Here are the 10 Biggest Scams in Canada

Published March 5, 2018 at 3:53 am

You might be worldly, tech-savvy, and aware of almost every possible scam in the book – from emails from senders claiming to be princes to text messages from the fake-CRA demanding you pay them thousands in back taxes you never knew you owed – but the unfortunate reality is that a lot of people in Mississauga are vulnerable to scams.

While most people are scam literate, others aren’t so lucky.

The Better Business Bureau (BBB) recently released its list of the top 10 biggest scams in Canada in 2017. Over $95 million was lost to scams last year, not counting the abundance of scams that go unreported. It’s always a good idea to be aware of as many scams as possible to lessen your risk of falling prey to them.

“Canadian businesses lose millions every year to those posing as CEOs who redirect company money through wire and email transfers.”

Businesses can build in payment redundancy systems, ensure email addresses are valid and correct, and educate employees about these scams to lessen their risk.

3) Romance Scams

More than $19 million was lost to catphishers last year. The BBB advises you never send money to someone you’ve never met, always meet in person, and don’t give out personal information like your email and phone number.

4) Employment Scams

This one was the number one scam in 2016, but in 2017, more than $5 million was lost to these scams. Employment scams target Canadians through reputable employment websites. According to the BBB, you should keep in mind that if you didn’t apply for a job, you didn’t get hired, a legitimate company wouldn’t ask you to wire money as a “test”, and look for poor grammar, lack of job details, and an over-the-top pay scale.

5) Cryptocurrency Scams

“Cryptocurrencies are speculative, high-risk investments that are mostly unregulated. As they have captured the attention of investors, so too have fraudsters taken notice.”

More than $1.7 million was lost to these in 2017. The BBB says there’s an elevated risk of fraud and manipulation here, and some offerings might not comply with securities laws.

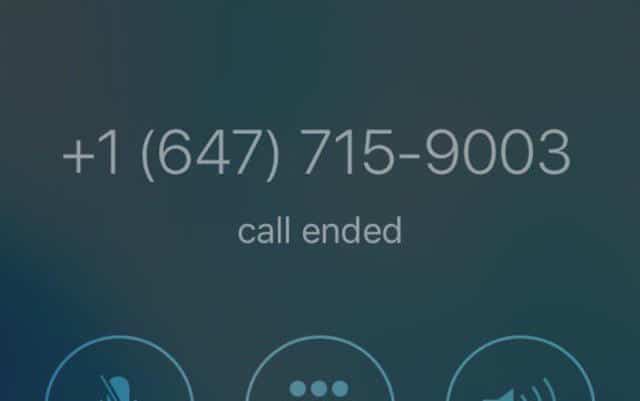

6) Income Tax Scams

Ah, the classic and widespread CRA scam. Threatening phone calls from the “CRA” plague people across the country. The BBB advises that the CRA doesn’t make threatening phone calls, won’t solicit information via email or phone, and Canadian government agencies don’t accept payment in Bitcoin.

Over $5 million was lost to income tax scams last year.

7) Miracle Weight-loss Scams

Losing weight is a popular goal, but the best way to get there is through diet and exercise! According to the BBB, if a fat-burning product looks too good to be true, it probably is, you shouldn’t trust unsubstantiated claims, and there is no pill for magic, rapid weight loss!

8) Advance Fee Loans

More than $1.5 million was lost to these last year, where shady lenders guarantee you’ll get a loan, asking for upfront payment as security.

The BBB suggests that if you’re approved for a loan and they request money as security, walk away, always research reputable lenders, and a guarantee of a loan before a credit check is suspicious.

9) Shady Contractors

“Yes, this is still a problem,” says the BBB. “Contractors without a conscience who take your deposit and disappear.”

More than $3 million was lost to shady contractors last year. How can you minimize your risk to this scam? The BBB says you should be wary of unsolicited offers of work, get several estimates for a job, and you can actually go to BBB.org to research trustworthy companies.

10) Fake Invoices

Finally, fake invoice scams plagued Canadians last year. You might have online accounts to many sites that charge money for certain services, iike Amazon, UPS, Canada Post, or iTunes. You might get realistic-looking invoices via email from sites like these.

According to the BBB, you should contact the company directly if you have any concerns, compare details of the original invoice to your order if you placed one, and never click on links or input any personal information.

Hopefully Canadians will be more wary of all of these scams next year!