Here’s what experts predict for the real estate market in Mississauga, Brampton and Caledon

Published September 7, 2023 at 10:57 am

Timing can mean a lot in the huge decision to buy a home and experts are weighing in on how the market will look for the rest of 2023 in Mississauga, Brampton and Caledon.

The latest numbers from the Mississauga Real Estate Board show home prices inching up slowly, aside from condos, which dropped in price.

The benchmark price of all home types was $1,127,200 in August 2023, the Mississauga Real Estate Board notes in their report released yesterday (Sept. 6). This is 2.5 per cent higher than August 2022.

The single-family home benchmark price was at $1,438,300, increasing by 5.5 per cent on a year-over-year basis in August. Townhouse/row units was $876,900, a gain of four per cent compared to a year earlier. Condo apartment price was $663,900, down by 1.3 per cent from year ago levels.

But the board is predicting a market in favour of buyers.

“Market conditions remained in balanced territory in August but continue to shift slowly towards a buyers’ market,” said Michael Kennelly, president of the Mississauga Real Estate Board.

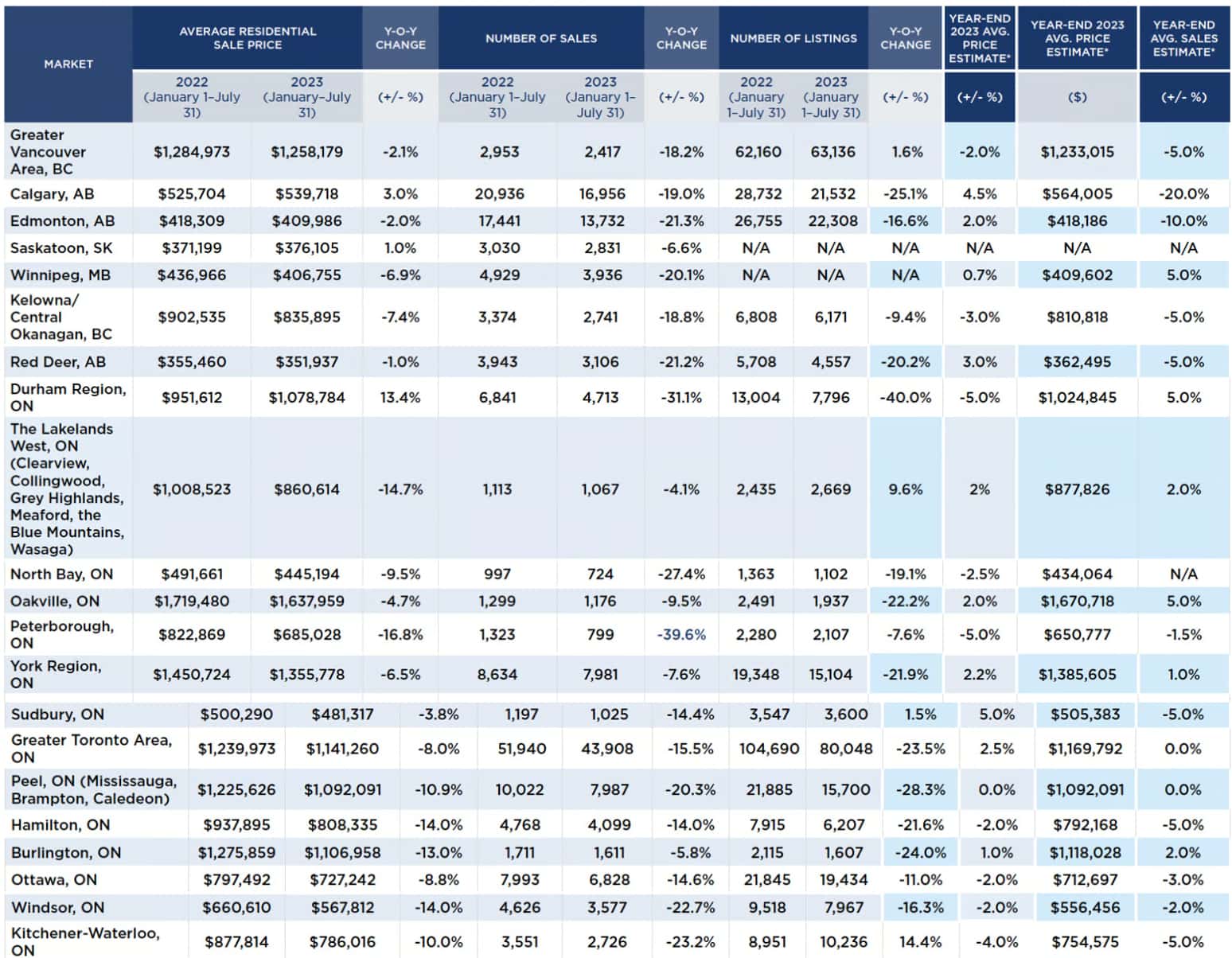

And RE/MAX Canada’s 2023 Fall Housing Market Outlook Report predicts average residential sale prices for all home types won’t increase and will remain flat at zero per cent from now until the end of the year in much of Canada including Peel Region.

Peel Region saw the average home sale price drop from $1,225,626 in the first half of 2022 to $1,092,091 in first half of 2023 — a 10.9 per cent decrease is year-over-year, according to the RE/MAX report.

RE/MAX estimates the average price for Peel will remain at $1,092,091 for the rest of 2023.

The report also suggests both the interest rate climate and lack of inventory will likely mean a softening market this fall across Canada. And this might bring more buyers back to the market next year.

“If the fall market is an early indicator for 2024 activity, we may see a very active first quarter as buyers and sellers take advantage of easing prices into the earlier part of next year,” said Christopher Alexander, president, RE/MAX Canada.

The report also found that 33 per cent of Canadians who want to buy and/or sell a home in the next 12 months will wait and see how interest rates play out.

Yesterday (Sept. 6), the Bank of Canada held the key interest rate steady at five per cent.

For those looking to buy a home outside of Peel Region, prices are expected to decline in some cities.

Seven regions in Ontario are expected to see a decrease in home prices this fall — Hamilton, Ottawa and Windsor (two per cent); North Bay (three per cent), Kitchener-Waterloo (four per cent), Durham Region, and Peterborough, (five per cent).

See the full RE/MAX Canada’s 2023 Fall Housing Market Outlook Report here.

And the Mississauga Real Estate Board report here.

INsauga's Editorial Standards and Policies