Home prices have dropped close to 20% in Mississauga

Published November 24, 2022 at 2:01 pm

Housing in Mississauga certainly isn’t cheap, but it’s definitely not as expensive as it was this time last year and prospective homebuyers have interest rate hikes to thank for that.

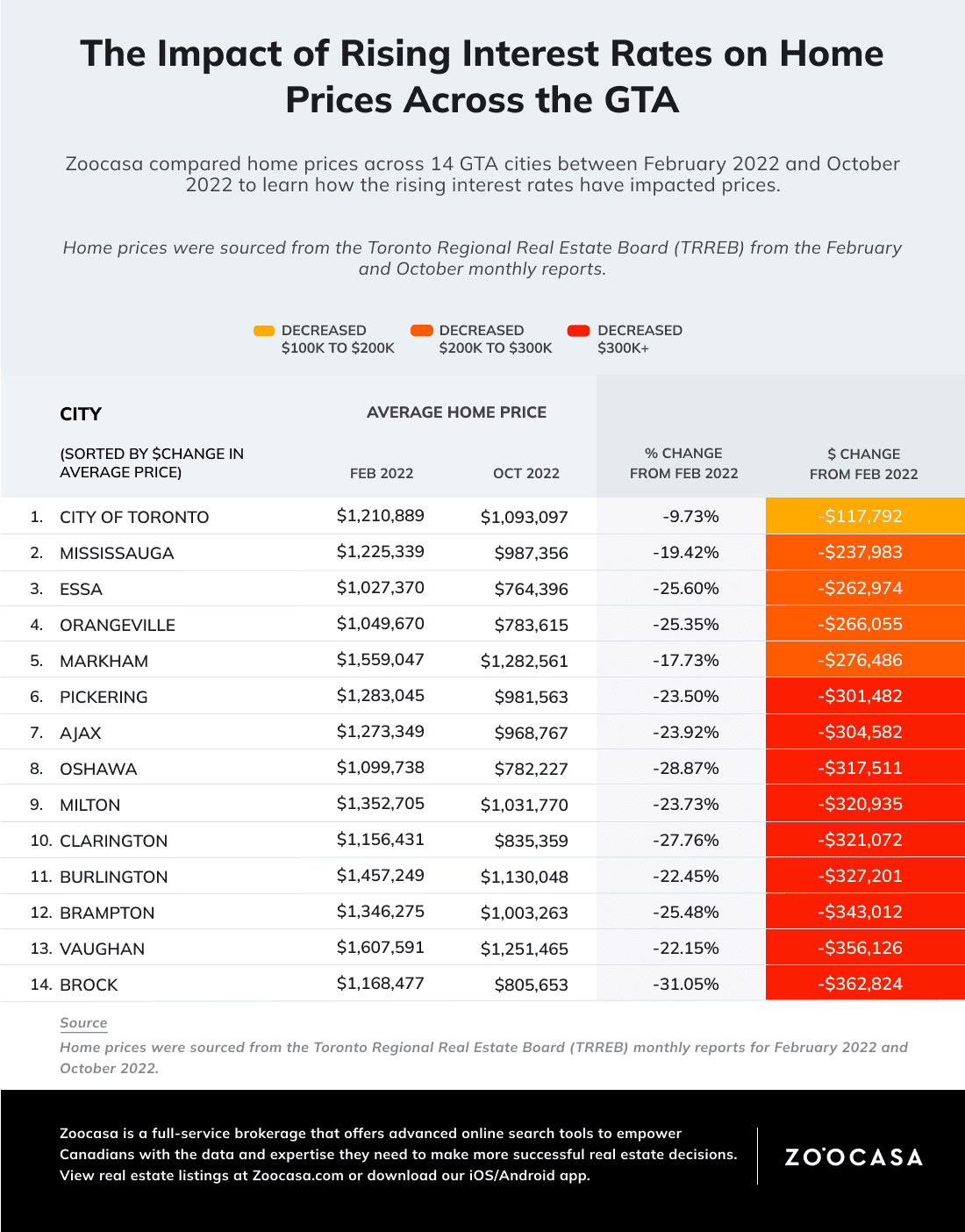

According to a recent report released by real estate website and brokerage Zoocasa, prices in Mississauga fell from an average of $1,225,339 in February 2022 to $987,356 in October 2022–a 19.42 per cent drop. That means that the average home price in the city has dropped $237,983 in just under a year.

As for what’s driving the decrease, the report points out that the Bank of Canada (BoC) has raised interest rates six times since March, with July’s increase of 100 basis points being the largest in Canada since 1988.

Although a hike occurred as recently as last month, the BoC is expected to make another announcement in early December, meaning a seventh rate increase is possible before the end of the year.

“Housing prices in every city covered by the Toronto Regional Real Estate Board have declined since February,” writes Daniel Crook, Zoocasa’s marketing and social media specialist, in the report.

“Many insist that rising interest rates are the culprit driving prices down in Ontario. As the cost of borrowing has increased in already costly markets, some prospective buyers have been priced out or are waiting on the sidelines for interest rates to come back down.”

According to the report, some Canadian provinces, regions and municipalities have been spared significant price drops. Zoocasa says prices are holding steady in nearby Toronto, where the average home price declined just 9.73 per cent from $1,210,889 in February to $1,093,097 in October.

The greatest decline was in Brock, where the average house price fell 31.05 per cent from $1,168,477 in February to $805,653 in October.

In the GTA overall, prices are down from $1,326,100 in February 2022 to $1,098,200 in October–a 17.19 per cent drop.

The picture is also different from province to province.

According to the report, prices in Ontario have dropped 18.26 per cent from $1,075,800 in February to $879,400 in October. British Columbia’s prices haven’t fallen quite as significantly, declining 8.51 per cent from $1,048,900 to $959,600.

Interestingly enough, prices are up 10.10 per cent in Prince Edward Island, where the average home price has hit $362,900. In Newfoundland, the average home price has increased by 6.22 per cent to $281,600. According to Crook, the price growth could reflect increased demand from out-of-province buyers looking for more affordable housing.

INsauga's Editorial Standards and Policies