Here’s how much you’ll pay to close on a home in Hamilton: Report

Published April 26, 2023 at 12:43 pm

If you’re hoping to purchase a home in Hamilton this year, your closing costs won’t be small, but they won’t be the highest in the province.

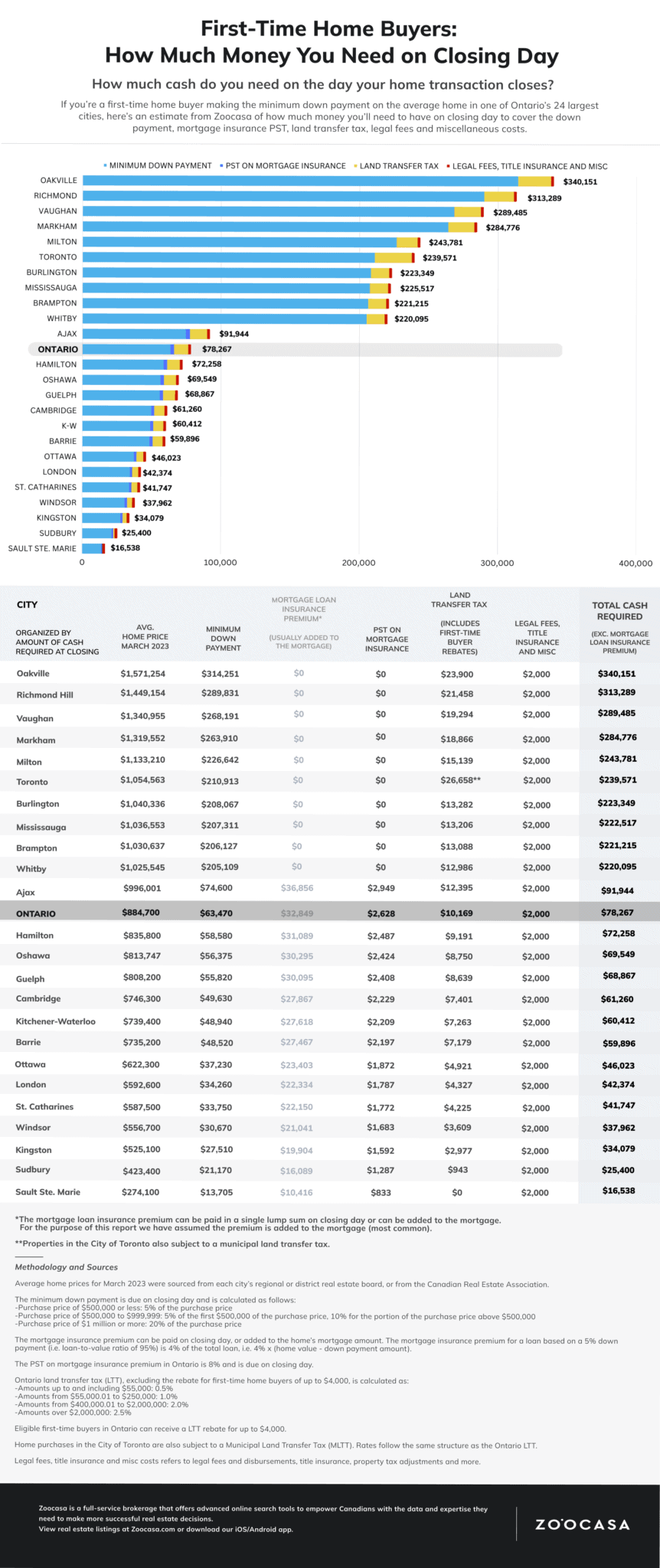

According to a recent report from real estate search platform Zoocasa, buyers purchasing homes in Hamilton will pay closing costs below the Ontario average of $78,267.

People purchasing property in Hamilton can expect to pay about $72,258–much lower than the $340,151 buyers typically face in nearby Oakville.

Other municipalities with significantly higher costs include Richmond Hill ($313,289), Vaughan ($289,485), Markham ($284,776) and Milton ($243,781). Hamilton is also much more affordable than other Southern Ontario municipalities, including Toronto, Burlington, Mississauga, Brampton, Whitby and Ajax.

“The closing date when buying a home is a time for celebration for most homebuyers – keys are transferred from the seller to the buyer and many hurdles have already been overcome to achieve this big step,” the report reads.

“However, before breaking out the champagne, there are a few expenses that need to be paid for first.”

Closing costs, which can be substantial, must be paid upfront in cash (paying in instalments is not an option) and include the down payment, PST on the mortgage loan insurance premium, land transfer tax, legal fees, title insurance and other miscellaneous costs.

Zoocasa compiled estimates based on average home prices in 24 major markets across Ontario to determine what buyers in various cities typically pay.

Calculations assume the minimum down payment is made, that all land transfer tax rebates for first-time home buyers have been applied, and that mortgage default insurance costs have been rolled into the mortgage.

According to the report, Hamilton buyers can expect closing costs to include a down payment of $58,580 (the average price of a home in the city is $835,800), PST costs amounting to $2,487, a land transfer tax of $9,191 and about $2,000 in other fees.

Cities and towns with lower closing costs include Sault Ste. Marie ($16,583), Sudbury ($25,400) and Kingston ($34,079).

“Buyers looking for affordability will have to head out of the Greater Toronto Area and into smaller cities like Guelph, Barrie, St. Catharines and Kingston, which all have average home prices below the Ontario average of $884,700,” the report reads.

“Though even among these cities there exists quite a big gap in expenses.”

insauga's Editorial Standards and Policies advertising