Is it better to buy or rent a home right now in Mississauga?

Published February 7, 2024 at 2:12 pm

As both rents and home prices increase, people in Mississauga might be wondering what the best option is right now.

The latest real estate report shows the average price of all home types in Mississauga reaching $1,048,658 in January – a 10.2 per cent increase from December.

The detached home average price hit $1,596,414 in January, and a townhome will cost around $1 million these days.

And borrowing costs are also high with the five-year fixed mortgage rate peaking at 5.49 per cent — dropping to 4.89 per cent in January 2024, according to a report from real estate brokerage Zoocasa.

But on the other hand, rents have also gone up. Asking rents have increased by 22 per cent in the past two years, according to Rentals.ca. The average rent for a one-bedroom apartment in Mississauga was $2,278 in 2023.

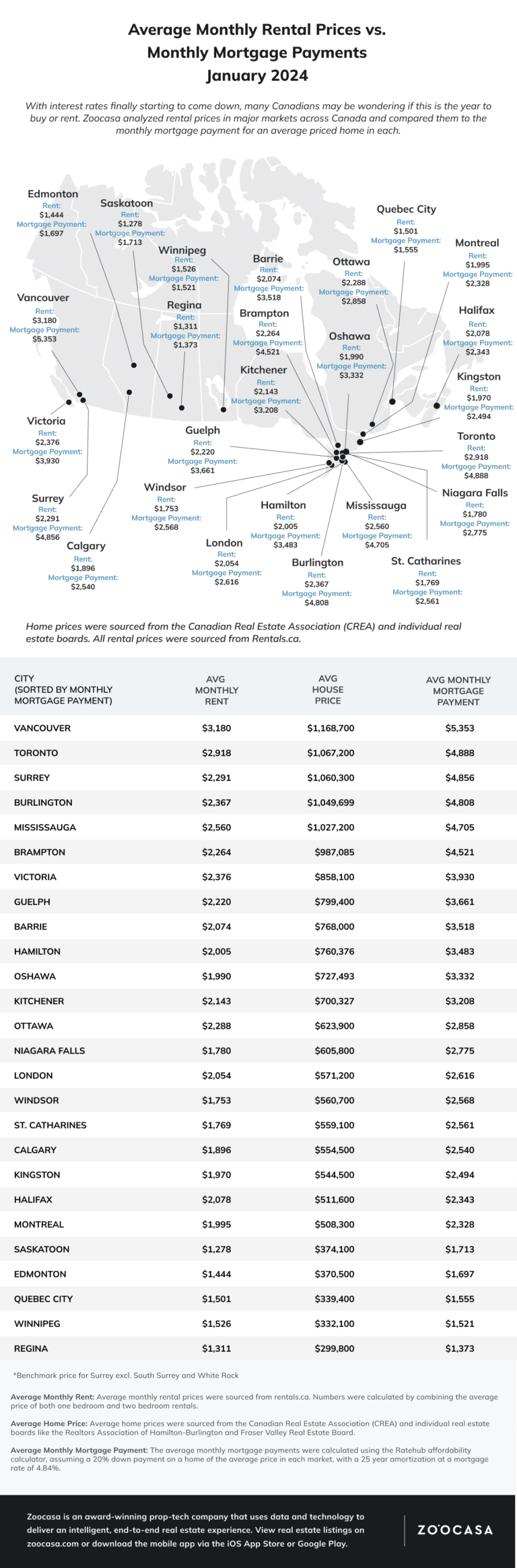

In an attempt to determine if this is the year to buy or rent, Zoocasa looked at 26 markets across Canada and compared monthly rental prices and monthly mortgage payments using average prices in December 2023.

Zoocasa notes that additional costs — such as utilities or property taxes — were not considered. Rental price numbers were sourced from Rentals.ca and were calculated by finding the average price of one-bedroom and two-bedroom rentals. Monthly mortgage payments were calculated assuming a 20 per cent down payment and a five-year fixed mortgage rate of 4.84 per cent amortized over 25 years.

The report found mortgage payments were nearly double rents in Mississauga.

The rent came in at $2,560 and a monthly mortgage payment was $4,705 — a difference of $2,145 in Mississauga.

This makes the city one of the most expensive in the GTA. Burlington had slightly higher mortgage costs but lower rents. Toronto was, of course, much more expensive for both rents and mortgages.

But Burlington had a $2,441 difference between rents and mortgages and Brampton had a $2,257 difference. The gap in affordability in Toronto is slightly less pronounced with a difference in rent and mortgage payments of $1,970.

Those looking to move out of province for a cheaper option may want to look at Winnipeg. The average rent in Winnipeg is $1,526, while the monthly mortgage payment based on the average price amount to $1,521 – $5 less than the average rent.

The most expensive housing option appears to be Vancouver where the average monthly mortgage payment above $5,000.

See the full report from Zoocasa here.