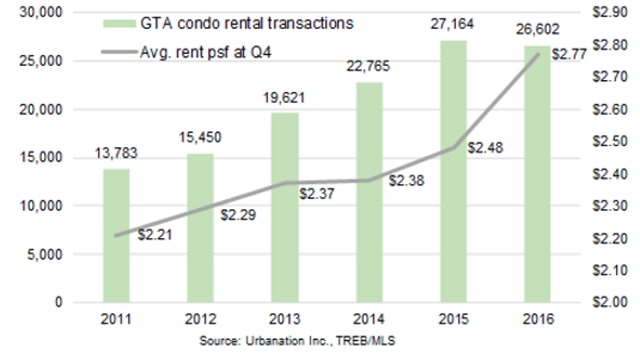

The data shows that renters in Mississauga and other 905 cities are paying about $1,739 a month (or $2.22 per square foot in a 719 sq. ft. condo). In Toronto, the same size unit costs about $1,990 a month ($2.77 per square foot).

While it’s not unusual for rental rates to climb as real estate costs escalate, the development is worrying for people who are hoping to save money by leasing their accommodations–especially since rental stock is low.

Urbanation reports that the number of condo apartments leased through the MLS system during 2016 in the GTA declined by two per cent to 26,602 units–the first annual decline recorded by Urbanation since tracking began in 2011.

Rental activity was slow for a few reasons, including construction delays for new buildings, less turnover in existing rental units and an increase in condo sales (more people are selling their ever more valuable units as opposed to leasing them).

“The undersupply of rentals in the GTA continued to worsen throughout the year, causing rents to surge alongside home prices and further deteriorating housing affordability across the region” said Shaun Hildebrand, Urbanation’s Senior Vice President. “While less pressure on rent growth may arrive in 2017 due to a temporary rise in new apartment completions, it’s become clear that more attention needs to be paid to building rentals over the longer-term.”

While it doesn’t look the real estate market is set to correct (and bring rental rates down while it’s at it), the city is working to address affordability issues and has been for some time.

The move to address the mounting crisis is crucial, especially as more people are priced out of an already expensive market plagued by high demand and low inventory.

According to this report, vacancy rates in the city are low. At present, the vacancy rate is 1.6 per cent (an ideal one is three per cent). Mississauga is also hurting for new affordable rental housing. In fact, a brand new Daniel’s development in Erin Mills is the first rental-only building in two decades and it’s a luxury property that boasts top-notch amenities. So while it’s certainly good for tenants looking for long-term leases, it’s not ideal for a low-income family or individual.

In terms of inventory, there are about 35,218 units available for rent for lower-income earners.

According to some worrying data, 74,575 households fall within the low-income bracket, bringing in less than $55,500 a year. As for middle-income households, there are currently 67,480 households that bring in $55,000 to $100,000 a year.

For lower-income earners, an affordable house should cost $221,000 or less to own or $1,390 or less to rent. For a household with a more moderate income, an affordable home would cost $398,000 or less to own or $2,500 or less to rent.

So while some can certainly the climbing rental rates, they’re no doubt a hardship for many.

It’ll be interesting to watch how 2017 plays out in term of real estate and rental costs.

INsauga's Editorial Standards and Policies