Housing Market Getting Tougher for Buyers in Mississauga

Published August 6, 2019 at 7:56 pm

If you’re having trouble finding a reasonably-priced home in Mississauga, you’re not alone–the housing market continues to challenge prospective buyers who are grappling with limited inventory and high prices.

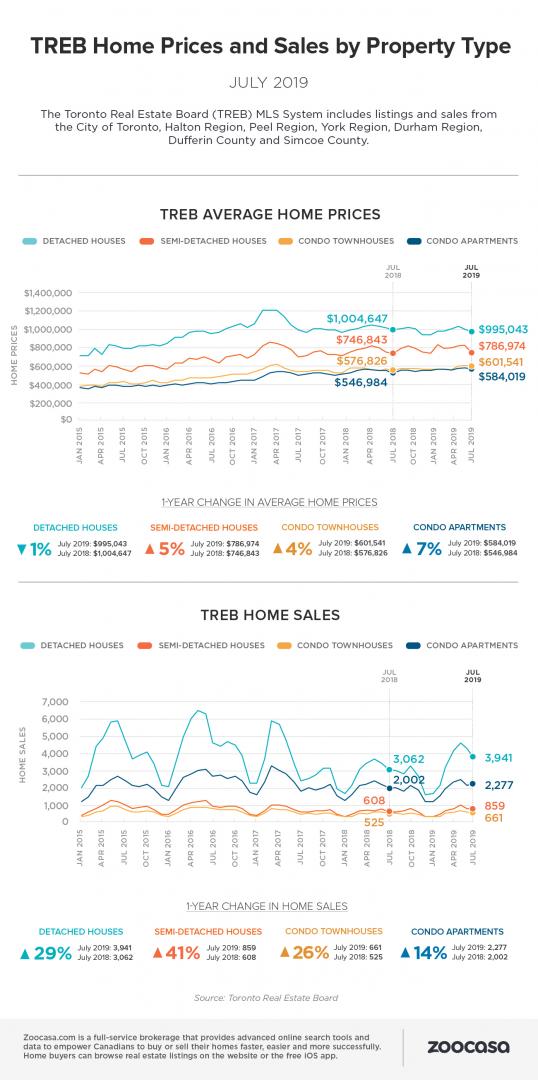

The Toronto Real Estate Board (TREB) recently announced that GTA realtors reported 8,595 sales through TREB’s MLS system in July 2019–an increase of 24.3 per cent compared to July 2018.

On a month-over-month basis, sales were up by 5.1 per cent after preliminary seasonal adjustment. TREB says that new listings were up compared to July 2018, but by a much lesser annual rate than sales (3.7 per cent).

TREB says active listings at the end of July were down by 9.1 per cent year-over-year, which means buyers are dealing with a challenging market marked by low inventory and more rigorous borrowing criteria.

But while the stress test has affected buyers, TREB says residents are more affected by the lack of supply than anything else.

“While the OSFI mortgage stress test has clearly had an impact on the number of home sales over the last year-and-a-half, for most GTA residents the goal of homeownership has not diminished. In fact, we’re seeing growing pent-up demand for ownership housing, especially as the number of GTA households continues to increase by 40,000 to 50,000 each year due to strong population growth,” said TREB CEO John DiMichele.

“As more and more households come to terms with the stress test and move back into the market in the coming months and years, they could suffer from a chronically under-supplied marketplace and acceleration of home price growth to unsustainable levels. Fortunately, policymakers have acknowledged the housing supply issue and are working toward solutions.”

TREB says it’s encouraging that municipal and provincial leaders are working to increase housing supply in Ontario and the GTA.

“On the housing supply issue, it has certainly been encouraging to see both the City of Toronto and the Ontario government working on solutions to bring more supply on-line. Based on Mayor John Tory’s motion, Toronto City Council gave city staff a strong mandate to report back on how to develop a greater diversity of housing options in traditional single-family neighbourhoods, including timelines. Similarly, we’ve seen the provincial government launch consultations to spur on, and speed up, the development of different forms of housing in conjunction with their ‘MoreHomes, More Choice’ Plan. TREB looks forward to working with the City and the Province to turn their initiatives into reality,” said TREB President Michael Collins.

As far as Mississauga goes, the city is actively working to increase housing supply for middle-income earners through its Making Room for the Middle plan. As part and parcel of that plan, it’s working to incentivize developers to increase the city’s low supply of affordable rental housing.

The city is also embarking on an ambitious plan to construct an entirely new community in Port Credit. The community, which was formally approved by council in late July, is slated to break ground in 2020 (barring issues at the provincial level, of course).

But while cities, regions and towns are working to create more housing, the market isn’t an easy one for buyers to navigate right this second, especially buyers on a budget.

TREB says the average selling price increased by 3.2 per cent on a year-over-year basis to $806,755, adding that the MLS Home Price Index composite benchmark was up by 4.4 per cent.

Not unexpectedly, higher density home types (think condos) continued to drive price growth, whereas detached home prices remained down in many communities throughout the GTA.

As far as Mississauga goes, real estate brokerage and website Zoocasa says prices are up quite a bit.

“The Greater Toronto Area housing market continues to steadily improve from last year’s softer buying climate, with most local markets experiencing a double-digit increase in sales and a decline in new home supply. That’s putting the squeeze on the market, driving prices higher across the 905 region, and setting the stage for bidding wars and less choice for prospective buyers,” says Penelope Graham, managing editor, Zoocasa.

Graham says that demand for Mississauga homes is up, as sales surged 15.6 per cent year over year in July, with a total of 843 transactions.

Meanwhile, new supply is crunched, declining 1.1 per cent, as only 1,284 new listings were brought to market over the course of the month.

Graham says that’s pushed the sales-to-new-listings ratio – a measure of a market’s competitiveness – to 65 per cent, well within sellers’ territory. This time last year, it sat at 56 per cent, which indicated it was a bit more balanced.

These factors have pushed the average home price up by 8.1 per cent to $764,463.

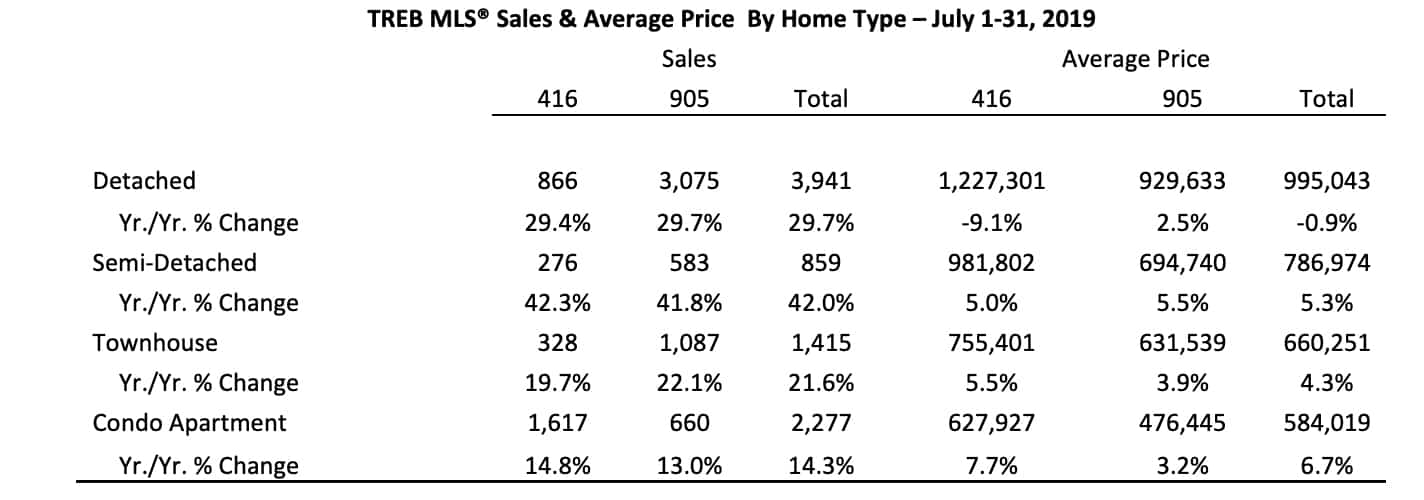

As for what’s happening in the 905 overall:

In terms of numbers specific to the entire GTA, a detached house in the 905 currently costs about $929,633 (a little up from $922,367 in June). A semi costs about $694,740 (almost identical to June’s average price of $694,282 ), towns are selling for $631,539 (up from $618,958 ) and condos are costing buyers about $476,445 (a little down from $483,893).

“Broadly speaking, increased competition between buyers for available properties has resulted in relatively strong price growth above the rate of inflation for semi-detached houses, townhouses and condominium apartments,” said Jason Mercer, TREB’s chief market analyst.

“However, the single-detached market segment, which has arguably been impacted most by the OSFI stress test, has experienced a slower pace of price growth, with average detached prices remaining lower than last year’s levels in some parts of the GTA.”

Are you planning to buy a house in Mississauga soon?

INsauga's Editorial Standards and Policies