Housing supply dwindling as more people move into Mississauga

Published November 5, 2019 at 8:34 pm

The market is booming in Mississauga (and Toronto and the GTA overall), but the attractiveness of the region is offset by the persistent lack of housing inventory and the continued supply and demand imbalance that’s driving up competition (and prices).

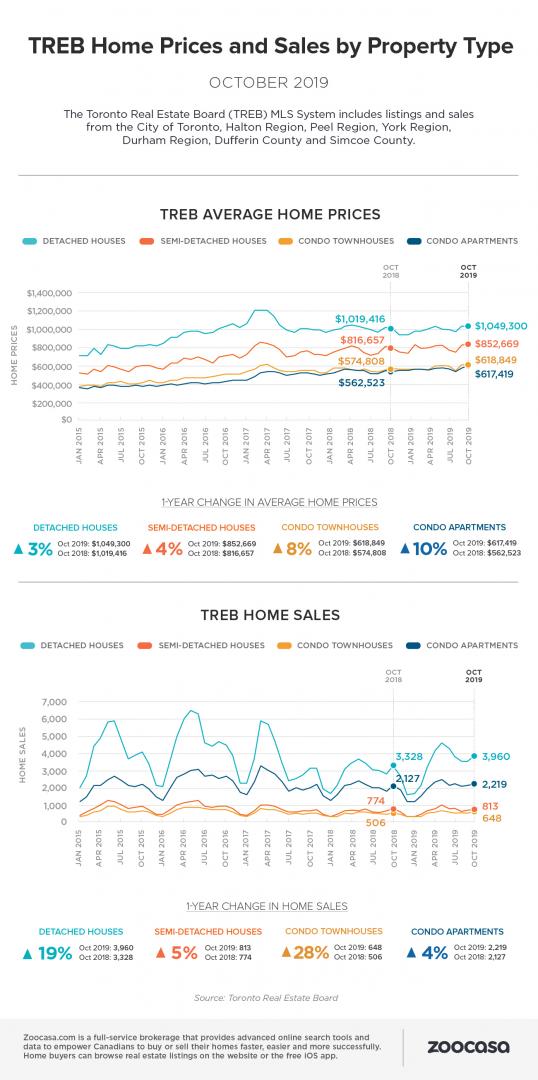

The Toronto Real Estate Board (TREB) recently announced that GTA realtors reported 8,491 residential sales through TREB’s MLS system in October 2019–a 14 per cent increase compared to the 7,448 sales reported in October 2018.

TREB says sales were up on a year-over-year basis for all major home types.

“A strong regional economy obviously fuels population growth. All of these new households need a place to live and many have the goal of purchasing a home. The problem is that the supply of available listings is actually dropping, resulting in tighter market conditions and accelerating price growth,” said Michael Collins, president, TREB, in a statement.

“During the recent federal election, some parties committed to more flexibility on the mortgage lending front, including the reintroduction of a 30-year amortization period for insured mortgages and more flexibility in the application of the OSFI mortgage stress test. These and other housing-related policy options should be brought forth in the new minority Parliament.”

While reintroducing 30-year mortgages and easing the stress test would get more people into the market, it’s not yet clear if that would help solve the housing crisis, as it appears to be driven–at least partially–by a lack of available housing for interested buyers.

TREB says that in October, new listings were down by 9.6 per cent compared to October 2018.

The tighter market conditions resulted in price growth across all major market segments.

Penelope Graham, the managing editor of real estate brokerage and website Zoocasa, said that sellers’ market conditions prevailed across the Mississauga, Brampton, and Halton regions in October.

According to Graham, the lack of inventory and high demand means that home prices are steadily on the rise, and buyers are finding that the competition is heating up with crowded open houses and multiple-offer situations becoming increasingly more common.

“Mississauga experienced sizzling market conditions in October, as the number of sales well outpaced the supply of new listings and transactions and price growth rose by double digits,” Graham said.

Graham says a total of 833 homes changed hands in the municipality, up 20.5 per cent compared to the same time frame in 2018. Coupled with a 5 per cent dip in new listings – just 1,137 homes were brought to market over the course of the month – that’s pushed the city steeply into sellers’ territory.

Graham says the average home price rose by a whopping 17.6 per cent to $816,383.

According to TREB data, the average price of a detached house in Mississauga sits at $1,172,971. The average price of a semi-detached house is $753,410, the average price of a townhouse is $599,056 and the average price of a condo is $524,316.

TREB is calling on all levels of government to work to produce more housing.

“All levels of government affecting the GTA plus many international organizations have recognized that we continue to face a supply issue in our region for all types of housing,” said TREB CEO John Di Michele in a statement.

“TREB looks forward to continuing its work with policymakers at all levels to bring more supply online, which will help ensure a sustainable pace of price and rent growth over the longer term.”

The MLS Home Price Index composite benchmark was up by 5.8 per cent on a year-over-year basis in October 2019 – the strongest annual rate of growth since December 2017.

The average selling price for all home types combined was up by 5.5 per cent to $852,142, compared to $807,538 in October 2018.

“As market conditions in the GTA have steadily tightened throughout 2019, we have seen an acceleration in the annual rate of price growth. While the current pace of price growth remains moderate, we will likely see stronger price growth moving forward if sales growth continues to outpace listings growth, leading to more competition between home buyers,” said Jason Mercer, TREB’s chief market analyst, in a statement.

INsauga's Editorial Standards and Policies