Hamilton one of the least affordable cities for single-income homebuyers in Canada

Published May 1, 2023 at 4:57 pm

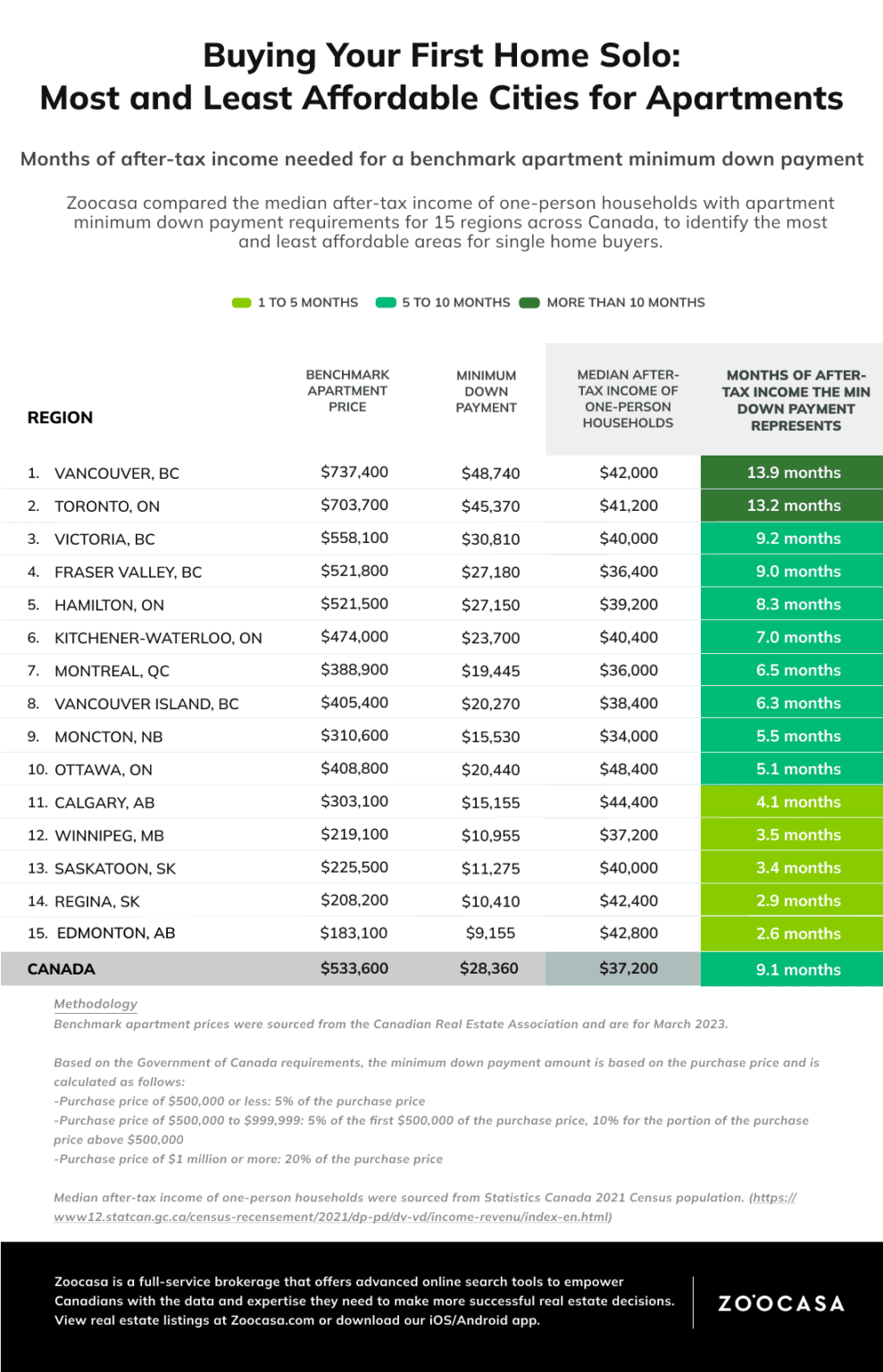

Homeownership remains a distant dream for many new home buyers in Canada and more so for single Canadians. A report released by Zoocasa found that, with rising home and rent prices, owning apartment units in major cities seems to be a growing trend among solo households.

According to the report, out of the fifteen cities, Hamilton is amongst the top 5 least affordable places to buy an apartment. The cost of an apartment in the city is around $521,500 and solo dwellers in the area with a yearly salary of $39,200 would have to save for over eight months to afford the $27,150 minimum down payment.

Infographic from Zoocasa’s report

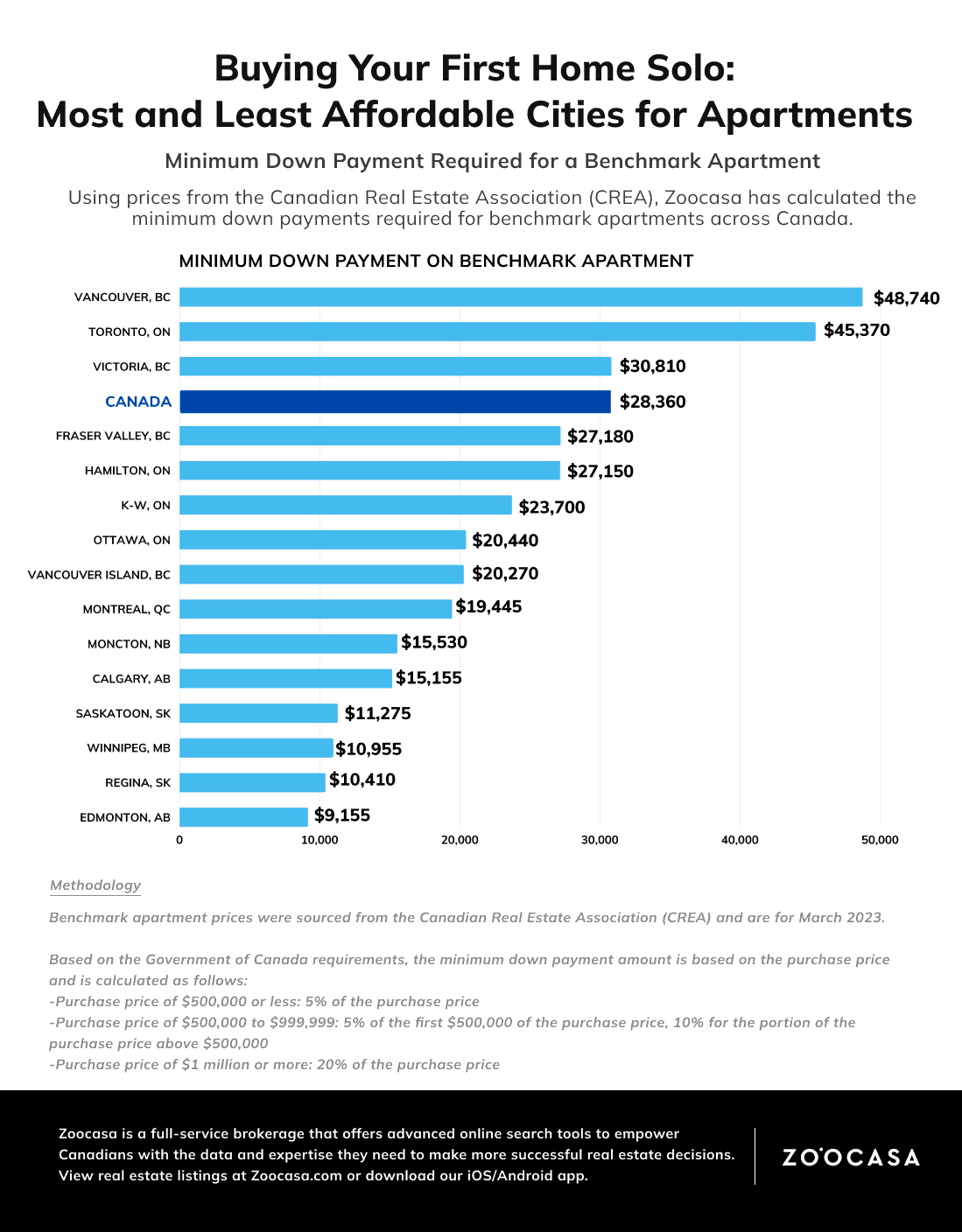

The nation’s most expensive markets, Vancouver and Toronto, have much higher down payments, meaning solo buyers will have to save their income for more than a year before being able to afford an apartment.

However, when comparing the most affordable cities for first-time homeowners, Edmonton topped the list, as it would take a single buyer earning $42,800 only 2.6 months to save the required $9,155 down payment.

Infographic from Zoocasa’s report

Other affordable markets include Calgary, Winnipeg, and Saskatoon, where median-income earners only need to save for less than 4.1 months to afford the down payment for an apartment.