Hamilton is running out of rentals; most units require $65K annual income: report

Published January 26, 2023 at 12:07 pm

Hamilton’s housing scene has cooled significantly as the city returns to a more balanced market due to overvalued homes and rising interest rates. There are times when a region’s real estate market can be reflected in its rental prices. Hamilton, however, has seen a contrast in the two markets — house prices have been declining, and rental prices continue to rise.

In fact, most vacant units last year were only affordable to renters with a yearly income of $65,000 or greater.

According to data from the latest Canada Mortgage and Housing Corporation (CMHC) report, Hamilton doesn’t have enough rental options, giving renters less choice and landlords more leverage. And the issue is Canada-wide.

Last year, the vacancy rate for purpose-built rental apartments in Hamilton was the lowest since 2002, at 1.9 per cent — matching the national rate. By comparison, in 2021, the vacancy rate for purpose-built rental apartments was 3.1 per cent across Canada.

“Lower vacancy rates and rising rents were a common theme across Canada in 2022. This caused affordability challenges for renters, especially those in the lower income ranges, with very few units in the market available in their price range,” said Bob Dugan, CMHC’s chief economist. “The current conditions reinforce the urgent need to accelerate housing supply and address supply gaps to improve housing affordability for Canadians.”

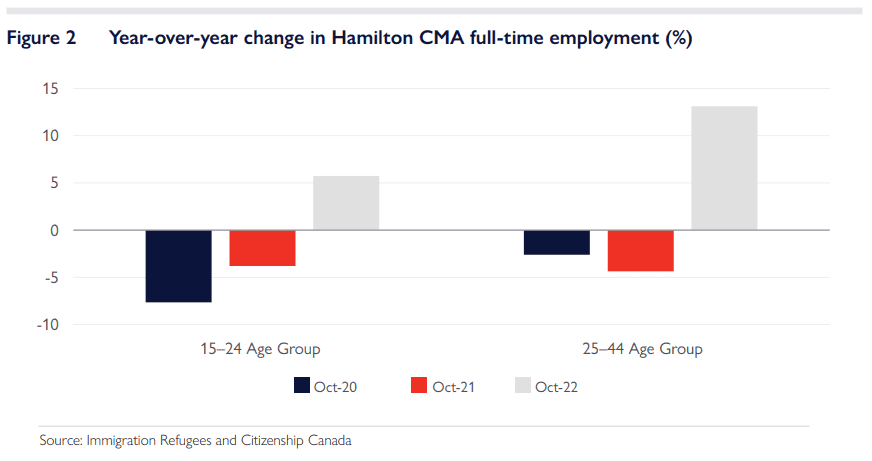

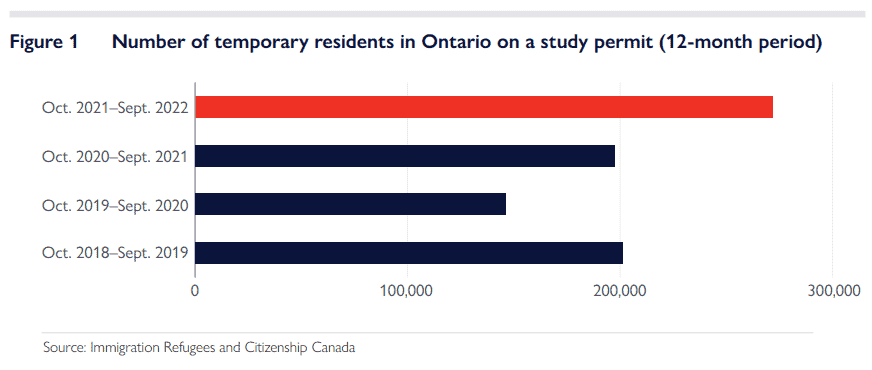

CMHC says the number of occupied units in Hamilton increased last year due to more student renters, higher full-time employment, and fewer renters transitioning to homeownership.

While declining, the overall cost of home ownership remains high enough that fewer and fewer people can afford to own, so they’re forced to rent, driving up the demand and cost of rentals.

“The surge in rental housing demand in the country reflected higher net migration and homeownership costs,” reads the report. “Higher mortgage rates, which drove up already-elevated costs of homeownership, made it harder and less attractive for renters to transition to homeownership.”

The average rent for a two-bedroom apartment in Hamilton increased by 5.3 per cent last year, signalling that even multi-income households are being priced out of home ownership. Ontario Premier Doug Ford also raised rent increase guidelines, reducing some of the tenants’ rent control protections.

Meanwhile, the vacancy rate for rental condominium apartments in Hamilton remained below 0.5 per cent for the fourth consecutive year, despite a significant increase in supply.

According to the report, only 12 per cent of vacant units in Hamilton were considered affordable to renters at the 40th income percentile of $46,000.

Unfortunately, there doesn’t appear to be any relief in sight. CMHC says future tenants will likely have to pay more than new tenants did in 2022. The average asking rent of a vacant two-bedroom unit in Oct. 2022 was higher than the actual rent paid for a unit that was turned over to a new tenant during the previous 12 months — suggesting rental property owners expect that rents will continue to increase.

insauga's Editorial Standards and Policies advertising