Home underbids are around $188K in this Mississauga neighbourhood

Published February 13, 2024 at 2:43 pm

As the real estate market remained sluggish this winter, one Mississauga neighbourhood had the highest underbidding on homes in the GTA.

The average price of all home types in Mississauga was below $1 million for much of last year but crossed above the $1 million mark in January. The average price was $1,048,658 – a 10.2 per cent increase from December, signalling a possible upswing in the market.

But a new report from Wahi, a digital real estate platform, finds one Mississauga neighbourhood had the highest underbidding amount of any place in the GTA.

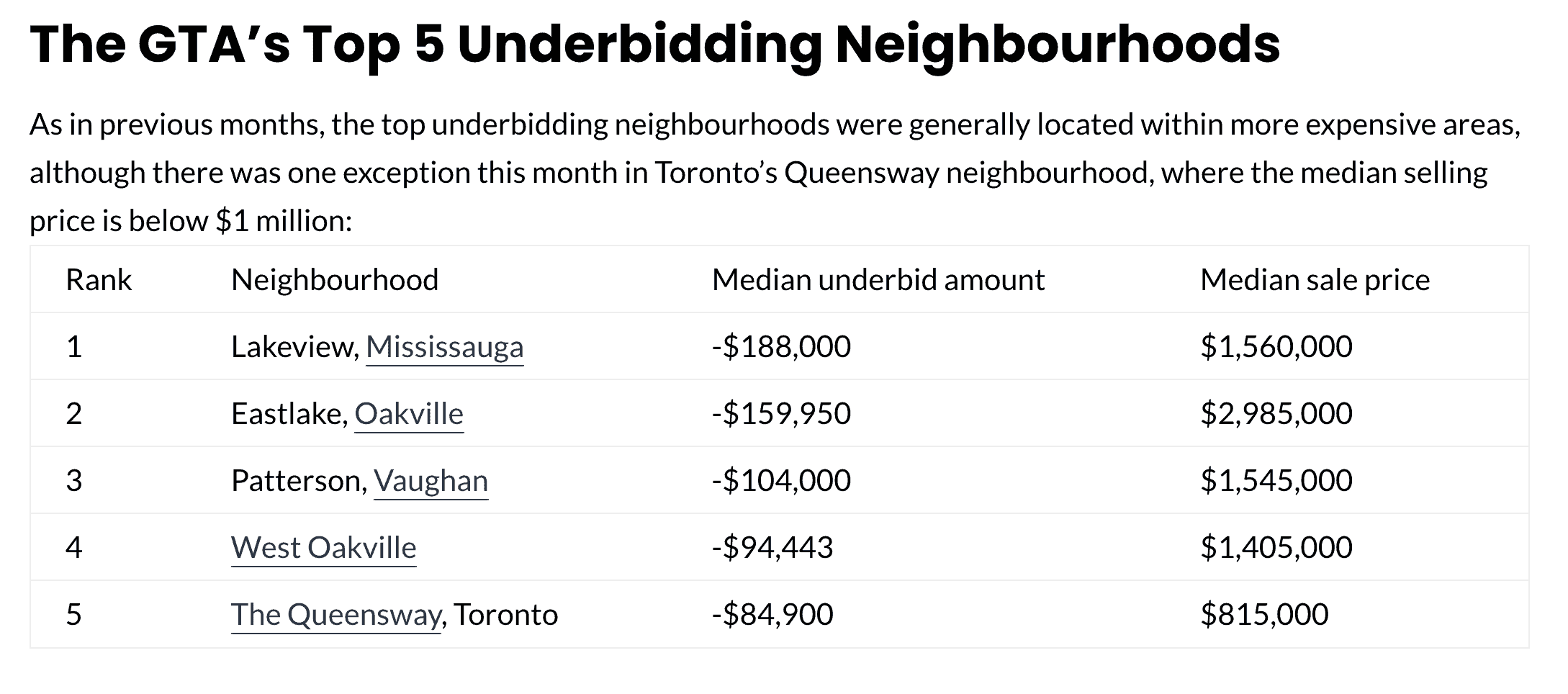

Lakeview, a neighbourhood poised to undergo significant change in the coming years with new real estate developments, had the highest underbid amount in the GTA in January, according to Wahi.

The median house price at $1,560,000 and the median underbid amount at $188,000 last month for Lakeview, according to the report.

At the end of each month, Wahi compares the differences between the median list and sold prices to determine whether a neighbourhood is in overbidding or underbidding territory, excluding those neighbourhoods with fewer than five transactions in a given month.

The top overbidding and underbidding neighbourhoods are ranked by the median overbid or underbid amount.

Based on these criteria, only 55 of the GTA’s approximately 400 neighbourhoods were evaluated in January as many areas didn’t see sufficient sales activity (in December, 122 neighbourhoods saw at least five transactions), according to the report.

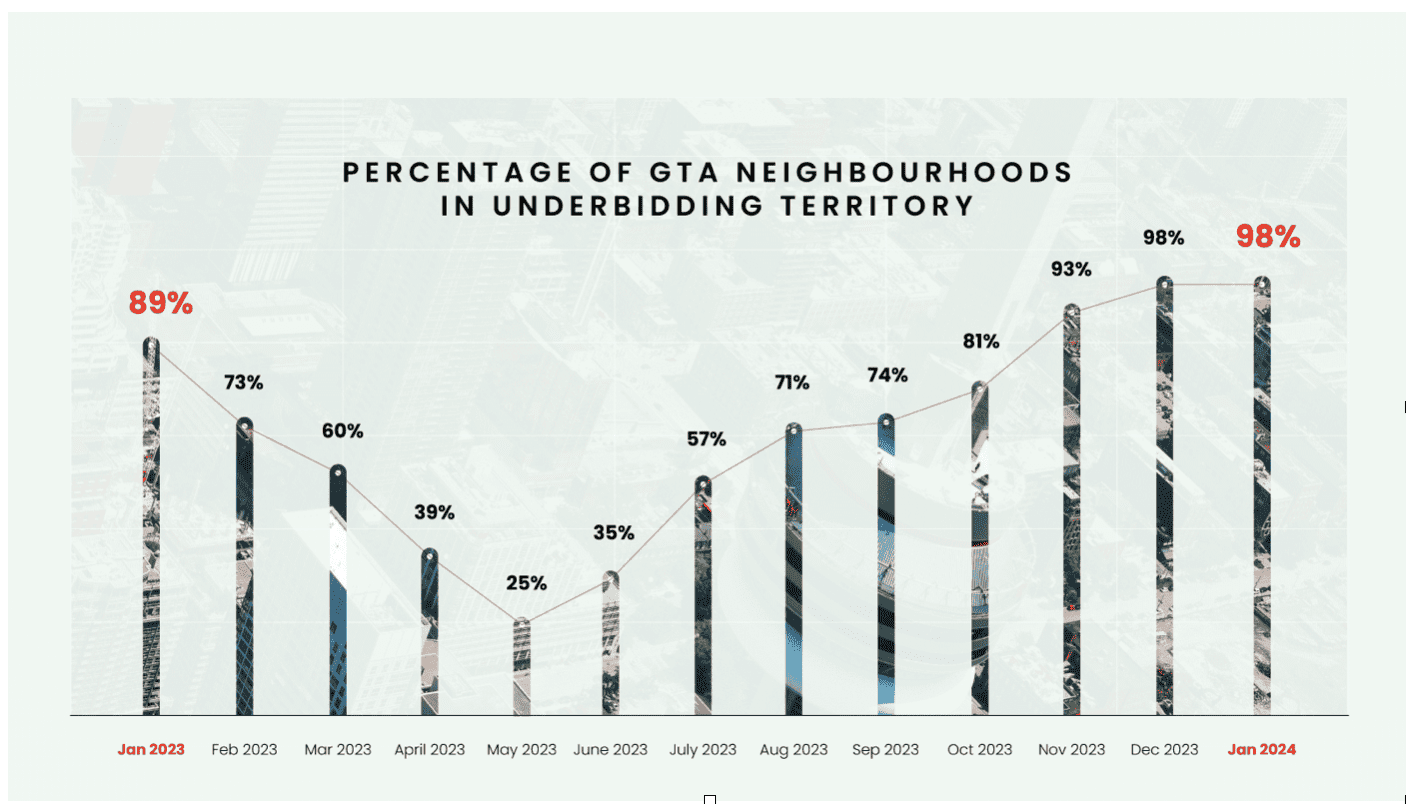

The report found nearly everywhere in the GTA is in underbidding territory right now — despite one or two anomalies such as a Mississauga home that sold for $250,000 over the asking price.

Across the GTA 98 per cent of neighbourhoods were in underbidding territory in January and December, according to the report.

“The Bank of Canada’s rate hikes last year are clearly having an impact on real estate markets across southern Ontario,” says Wahi CEO Benjy Katchen. “Although we are starting to see some signs of multiple offers across the GTA, the larger trend continues to be one of underbidding. With interest rates recently stabilizing or in some cases even falling, now could be a great time to potentially purchase a home.”

But it’s also important to note that seasonal factors normally influence bidding activity. There tends to be limited competition during the winter months.

No neighbourhoods in the GTA were in overbidding territory, and Windfields, in Oshawa, was the lone neighbourhood selling at-asking with a median sale price of $899,000.

See the full report here.

INsauga's Editorial Standards and Policies