House Prices in Mississauga Reach Wild New Heights

Published April 19, 2017 at 6:33 pm

That crash/correction that some people say is right around the corner doesn’t appear to be hitting the red hot GTA market anytime soon.

According to a recent Royal LePage House Price Survey, overheated home price appreciation in the region showed double-digit growth in the prices of homes across the GTA.

In the first quarter of 2017, the aggregate price of a home in the region rose by what the real estate company calls an “astounding” 20 per cent year-over-year to hit $759,241.

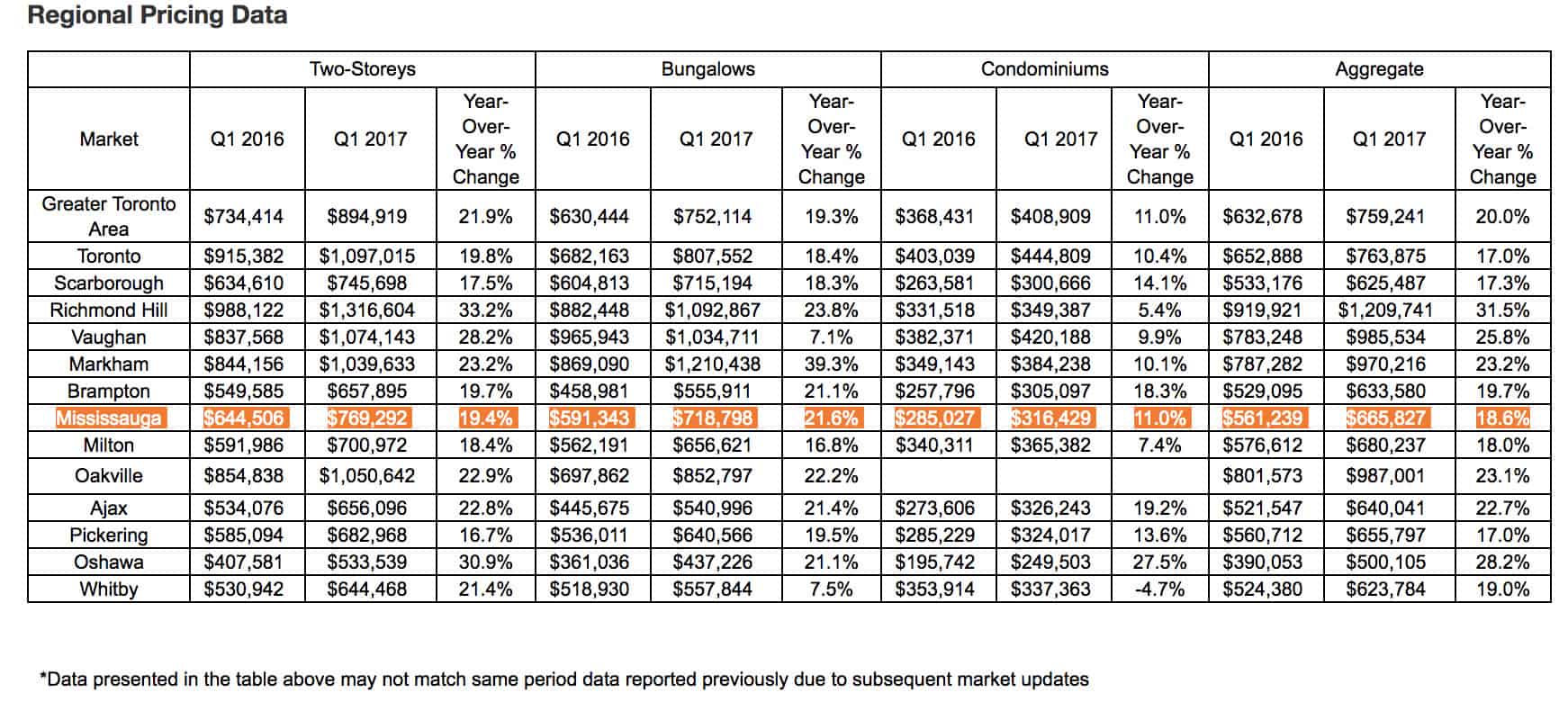

The median price of a two-story home and bungalow climbed 21.9 per cent and 19.3 per cent year-over-year to $894,919 and $752,114 respectively. Condos are also becoming most costly, with year-over-year prices increasing 11 per cent to hit $408,909.

In terms of Mississauga specifics, the average two-story home costs about $769,292 (up from $644,506 last year). Bungalows now cost $718,798 and condos run buyers about $316,429. Overall, home prices have risen 19.7 per cent year-over-year.

“A remarkably low supply of listings in Mississauga contributed to rising home prices in the region in the first quarter,” the report reads. “The aggregate price of a home within the region climbed 18.6 per cent year-over-year to $665,827, as migration from other parts of the GTA, as well as a lull in new home builds and continued interest from investors placed upward pressure on the market.”

Royal LePage reports that, during the quarter, the strongest growth came from the suburban areas outside of the downtown Toronto core. The growth in the suburban market makes sense, as more and more people have been completely priced out of Toronto’s denser neighbourhoods. This suburban migration, has, naturally, led to an uptick in 905 house prices and has further compromised the area’s already modest supply of available housing.

“With prices coming back to earth in the Lower Mainland of British Columbia, the Greater Toronto Area has claimed the title of Canada’s hottest housing market this quarter,” said Dianne Usher, senior vice president, Johnston and Daniel, a division of Royal LePage. “A serious lack of inventory due in part to rezoning processes that don’t permit intensification in many populous areas within the region, coupled with incredible demand fueled by a strong economy, immigration, high household formation and continued low interest rates, has driven the market into a frenzy, causing ultra-hot home price appreciation.”

Royal LePage points out that Toronto’s hot housing market hasn’t only affected nearby satellite cities, it’s driven prices up in municipalities up to two hours outside the city core.

“As affordability across the GTA continues to erode, many homebuyers have increasingly begun to search for property elsewhere in southern Ontario where market factors are more favourable,” Usher continued. “However, the fact remains that many of these regions are not built to support large volumes of demand, causing market conditions in these areas to quickly intensify.”

INsauga's Editorial Standards and Policies