Here’s How Much of a Mississauga Resident’s Income Goes to Rent

Published September 18, 2019 at 6:15 pm

In a perfect world, no one would spend more than 30 per cent of their income on their house or apartment.

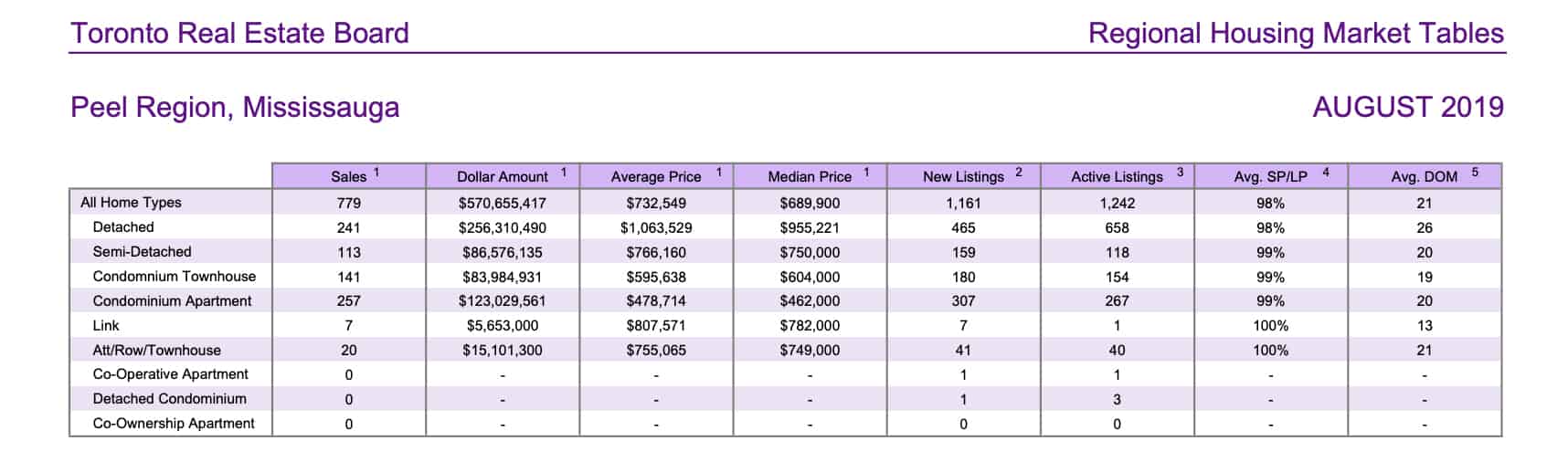

But that financial rule of thumb has quickly become archaic at a time when a one-bedroom apartment costs about $1,927 a month in Mississauga and the average house costs about $732,549 (all home types combined).

A few years ago, the City of Mississauga launched its Making Room for the Middle plan to address the fact that middle-income earners (think teachers, nurses and social workers) can no longer afford houses in the city.

In fact, the city said that data showed that 1 in 3 households was spending more than 30 per cent of their income on housing and that the number was expected to rise.

According to data recently released by the Canadian Rental Housing Index, that number is growing.

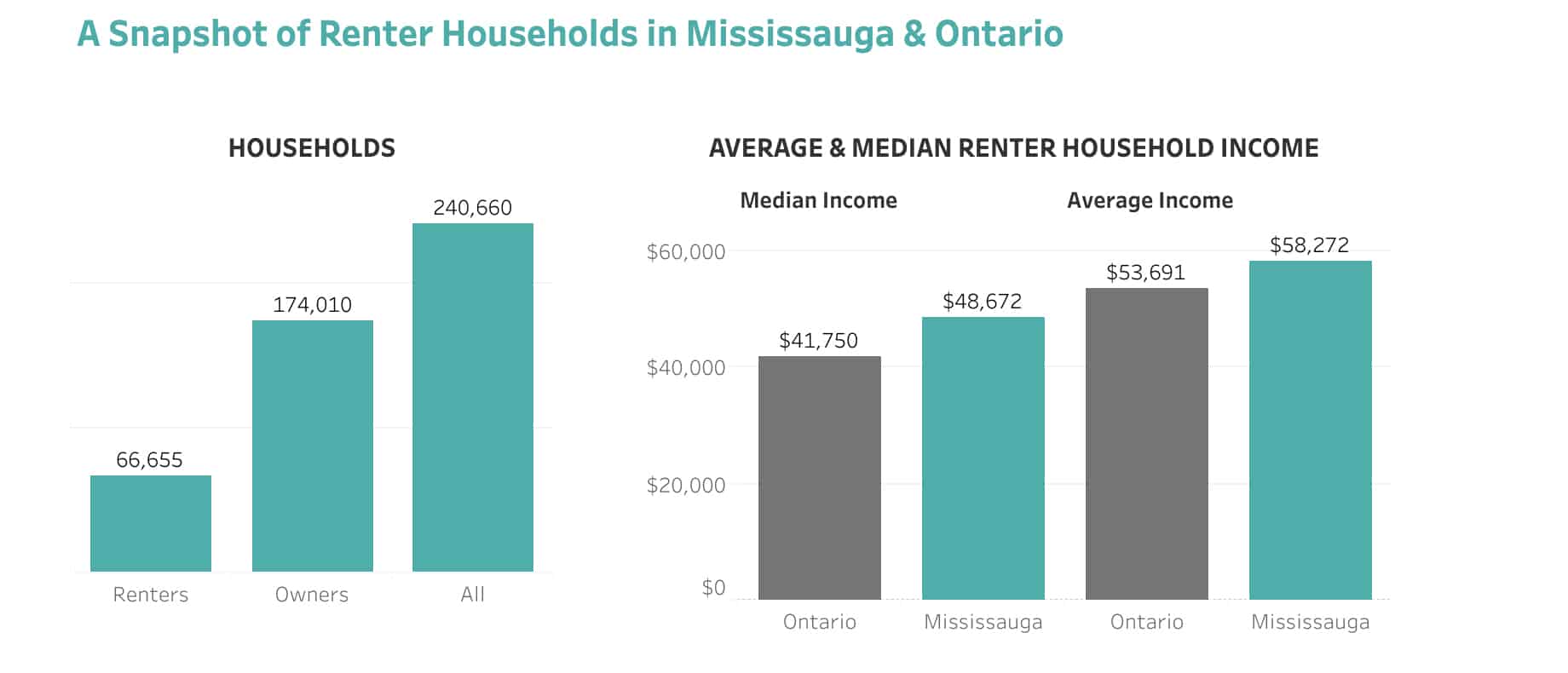

According to the Canadian Rental Housing Index, Mississauga is comprised largely of homeowners. In fact, there are 66,655 tenant household and 174,010 owner households.

Mississauga residents are also a little better off financially than Ontario in general, with the average income sitting at $58,272 in Mississauga. In Ontario, the average income is $53,691.

How much are Mississauga residents spending on rent and utilities? The data indicates that, on average, 26 per cent of a household’s income is spent on rent and utilities in Mississauga vs. 25 per cent in Ontario.

In Mississauga, these costs typically amount to $1,281 a month.

While that sounds promising, data shows that 21 per cent of renter households are living in crowded conditions in Mississauga. In Ontario overall, only 12 per cent of rental households are living in crowded conditions.

This suggests that, in a bid to save money, multiple tenants are sharing too-small quarters.

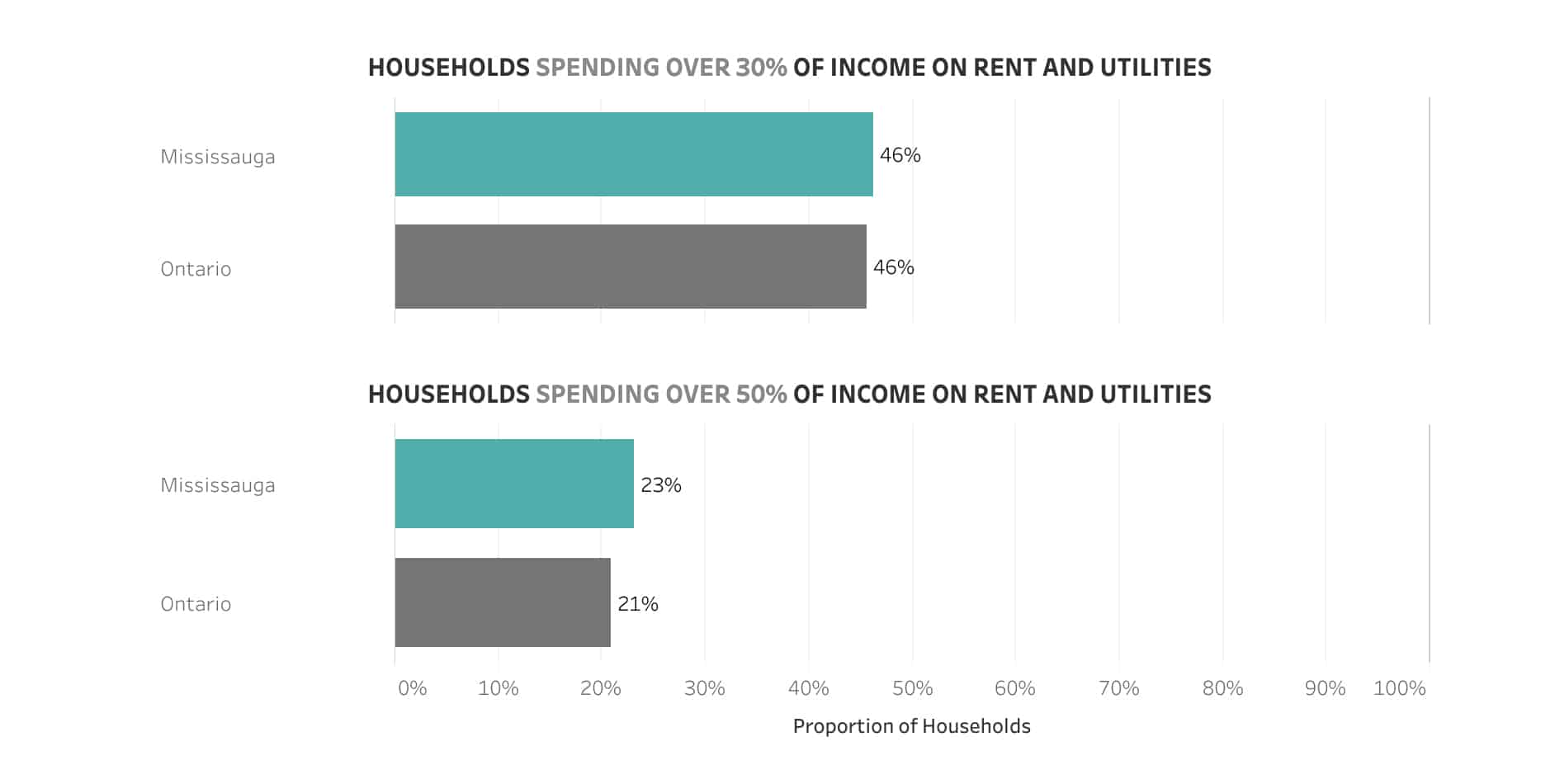

The Canadian Rental Housing Index also confirms the city’s fears–many households are living in unaffordable homes.

In Mississauga, 46 per cent of households are spending over 30 per cent of their income on rent and utilities.

That number is in line with the number of people who spend over 30 per cent across the province.

Data also indicates a significant amount of households are sacrificing more on shelter costs. According to the index, 23 per cent of households are spending over 50 per cent of their income on rent and utilities. That’s slightly higher than the Ontario number, which sits at 21 per cent.

It appears things aren’t good for renters or buyers.

When Mississauga launched its housing plan in 2016, it said that households that bring in $50,000 to $100,000 a year can typically only afford homes priced between $270,000 and $400,000. The city rightly pointed out that their only options are condos and a limited selection of townhouses, and that reality has gotten starker as home prices have continued to rise.

According to data recently released by the Toronto Real Estate Board, the average price of a row townhouse now sits at $755,065. Condos, the last bastion of affordable housing, cost $478,714.

According to data recently released by the Toronto Real Estate Board, the average price of a row townhouse now sits at $755,065. Condos, the last bastion of affordable housing, cost $478,714.

Condo townhouses cost about $595,638.

Everything is now above the $400,000 mark and renters are feeling the burn just as much as prospective buyers–especially since the two-bedroom units so coveted by renters now cost about $2,336 a month.

At a time when Mississauga’s rental vacancy rate sits at 0.8 per cent (a healthy rental market boasts a rate of three per cent or higher), the city has a vested interest in creating and preserving the rental stock.

To its credit, Mississauga has been working to increase its rental supply to take the pressure off of desperate tenants who are being rapidly priced out of the market.

Part of the city’s Making Room for the Middle plan, which includes incentivizing developers to include some amount of affordable units in new developments–also boasts bylaws designed to protect renters and the city’s existing rental stock.

In recent months, several rental projects have been announced—one on Sheridan Park Drive and another on Hurontario, to name a few—but these announcements came after years of complete and utter silence on the apartment development front.

In other good news for renters, Urbanation recently released a report that revealed that vacancy rates in Toronto edged up in the second quarter of 2019, which is encouraging in a province that’s seen very little purpose-built rental construction over the past 20 years or so.

If Mississauga follows suit and supply starts to match demand, tenants might be better off.

Here’s hoping for more fulsome rental construction soon.

insauga's Editorial Standards and Policies advertising