Home sales drop 72 per cent in Mississauga amid COVID-19 pandemic

Published May 6, 2020 at 7:29 pm

The COVID-19 pandemic has had a profound impact on housing sales in Mississauga and the overall GTA, even as prices remain quite high year-over-year.

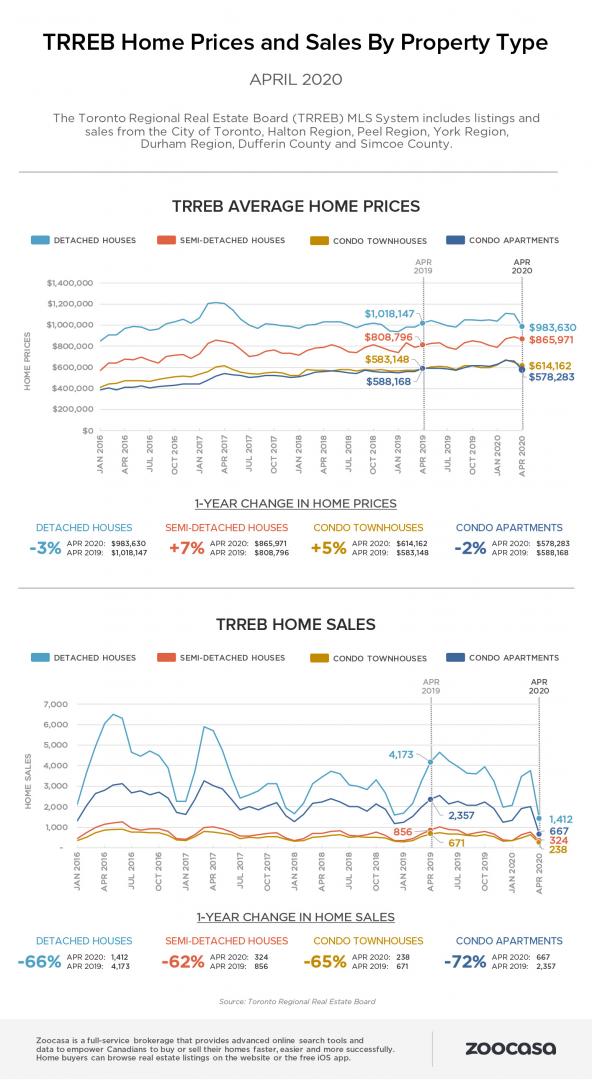

Home sales in the GTA plunged 67 per cent in April as unprecedented COVID-19 social distancing measures and economic uncertainty affected sales and new listings, the Toronto Regional Real Estate Board (TRREB) reported this week.

“Past recessions and recoveries do not necessarily provide the best guide as to how the housing market will recover from the impact of the COVID-19 pandemic,” TRREB chief executive John DiMichele said in a statement.

“A key factor for the housing market recovery will be a broader reopening of the economy, which will result in an improving employment picture and a resurgence in consumer confidence.”

TRREB said there were 2,975 residential transactions in the GTA in April, compared with 9,005 transactions in April 2019. New listings fell to 6,174 from 17,212 in April 2019, a decline of 64 per cent.

On a seasonally adjusted basis, TRREB said April home prices in the GTA fell 11.8 per cent from March.

Prices for renters were also down for the month, with the average one-bedroom rent falling 2.7 per cent to $2,107, and the average two-bedroom rent falling 4.1 per cent to $2,705.

Condo rentals were down on a year-over-year basis in April, falling 57.9 per cent for one-bedroom units and 54.4 per cent for two-bedroom units.

In Mississauga, the average price of a detached home reached $1,190,941 in April. Semi-detached homes cost $803,008, townhouses cost $752,971 and condos cost $500,375.

Real estate brokerage and website Zoocasa also says Toronto region home sales activity slowed considerably as buyers and sellers withdrew from the market in reaction to provincial and public health safety measures in place for COVID-19.

According to Zoocasa, there were 520 home sales across the Peel Region in April, a 73 per cent year-over-year decline in sales activity. A similar trend played out in the nearby Halton Region with 338 homes changing hands in April–a 65 per cent annual decline in sales.

Although sales were down, there was an increase in average home prices in both regions year-over-year. Average home prices rose 7 per cent to $802,155 in Peel and 2 per cent to $870,966 in Halton.

Zoocasa says Peel Region is edging closer to buyers’ market territory–a detour from where the market sat at the beginning of March.

According to Zoocasa, there were 532 new listings in Mississauga in April and 260 home sales; reflecting a steep 72 per cent year-over-year decline in transactions.

Average home prices in Mississauga grew faster than the regional average at 8 per cent annually, ending April at $832,112.

A closer look at housing types reveals that detached house prices grew 5 per cent year-over-year to $1,168,041, while semi-detached and condo apartments grew 6 per cent to $802,661 and $500,349, respectively.

Average prices for condo townhouses clocked in at $603,004 for April, an increase of 5 per cent.

As for when sales will begin to recover, it’s impossible to say–but parts of the economy are slowly beginning to reopen.

Provincial, local and federal officials say they’re making cautious plans to relax or remove restrictions that were put in place in mid-March to slow the spread of the novel coronavirus, which has been blamed for more than 1,300 deaths in Ontario.

Most recently, the Ontario government said it will be allowing all retail stores with a street entrance to provide curbside pickup and delivery, as well as in-store payment and purchases at certain businesses.

But while the economy is slowly opening, Ontario recently announced it’s extending its emergency orders. The orders, which were set to expire May 6, include the closure of non-essential businesses, the prohibition of public gatherings of more than five people, and the closure of outdoor amenities such as playgrounds.

They have now been extended for another two weeks, to May 19.

Ontario’s overall declaration of a state of emergency was extended last month to May 12.

So while the province is beginning to recover, physical distancing measures–and their impact on the real estate market–aren’t going anywhere anytime soon.

“The necessary social distancing and economic impacts associated with COVID-19 clearly impacted home sales and listings throughout April 2020,” added TRREB president Michael Collins.

He said TRREB members have used live video streaming to replace in-person open houses “and I would expect the use of these innovative techniques to increase as some level of social distancing remains in place for the foreseeable future.”

With files from The Canadian Press

insauga's Editorial Standards and Policies advertising