Here Is Why People Should Rent An Apartment In Mississauga Right Now

Published May 27, 2019 at 6:05 pm

Though Mississauga’s rental market has been expensive, it finally seems like the city is doing better. Mississauga is currently the sixth most expensive city compared to being the second most in March.

The city is working to welcome more purpose-built rental developments (one is planned for the Sheridan neighbourhood and another is being constructed in Cooksville), which may be why it has become slightly easier to find rental accommodations.

There has also been a lot of improvement in the overall housing development in Canada. In April alone, there were 14,697 new housing completions in Canada, the highest total of the year, adding new rental supply and likely contributing to the cooler rental rates.

A new Supply Action Plan was also announced by the Conservative government early this May. The new plan is expected to increase the housing supply in Ontario. It will also curb the out-sized price and rent growth experienced in the province over the past decade.

In fact, according to the May 2019 Rent Report from Rentals.ca and Bullpen Research & Consulting, the average and median rents for all property types in Canada have decreased by about two per cent, which can be attributed to the smaller average units for lease in April.

In April, the average property listing on Rentals.ca was priced at $1,844, a decrease of 1.1% month-over-month. The median asking rent has also decreased by 2.9 per cent with an average of $1,700 per month.

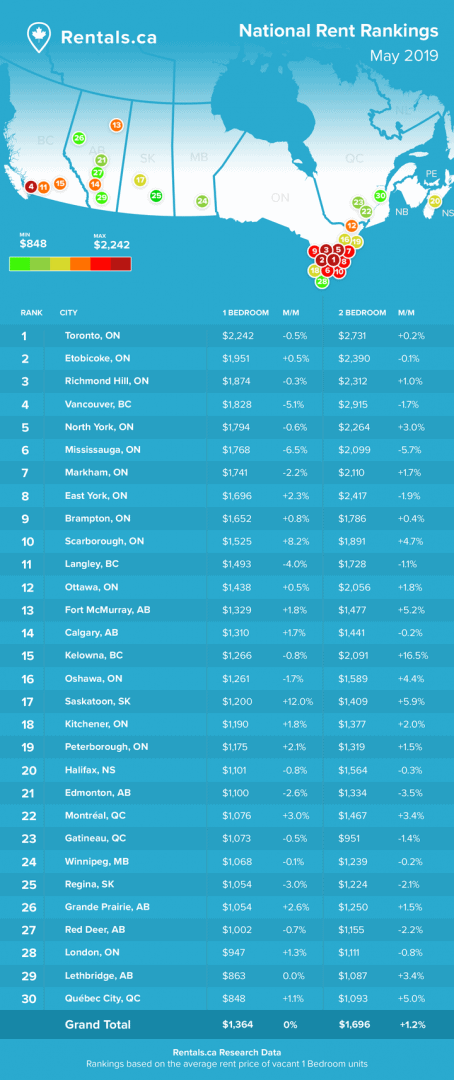

You can see an infographic, courtesy of Rentals.ca, below:

According to Rentals.ca, the average monthly rent is $1,768 for one-bedroom homes and $2,099 for two-bedroom homes in Mississauga. This means that tenants looking to rent an apartment will likely pay about $200 less per month than in Toronto for one- and two-bedroom units, when considering the average rental rates. Toronto is the most expensive city with the average monthly rent at $2,242 for a one-bedroom and $2,731 for a two-bedroom.

While Mississauga is doing better, Brampton is now the ninth most expensive city. It currently costs an average of $1,652 to rent a one-bedroom and $1,786 for a two-bedroom. The average rental rate in Brampton went up a small percentage since March 2019.

National Rental Rates

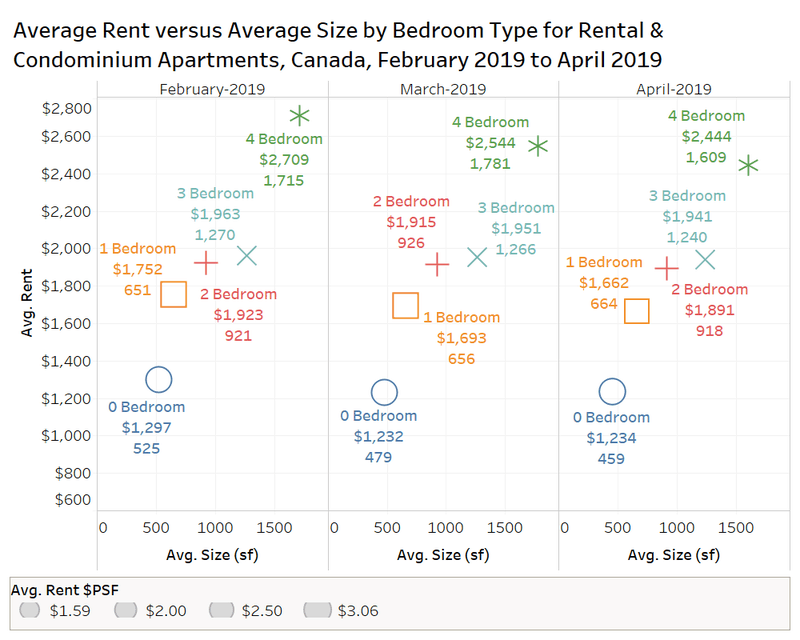

As for what the rental market in Canada looks like, a chart created by Rentals.ca shows the average and median rent levels by bedroom type for all property types in Canada from February to April.

In April, landlords were asking $1,234 per month on average for studio units in Canada, which is a decrease from February ($1,297). One-bedroom units were offered at $1,662 per month on average, while two rental bedroom units were offered at $1,891 on average. Rental units have experienced a small decrease since February.

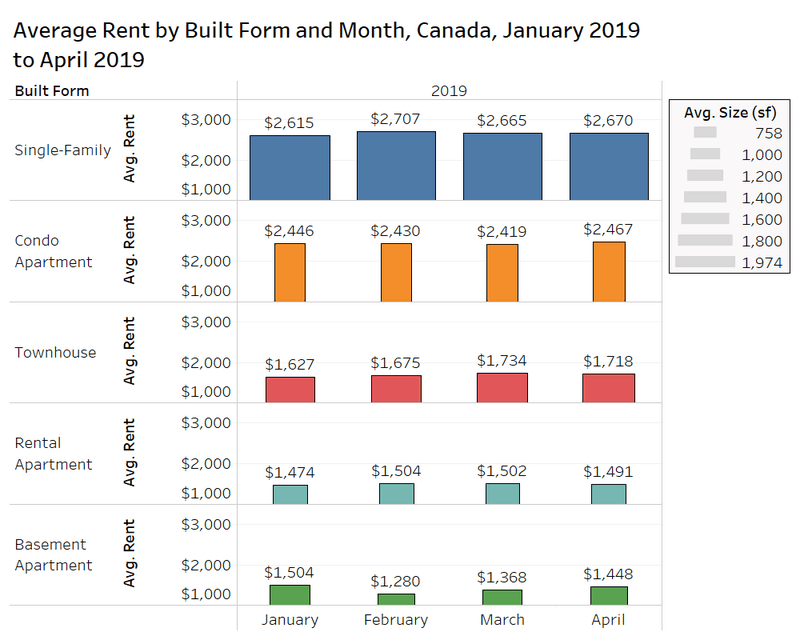

According to the report, more people are looking at single family units such as single-detached and semi-detached homes, which has caused a decrease in the average rent for an apartment. There was a 0.2 per cent increase in single-detached and semi-detached homes with a 2 per cent increase in listings for condo apartments. The average condo apartment was listed for $2,467. The average rental apartment was listed at $1,491, which is a decrease from $1,502 in March.

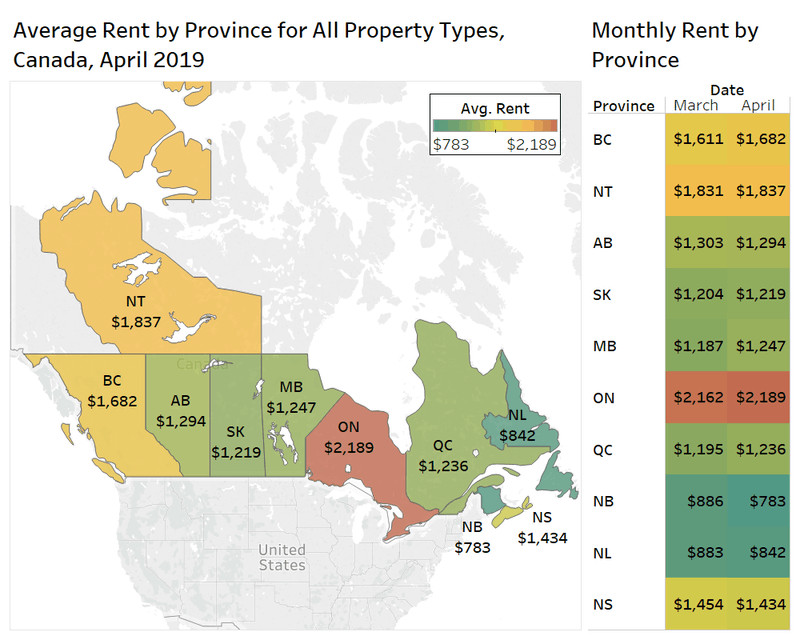

Provincial Rental Rates

Ten of the top 12 most expensive cities are in Ontario, making Ontario have the highest monthly rent at $2,189 for all property types. This is an increase of 1.3 per cent from March.

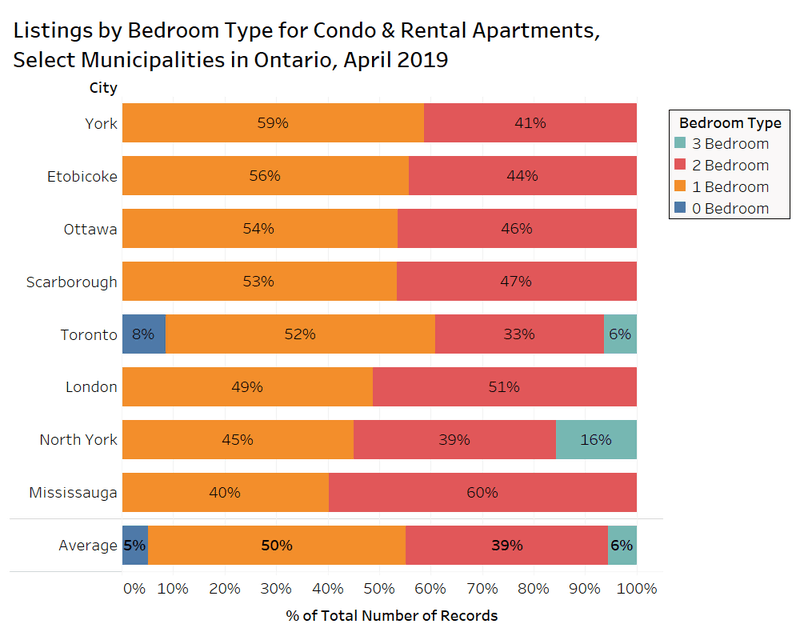

Rental.ca also looks at the condo and rental apartment breakdown by bedroom type for several municipalities in Ontario.

The highest share of two bedroom units for lease can be found in Mississauga and London. Two- bedroom apartments make up more than half of the properties in both cities. Tenants looking for a one bedroom apartment can go to York, Etobicoke, Ottawa or Toronto.

So, why are the rental prices in Canada decreasing?

As stated before the new Supply Action Plan in Ontario and housing completions in Canada have made prices decline for another month.

The general consensus among economists is that there will be no mortgage rate increase in 2019, which may spur some tenants to jump into the ownership housing market, freeing up units for other prospective tenants and easing upward rent inflation pressures.

Graphics courtesy of Rental.ca

insauga's Editorial Standards and Policies advertising