House prices climbing as fewer homes hit the market in Mississauga

Published December 4, 2019 at 8:34 pm

While there’s been a great deal of talk about the need for more affordable housing in Mississauga and the GTA, the solution does not appear to be more policies geared towards helping people get into the market (such as by extending amortization periods and boosting down payments with additional loans)–it’s creating more housing to offset the persistent supply and demand imbalance.

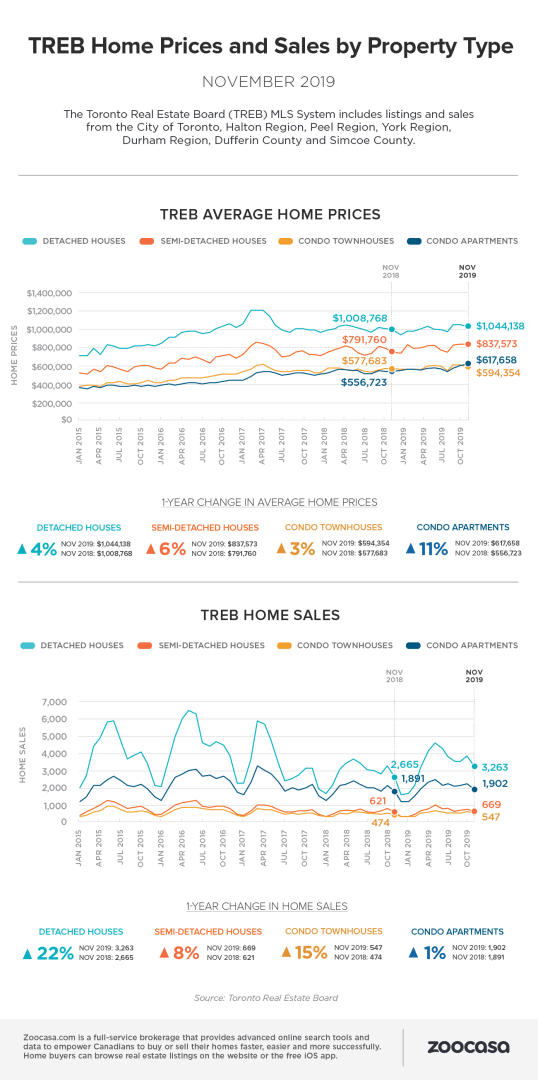

According to recently-released numbers from the Toronto Real Estate Board (TREB), sales and prices are up while listings are down.

TREB says GTA realtors reported 7,090 sales through TREB’s MLS system in November 2019 – a 14.2 per cent increase compared to November 2018.

TREB says on a GTA-wide basis, sales were up year-over-year for all major market segments, with sales growth in low-rise home types (including detached houses) leading the way.

New listings are down 17.9 per cent year-over-year and active listings are down 27.2 per cent.

“An increasing number of home buyers impacted by demand-side policies over the past three years, including the 2017 Ontario Fair Housing Plan and the OSFI mortgage stress test, have moved back into the market for ownership housing,” said Michael Collins, president, TREB.

“Based on affordability and stricter mortgage qualification standards, many buyers may have likely adjusted their preferences, changing the type and/or location of home they ultimately chose to purchase.”

Because of the hypercompetitive market, prices continued to climb. TREB says The MLS Home Price Index composite benchmark increased by 6.8 per cent year-over-year and the average selling price increased by 7.1 per cent year-over-year to $843,637.

As far as Mississauga goes, real estate brokerage and website Zoocasa says competition is heating up.

“Housing market conditions continued to get much more competitive for homebuyers across the 905 regions in November, as sales spiked and new listings declined across every local market,” says Penelope Graham, managing editor, Zoocasa.

“With more than 80 per cent of all newly-listed homes selling over the course of the month, prospective purchasers are more likely to face a supply crunch and could come up against other buyers in multiple-offer situations, which will drive home prices higher.”

Graham says sales activity for Mississauga homes for sale and the supply of new listings have been diverging sharply, putting increased pressure on the buying pool, and shifting the market strongly in favour of sellers with a sales-to-new-listings ratio of 86 per cent, compared to 64 per cent the same time last year.

A total of 644 homes traded hands in November, up 12.5 per cent year over year, while 744 were brought to market, marking a sharp 15.8 per cent decrease.

Combined, those forces have pushed the average home price in Mississauga up by 7.7 per cent to $789,760.

In Mississauga, the average price of a detached house sits at $1,104,975. A semi costs about $768,468, a town costs $609,946 and a condo costs $513,566.

TREB says that all levels of government need to work together to increase housing supply, as motivated buyers are competing for a limited supply of available houses.

“The Greater Toronto Area needs flexible housing market policies that will help sustain balanced market conditions over the long term. All levels of government in Canada plus reputable international bodies have acknowledged that we have a housing supply problem,” said TREB CEO, John DiMichele.

“In 2020, policymakers need to translate their acknowledgement of supply issues into concrete solutions to bring a greater array of ownership and rental housing online. As always, TREB will be there to help policymakers in this regard.”

TREB says high prices are proving a challenge for buyers across the GTA.

“Strong population growth in the GTA coupled with declining negotiated mortgage rates resulted in sales accounting for a greater share of listings in November and throughout the second half of 2019,” said Jason Mercer, TREB’s chief market analyst.

“Increased competition between buyers has resulted in an acceleration in price growth. Expect the rate of price growth to increase further if we see no relief on the listings supply front.”

insauga's Editorial Standards and Policies advertising